What’s up, what’s up, my pal?

Today, we’ll teach you the best way to start trading foreign currencies (Forex).

Now, here’s the thing:

It’s not only forex where you may put this trading approach to use. The concept is transferable to the futures and stock markets as well.

I’ve used the term “BWAB trading technique” to describe this investment method.

The BWAB trading strategy

First, I’ll go through the considerations that led me to share this tactic with you, and then I’ll describe what it is.

- Quickly discerned

Because they are unfamiliar with price action analysis, chart patterns, and other such jargon, rookie traders often lose money.

- For novice traders to be able to recognize this pattern, I made it as simple as possible to do so.

Solid reasoning supporting the success of this trading method

- Even the most seemingly random plans need to make sense.

No one else will have the guts to make the deal. There is still some time left until we may expect to see results.

- That is to say; the pattern only appears after a period.

Those just starting will only be able to ride the wave if it develops too soon. It won’t be possible for them to answer for a long time.

I wanted to make sure that even beginner traders needed some time to absorb this trading approach.

The BWAB trading strategy (long setup)

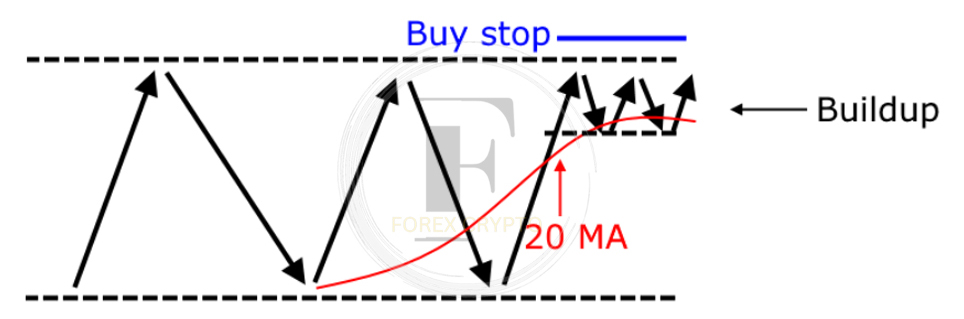

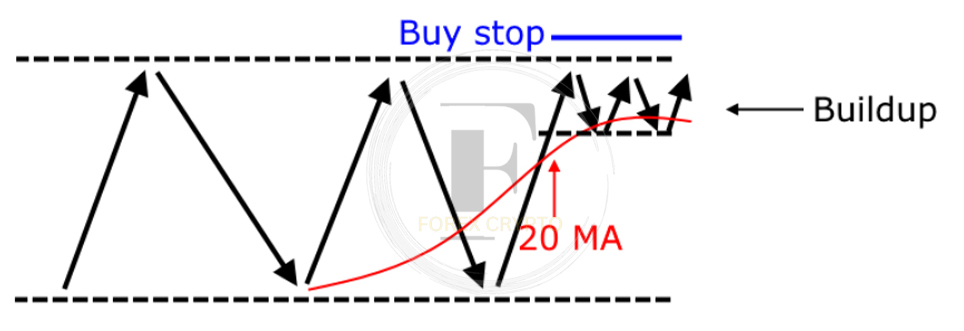

This is roughly how the argument goes:

- There is a range in the market.

- A consolidation pattern starts as the price moves closer to the previous highs.

- For the 20-period moving average to fall to near the accumulation lows would be a bearish sign.

- To enter a buy-stop order, set your stop loss to three times the average true range.

- Listen, I’ll break it down for you…

In this range, the market is: 1. (ideally 80 candles or more)

You need not be analytical here. You may even consider yourself successful if you only receive 77 or 75 candles.

In most cases, though, I’ll settle for no less than 80 candles since the greater the number of candles, the greater the effective range.

Second, the price is consolidating in a narrow range around the resistance highs (the buildup)

I want a concentrated increase at the points of most excellent resistance.

Third, the accumulation lows will be reached when the 20-period moving average reaches those levels.

This indicates that the market is setting up to make a bullish move.

With a trailing stop loss of three times the average true range, place a buy-stop order above the highs

Don’t worry if you don’t know what any of this technical terminology means.

I’ll show you a tonne of graphs and choose cases since providing concrete illustrations of those things is simpler.

So that you can have a general concept, let me draw it out for you.

The market is trading in a range with a desirable width of about 80 candles. It then climbs to the resistance levels, where it creates a tight consolidation, or what I would call a buildup.

Finally, letting the 20-period moving average approach the accumulation’s troughs would be best. To you, this indicates that a breakthrough is imminent.

When that occurs, you may enter a buy-stop order above the highs, around the resistance level.

And if the market does break out, you may go long with a trailing stop loss of 3 ATR.

(I’ll elaborate with a few illustrative charts later on how it works.)

The BWAB trading strategy (short setup)

In contrast, the quick setup is as follows:

- There is a range on the market (80 candles or more)

- As the price moves closer to support, a consolidation pattern is forming (a buildup)

- Twenty-period moving average reaches accumulation peak

- To enter a sell-stop order, set the stop loss to 3 times the average true range.

Why does it work?

Why, then, is this method of trading successful?

Sign of strength

Consolidation at resistance’s high indicates that buyers have the upper hand. Furthermore, it indicates a market for a product at a more fantastic price.

But it also indicates that sellers need help getting the price down.

That’s a positive sign that things are looking up for you.

The volatility cycle is in your favor

Now, here’s the thing:

The market’s volatility is dynamic and ever-evolving.

A return to high volatility follows low volatility, and this cycle repeats indefinitely.

Suppose the market is relatively calm throughout the lead-up. However, the risk-to-reward ratio of your trade may improve significantly when the price breaks out and volatility increases.

Since you are about to enter a period of low volatility, this is what I mean when I say that the volatility cycle is in your favor.

A logical place to set stop loss

Place your stop loss order below the accumulation’s lows.

The analogy here would be a trader who buys a breakout without waiting for the requisite buildup. Please recommend a safe spot to put a stop-loss order.

Below the support, zone seems like a good bet, but that’s a way out.

That’s why you should use this trading method.

The acronym BWAB refers to achieving a breakout after a gradual buildup. Simply put, it’s a trading strategy built on a breakout.

In any case…

The BWAB trading strategy walkthrough

Give me a moment while I give you some illustrations.

To provide one illustration:

We prioritize finding a fireplace mantel that can accommodate at least 80 candles.

Using the Shift + Click + Drag method on TradingView, you can see roughly 83 bars or candles in this area.

Then it satisfies our requirements.

And then, where exactly is that peak of opposition?

So what happens after the price builds up?

Wait for the 20 MA to reach the accumulation’s lows to take action.

There is a clear upward trend in prices, and the 20 MA has recently touched the lows of this accumulation, suggesting that it is providing support.

Excellent, this completely satisfies our requirements!

Put a buy-stop order above the resistance highs as the fourth step.

Finally, a trailing stop loss of 3 ATR will be in place. The chandelier stop is an indicator that can be used in this location.

To explain how it functions, consider that this is a variant of the Average True Range indicator. First, I’ll try to explain.

If you have already entered a buy trade, you can use the blue line as a trailing stop loss. Then, exit the trade when the price closes below the blue line.

The parameters of this indicator are:10

The ATR multiplier is the crucial factor over here. So if I gave you 3 ATR, you’d be able to catch a medium-term pattern.

Increasing the ATR multiplier to 4, 5, or whatever you choose will allow you to catch a longer-term trend.

The action of this blue line is straightforward.

When you take out your trusty ATR (which stands for “average true range”) indicator, you’ll have a quantitative assessment of the market’s previous volatility.

So, let’s suppose the current price level is Y, the ATR is X, and the multiplier is 3.

To do this, let’s say

Y – 3X = Z

Z, the blue line in the diagram, is what we shall obtain.

As the current market price, Y rises, you may expect the blue line representing your chandelier stop to rise.

And here you stay in the trade until the price closes below the chandelier stop.

This is a good deal, and I intentionally chose this one to clarify my point.

However, this is how the trading method works.

Here’s a second illustration (New Zealand dollar/Japanese yen):

To begin, let’s locate a space with at least 80 candlelights.

It is approximately 77 bar.

No, Rayner, this isn’t 80 bars yet, you may be thinking. So we have 77 bars. Is this layout still acceptable?

Don’t be such an idiot. If there is just a one-bar, two-bar, or five-bar discrepancy, you should probably go with it.

All that counts is the idea, not the particulars.

The next step is to locate resistance peaks.14

Find the crescendo, the third consideration.

It will be darn simple to search for a buildup in retrospect. However, the situation becomes more complex in real-time.

Just imagine this from a long time ago.

There could be a buildup in the making, and you could be eager to buy the breakout to new highs.

Just ensure you enter the trade before the market makes a decisive move. The question is, how do we know the market is preparing?

The 20-day moving average (MA) becomes significant when it falls below the current price.

And that can only occur after the market has had time to settle. So, the anticipation must be sustained for a considerable time.

To illustrate this point, I’ll show you how far the lows of this pullback are from the 20 MA by first putting the 20 MA in perspective.

Thus, this indicates that you should not enter your trade at this time. The 20-day moving average should get close to the accumulation’s lows.

In the future, we see that the 20 MA has dropped to the foundation lows.

We can now deduce that the market is preparing to break out, at which point you would want to place a buy-stop order above the highs with a trailing stop loss of 3 average accurate range units.

The market chopped the 20 MA for some time before the breakout, but that is largely irrelevant at this point.

A robust and compact introduction is what you need most if you want to succeed. More snugness is preferable.

The chandelier stop trails your stop loss when the market breaks out.

The price will cause the blue line to rise as the market continues to rise. As a result, you will get out of the trade once the price drops below the support level you set.

The entire chandelier stop would be skewed, signaling that you should get out of the trade.

Here’s a Third Illustration (Euro/Dollar):

Find a market with a spread of at least 80 candles before investing.

Locate the points of most excellent resistance next.

The accumulation, in this case, occurs without the presence of resistance, which makes it a little bit unique.

For the earlier examples, the buildup we formed before resistance, before the breakout.

But this one seems to hit resistance, break out of resistance, and then form a buildup. And this is fine as well.

You should watch for the 20 MA to reach the lows to take advantage of the buildup.

The 20 simple moving average has yet to drop below the consolidation lows. Thus a breakout is still premature.

You can now set a buy-stop order above the recent highs since it has reached the lows of the buildup up here.

In addition, while trend-following, set your trailing stop loss at 3 ATR.

In any case…

Tweaks and modifications

No stone has been set with this BWAB trading method.

In other words, you can stick to my guidelines in the letter. Sorry, but that’s not how it works.

And I want what I teach to be something besides a carbon copy of what you use in your trade. So please use your judgment here.

There are a few things that might need some tweaking on your end.

1. Adjust the trailing stop loss

The 4- or 5-ATR trailing stop loss is suitable for capturing a longer-term trend.

Keep in mind that if you use a broad trailing stop loss and want to keep your 1% risk per trade, you will need to reduce the size of your position.

2. You can go with an early exit

Using this method, you may cut down on your financial losses.

I’ll show you how it works.

Check out the value of one dollar in Turkish Lira.

Say you’re placing a buy order with a stop price above the prior highs (at the blue dotted line) and a stop loss price below the accumulation.

When the market turns against you, it often does so after a false breakthrough.

Even though it hasn’t reached your trailing stop loss, you may want to get out of this trade now to limit your losses.

If you anticipate the market will reach your stop loss, you may cut it to something like 0.5 or 0.6 R of loss instead of letting it strike you ultimately.

The risk with this strategy is that you will get out of the trade too soon if the market makes a sharp upward turn. That’s the catch, though.

If you’re set on using this method of an early exit, you should be ready to re-enter the trade. Since it’s possible, this is just a purge intended to remove ineffective holders.

Thus, you have a trailing stop loss (red dotted line) in place and will re-enter the trade if the market re-breaks above the new swing high (blue dotted line).

This is insurance, so you can get in on the transaction if the trend develops into something more substantial.

I limit myself to no more than one instance of this behavior. Too many exits are annoying to me.

Even if I am stopped out of the trade early, I could attempt to get back in if the market breaks out above this swing high.

Next…

3. Pre-breakout technique

If you could join the trade before the breakout happens, wouldn’t that be fantastic?

Is it feasible? In a word, yes.

And I’d want to teach you what I call the pre-breakout method.

Multiple frames are required for the execution of this method.

You want to watch for a false break setup near support levels on the lower timeframe.

You’re hoping for a price bounce back over this level of support.

In this case, the price drops to test support but then recovers to close bullishly inside the range. Again, I would classify this as a “setup for a fake break.”

And with a stop loss 1 ATR below the lows, you may enter at the start of the next candle.

When put in perspective, you purchase at the lowest point of the upswing over here. You’ve arrived at the pre-breakout stage.

You stand to gain a lot with minimal risk. Although this is a complex method, it will be well worth your effort to learn the basics of the idea and how it operates.

Pros & cons

Pros:

Assuming it develops into a full-fledged trend you can ride, the risk-to-reward ratio is in your favor at 1:3 or better.

Cons:

Trading possibilities are few for the BWAB method.

Let’s pretend you’re a forex trader who only deals with daily charts. You will only be able to make a few profitable trades in a year.

If you wish to trade this method profitably, you must broaden your horizons and investigate other markets, such as stocks and futures.

And once again, the basic idea is the same.

So, to review…

Recap

An Overview of the BWAB Trading Method

Changing the BWAB trading method to include a trailing stop loss, an early bailout, and a pre-breakout

That’s all I wanted to say, and until then, take care.

Comments (No)