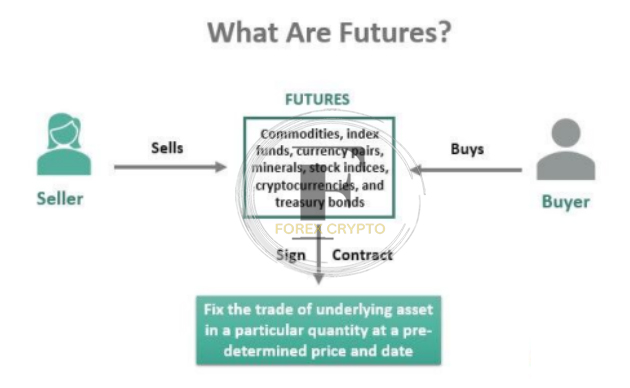

Futures trading is a type of financial trading where individuals or institutions buy or sell futures contracts that enable them to purchase or sell an underlying asset at a predetermined price and time, This can include commodities, currencies, stocks, and more, Many traders use futures trading to hedge against risk or to speculate on price movements in different markets.

Introduction to Futures Trading

Futures trading can be complex, but it offers traders a range of benefits, Unlike traditional stock trading, futures trading allows traders to buy and sell without actually owning the underlying asset, This can provide greater flexibility and leverage, Additionally, futures markets are regulated, which can provide greater transparency and stability.

Advantages of Futures Trading Some of the key advantages of futures trading include:

- Increased Leverage: Futures trading allows traders to control a large amount of assets with a relatively small investment,

- Flexibility: Futures contracts can be customized to suit specific needs,

- Liquidity: Futures markets are highly liquid, meaning traders can easily enter and exit positions.

- Transparency: Futures markets are regulated and transparent, providing greater confidence to traders,

- Diversification: Futures trading allows diversification across multiple markets and products,

Before beginning futures trading, it is essential to do thorough research and have a thorough understanding of the risks that are involved , Futures trading may be a beneficial tool for investors wanting to control risk or speculate on price changes in various markets.

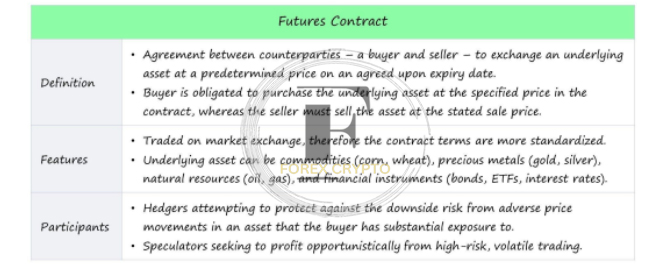

Understanding Futures Contracts

What are Futures Contracts?

Futures contracts are financial trading instruments that allow traders to buy or sell an underlying asset at a predetermined price and time, This can include commodities, currencies, stocks, and more, Unlike traditional stock trading, futures trading allows traders to control a large amount of assets with a relatively small investment.

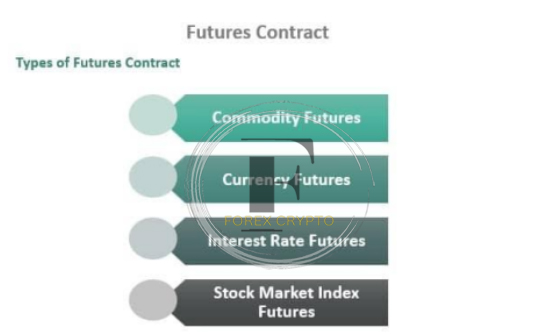

Types of Futures Contracts

There are various types of futures contracts, including commodity futures, currency futures, stock futures, and interest rate futures, Each type of contract has its own specifications and trading hours, Futures trading can be complex, so it is important for traders to do research and understand the risks involved before getting started.

Benefits and Risks of Trading Futures

Benefits of Trading Futures

Trading futures allows traders to control a large amount of assets with a relatively small investment, This can provide increased leverage and potentially higher returns, Futures contracts also allow traders to hedge against price fluctuations in underlying assets, offering a means of risk management, Additionally, futures trading offers access to a wide range of markets, including commodities, currencies, stocks, and more.

Risks of Trading Futures

Futures trading can be complex, and it involves significant risk, With leverage, even small changes in price can result in significant losses, Additionally, the market can be volatile, and unexpected events can lead to significant price swings, Traders should be aware of the risks involved and ensure they have a thorough understanding of the market and their trading strategies before getting started.

Popular Futures Contracts

S&P 500 Futures

The S&P 500 futures contract is based on the Standard & Poor’s 500 Index, a widely recognized benchmark for the overall performance of the U.S, stock market, Trading S&P 500 futures allows investors to speculate on the future direction of the market and mitigate risk by hedging against any potential losses.

Gold Futures

Gold futures allow investors to speculate on the price of gold without having to physically own the metal, This makes it a popular option for those looking to trade in the commodities market, As a tangible asset that is considered a safe-haven investment, gold can provide a hedge against inflation and market downturns.

Crude Oil Futures

Crude oil futures are based on the price of oil and are heavily influenced by global supply and demand, Traders can speculate on the future price of oil to potentially profit from price movements or to hedge against any potential losses from owning physical oil, As a vital commodity that underpins global economic growth, crude oil futures remain a popular choice for investors.

How to trade Futures Contracts

Opening a Futures Trading Account

To begin trading futures contracts, an investor must first open a trading account with a brokerage firm that offers futures trading, It is important to research and compare different brokers to find the one that best suits an individual’s needs, as fees, trading platforms, and customer support can vary.

Understanding Margin and Leverage

Margin and leverage are two important concepts to understand when trading futures contracts, Margin is the amount of money a trader must deposit to hold a futures position, while leverage is the ability to control a larger investment with a smaller amount of capital, It is important to understand the potential risks involved with using leverage and to have a solid risk-management strategy in place.

Analysis and Strategies

Fundamental Analysis of Futures Contracts

Fundamental analysis involves examining the underlying economic and financial factors that can impact the price of futures contracts, This includes analyzing supply and demand factors, global events, and government policies that can affect a particular commodity or financial instrument.

Technical Analysis of Futures Contracts

Technical analysis involves the use of chart patterns, technical indicators, and other tools to analyze historical price and volume data to forecast future price movements, This approach can help traders determine the possible places of entry and exit for their transactions.

Trading Strategies for Futures Contracts

Traders use various strategies to enter and exit futures contracts, including trend-following strategies, mean reversion strategies, and momentum strategies, It is important to backtest and regularly review the effectiveness of these strategies to ensure they align with the trader’s risk tolerance and trading goals.

Commodity Futures

What are Commodity Futures?

Commodity futures are exchange-traded contracts that allow traders to trade a particular commodity at a predetermined price and date in the future, Unlike physical commodities, futures contracts allow traders to speculate on the price movements of commodities without actually possessing them.

Popular Commodity Futures Contracts

Some of the popular commodity futures contracts include crude oil, gold, natural gas, corn, soybeans, and wheat, These contracts are traded on various exchanges around the world and offer traders exposure to different commodities, Traders can use fundamental and technical analysis to develop trading strategies for these contracts.

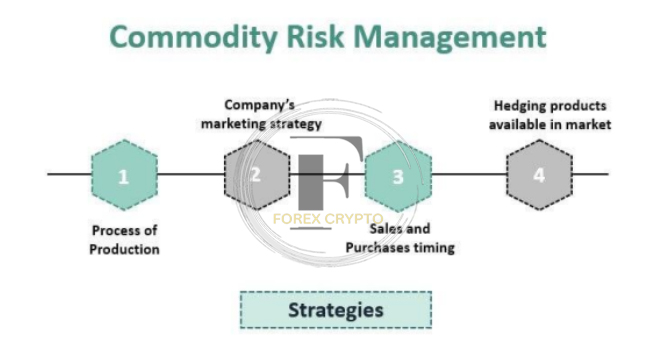

Managing Risk in Futures Trading

Importance of Risk Management in Futures Trading

Risk management is a crucial element of futures trading, Traders who fail to manage their risk properly are at risk of suffering significant losses, By implementing sound risk management strategies, traders can minimize their exposure to losses and increase their chances of success in the futures markets.

Tips for Managing Risk in Futures Trading

There are several tips that traders can follow to manage their risk in futures trading successfully, These include setting stop-loss orders, diversifying their portfolio, avoiding leveraged positions, staying up-to-date with market news and trends, and using technical analysis to identify potential trading opportunities, By following these tips, traders can take a proactive approach to risk management and increase their chances of success in futures trading.

Managing Risk in Futures Trading

Importance of Risk Management in Futures Trading

Managing risk in futures trading is an essential practice to avoid significant losses, Proper risk management strategies can increase the chances of succeeding in futures trading.

Tips for Managing Risk in Futures Trading

To manage risk in futures trading, traders must set stop-loss orders, diversify their portfolio, avoid leveraged positions, stay updated with market news and trends, and leverage technical analysis, These tips will help traders to be proactive in managing risks and improve the chances of success.

Conclusion

Summary of Futures Trading Basics

Futures trading involves the buying and selling of underlying assets at a predetermined price and date, It offers several advantages such as leverage, flexibility, and diversification, but it also poses risks such as market volatility and financial risks.

Final Thoughts on Trading Futures

To trade futures successfully, traders must educate themselves about the financial markets, understand the risks and rewards, and implement sound risk management strategies, By following these principles, traders can increase their chances of success in futures trading.

Comments (No)