We’ll go deep into the intriguing topic of trading opening range breakouts. Several investors have asked us whether and how they may benefit from a breakout strategy based on the starting range. Therefore, we have agreed to have a separate conversation about it. In this piece, we’ll review the essentials of ORB trading that each trader needs to know.

Opening fury favors the period immediately after the market opening, as the name implies. The opening period is a common choice for traders since it allows them to start trading immediately. The first fifteen to thirty minutes after a market begins to trade are known as the “opening time window.”

What Is the Opening Price, and Why Is It Important?

- It is essential to fully grasp the day’s beginning price and the opening range breakout technique.

- The commencement of a trading day often determines the general direction of the day’s trade. However, it also draws other implications from statistics. Analysts saw a lot of ritualized activity in the open. Adam Grimes reviewed approximately 46,000 data points from equities, futures, and currencies as he built this theory and displayed the open as a proportion of the daily range. Grimes’s well-known graph demonstrated that the open is often located close to the day’s high or low. The pattern became more apparent when he focused his research on specific pieces of information. The propensity of the open price to congregate around the day’s high or low His research has shown without a doubt that the opening price is the most crucial of the day. When the stock price rises beyond its opening range, it is called a “breakout.”

Key Understanding

- The first trading hour of the day is the busiest and fastest moving of the day. The market’s mood is established at opening time.

- The opening hour is when profits are at their highest, but it is also the most dangerous.

- You may lose money in trading if you don’t have a plan.

- Researching the significant reversal and continuation patterns in the opening chart is called a breakout.

- Within the first hour, the chart records any shift or reversal.

The Opening Range Breakout Trading Strategy Explained

The open provides a wealth of information for developing a profitable trading strategy because of its high relevance and non-random price movement. Multiple trading opportunities and large volumes are common characteristics. Trading entry points and forecasting the day’s price movement are based on the opening range.

In the 1990s, the idea took off as traders began to base their strategies on the first hour of trading or the opening range. Although more modern tools and data allowed traders to include shorter periods—such as 15 and 30 minutes—the original nomenclature remained in use.

How To Measure The Range

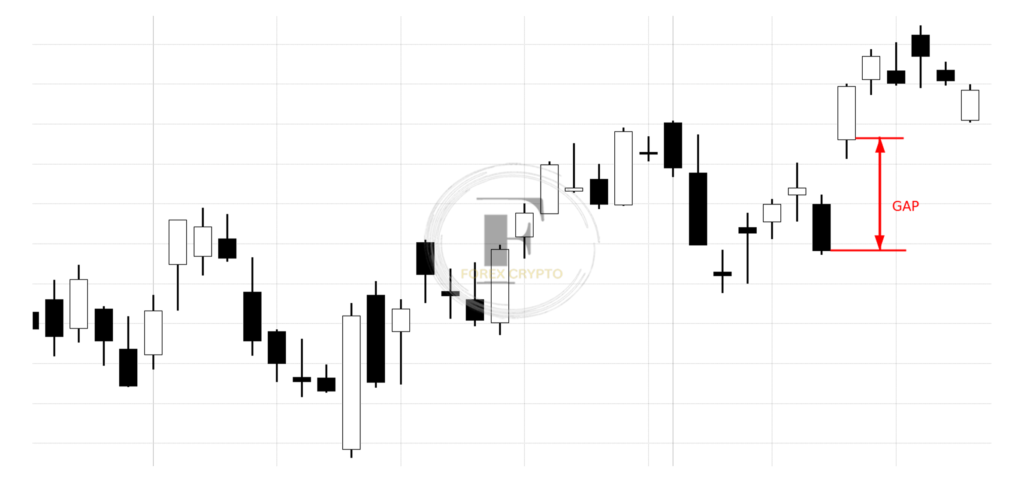

Given that the opening range is crucial to the approach, it’s worth clarifying what it is. Price fluctuations in the first hour of trading are referred to as the “opening range.” The range may be readily determined by comparing the previous trading day’s high or low to the current trading day’s high or low. The size of the starting range is determined by the amount of gap between the two candles.

The significance of establishing an opening range. This is the case because the starting price range sets the tone for the trading day. After breaking out of the range, prices often continue in the same direction. After the breakthrough has occurred, intraday traders may enter the market.

How To Trade In Opening Range Breakout

The opening range breakout method enters a trade when the opening price moves above or below the previous day’s high or low. The following elements are fundamental to the ORB trading approach.

Time Frame Selection

As previously mentioned, time-frame trading is the essence of an opening range breakout. It’s OK if a trader uses a different period than another. However, 15- and 30-minute intervals dominate the market due to their efficiency. The ORB strategy’s core idea is consistent across time frames. Thus, traders who prefer shorter time frames (such as ten- or 5-minute charts) may continue to employ them successfully.

Stock Volume Comes Into Play

- How would you evaluate a stock’s potential profitability as an investment? Maintain the same level. Commonly, stock prices follow the market’s overall trend. Some equities, however, when presented with a trigger, will break out to form their trading range. The enormous volume at which these stocks move is only one of the reasons why so many investors are interested in them. All intraday traders hunt for equities with rising volumes. Wider candles on a volume chart indicate rising volume.

- These stocks may be found by monitoring the performance of the market in the early morning. Then, figure out why there is such a huge demand. Stay clear from such stocks if you can’t pinpoint a specific catalyst that might change the market’s perspective.

Developing Directional Bias

Doesn’t everyone usually say to “trade with the market”? It is also true for ORB tactics. Investing in bullish stocks with a catalyst is a straightforward method to increase your chances of success.

You should put your money into equities that are experiencing the most volatility. Checking it against the stock’s chart might help you determine whether or not to invest.

By dividing the stock price by the market index price, one can quickly build the trend of the relative strength line, which may be used to determine the market’s direction.

Identifying Strong Breakouts

- To make money with the ORB trading method, you need to recognize robust breakouts that will lead to profitable trades. Although it is simple to pinpoint an entry point for the opening range breakout technique, novice traders may need help.

- To verify the strength of a breakthrough, traders can keep an eye out for a “narrow range breakout,” which appears as a cluster of candles. When volatility is low, the range is tight, and when it’s high, it is broad. These two trends represent lucrative trading patterns when taken together.

- Among traders, the NR4 pattern and the NR7 pattern are two of the most popular narrow-range patterns. Therefore, the likelihood of making a profit from the trade increases when the two appear on the trading chart, followed by an open-range breakout.

- In most cases, a significant breakout will occur around the VWAP area. However, whipsaws are more likely to happen if the transaction appears outside the VWAP zone. Therefore, it’s best to stay away from it if it does.

- Third, try to find hubs with a lot of traffic. As shown, volume is a crucial determinant of a successful breakout from the starting range. In more than half of all situations, the reconsolidation of prices occurs at the high-volume node. Therefore, this might be an excellent opportunity to buy if the price is above the node with the most volume.

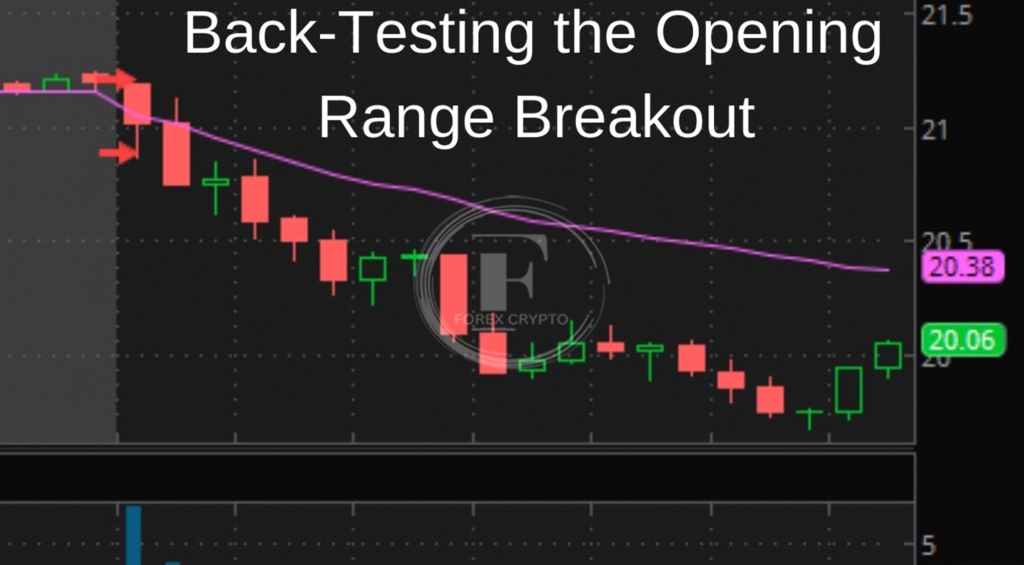

Executing Trade Using Opening Range

- When a stock breaks out of its starting range, it’s easy to plan an entry and a stop loss. I’ll show you the ropes.

- It would help if you waited for the opening range to develop before entering the market and then entered once the breakout occurred above or below the candle, depending on your chosen period.

- You should join the market whenever it shows signs of moving in the desired direction. But before you take a position, be sure the trend will continue and there won’t be a reversal that may cause a whipsaw. When this happens, a stop-loss order is activated. If you place a reasonable stop loss, you may reduce your losses during a whipsaw to a manageable level. It will help if you consider your degree of comfort with loss when deciding where to set your stop loss.

The Bottom Line

- The busiest part of a market’s day is when it first opens. It typically provides certain clues about the day’s trading trend. Such indications are sought after by intraday traders since they help inform trading decisions. Breaking out of the opening range may be a precise entry point in your trading plan.

Comments (No)