When you trade on margin, you pay just a portion of the full investment price up front and borrow the remainder from your broker.

Using margin, you may speculate on the rise and fall of asset prices that would otherwise be beyond your financial reach. However, it’s important to remember that margin trading may boost profits but also magnify the amount and frequency of losses.

Just what does it imply to trade with a margin? Learn the basics of trading on margin, including what it is, how it works, and the rewards and hazards involved.

What is margin trading?

- By trading on margin, you might avoid shelling out the total purchase price of an item. Instead, in a margin deal, you pay the broker merely a tiny percentage of the underlying asset’s value.

- So what exactly is a trading margin? Traders need to be mindful of two different margins. Margin is the first investment needed to initiate a trade. It is quantified by the leverage ratio, which indicates the extent to which you use leverage.

- With a leverage ratio of 2:50, that is a 50% profit margin

- At a leverage ratio of 5:1, your margin will be 20%.

- Leverage of 10:1 yields a 10% profit margin.

- A leverage ratio of 20:1 would equate to a margin of only 5%.

- Using a leverage ratio of 30:1 yields a margin of 3.3333%

- Limits on how long you may keep a margin transaction open are determined by your maintenance margin or the percentage of your account’s equity you need to preserve to avoid going into the red (overall account value). The maximum permitted leverage for retail accounts ranges from 30:1 for specific asset types to 2:0 for others.

- Brokers will want equity coverage of your margin to reduce their risk. Brokers may issue a margin call if they believe you may incur losses and have not made enough provisions in your account to cover them. A margin closeout will occur if your trading situation continues to deteriorate.

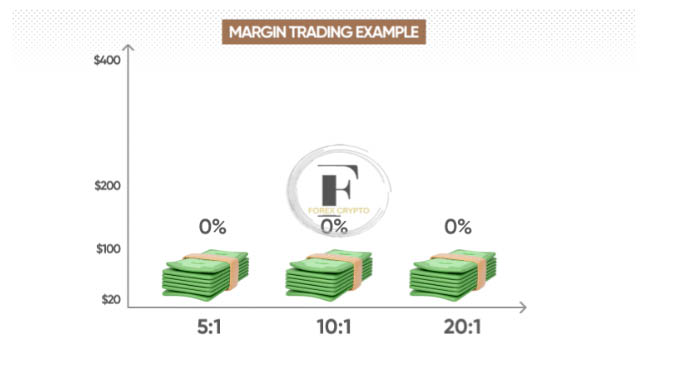

Margin trading example

- Suppose you want to invest in CFD stocks but only have twenty dollars to put into your trading account. If your leverage is 5:1, you may trade $100 worth of the asset for only $1 in the margin, with each additional dollar in the margin equivalent to 20% of the entire value of the deal. The broker adds $5 to your $1 investment, turning $20 into $100.

- With the leverage of 10:1 or a 10% margin, investors may trade $200 with only $100 of their own money. This is because each investor’s $1 would only represent 10% of the whole transaction, or $10.

- You could trade $400 on a $20 investment if the leverage were 20:1, or 5% margin. The margin percentage, or leverage ratio, varies depending on the asset.

How does margin trading work?

- Suppose you want to invest in CFD stocks but only have twenty dollars to put into your trading account. If your leverage is 5:1, you may trade $100 worth of the asset for only $1 in the margin, with each additional dollar in the margin equivalent to 20% of the entire value of the deal. The broker adds $5 to your $1 investment, turning $20 into $100.

- With the leverage of 10:1 or a 10% margin, investors may trade $200 with only $100 of their own money. This is because each investor’s $1 would only represent 10% of the whole transaction, or $10.

- You could trade $400 on a $20 investment if the leverage were 20:1, or 5% margin. The margin percentage, or leverage ratio, varies depending on the asset.

Several little losses might rapidly build up to a significant sum if you have many transactions open or if you are trading a highly volatile asset class in which substantial price swings occur quickly.

Minimum equity requirement

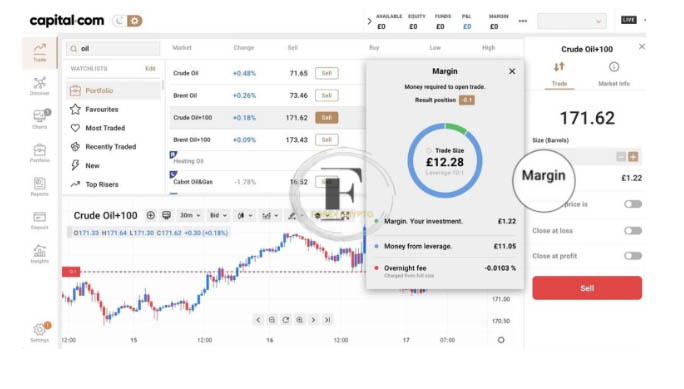

- Margin, initial margin, deposit margin, and needed margin all refer to the same thing: the money you need to put up before you can begin trading. We term it “necessary margin” here at Capital.com.

- The margin you need to invest will change depending on the kind of assets you buy. It is based on the margin ratio, a proportion of the asset’s value. Margin requirements vary per instrument.

- Several currency pairings used in CFD (contract for difference) trading have a margin requirement of 3.333%. The margin requirement for indices and widely traded commodities like gold is 5%.

- It may be as high as 50% for riskier assets like cryptocurrencies, which are unavailable to retail consumers in the UK.

- If you have many open positions, your “used margin” will equal the total margin needed for all your trades. Free margin is the amount you have available to make new deals.

Maintenance margin

- To keep a trade open, you’ll need maintenance margin funds in addition to your needed margin, the amount of readily accessible cash you need to initiate the transaction.

- Margin requirements are based on the total amount of your open transactions and whether or not you are presently earning money on those deals.

- Your cash balance, or funds, refers only to the money in your account, whereas your equity considers your cash balance and any unrealized gains or losses. Margin is the amount of money you need to have in your equity to make a purchase. It is determined by multiplying the number of contracts by the leverage in use with the current closing price of open positions. The ratio of your equity to your margin determines your margin level.

- When the value of your transactions grows and decreases, so does the amount you require as your total margin. Therefore, maintain a 100% equity buffer at all times.

- Always keep an eye on your deals’ status to ensure you stay within the margin. If the margin requirement exceeds your available funds, you’ll need to terminate your trade or deposit additional money to keep it at par.

Credit limit or maintenance margin

- You must have a total margin balance in your account that is more than or equal to the statutory margin plus any additional margin you may have. These are the parts of your trading account that are now sitting idle. They protect you against the financial loss that might result from a deal gone wrong.

- Margin requirements are based on the total amount of your open transactions and whether or not you are presently earning money on those deals.

- Equity refers to the amount of money already in your trading account, while margin refers to the amount you may be obligated to pay due to losing trades. The margin level is calculated by dividing your equity by your margin and is expressed as a percentage.

- When the value of your transactions grows and decreases, so does the amount you require as a total margin. Therefore, your total margin should always be equal to or greater than 100% of your risk.

- Monitor your deals’ status constantly to ensure you stay within the margin. For example, a margin call would be issued if insufficient money were present.

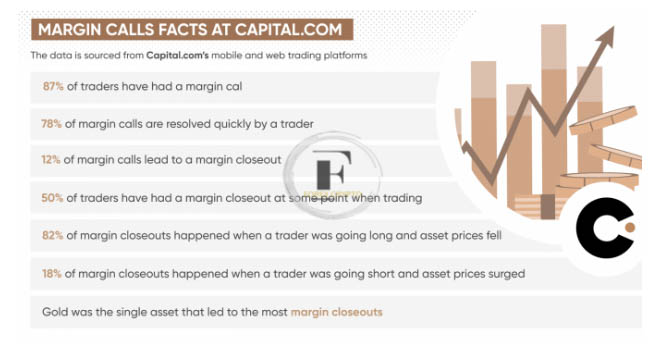

Margin calls: how to avoid them?

- You may get a margin call if your transaction goes against you and you don’t have enough money to cover your losses. For example, you will get a margin call when your margin account equity falls below the required minimum.

- You must either increase money or liquidate positions to prevent future losses since your broker is nearing its lending limit.

- Not responding to a margin call is a bad idea. There is a danger that your broker may close your transactions due to a margin closeout.

- Capital.com, as of May 2022, delivers over 38,500 margin call emails to customers daily.

- Using a stop order, more funds in the account, or the closure of unprofitable positions are all risk management techniques that might be used to forestall a margin call. With unpredictable markets, it’s best to be ready for the worst constantly.

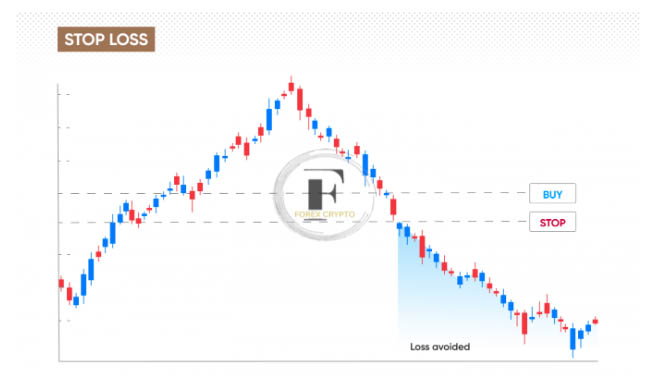

Why are stop orders important?

- When an open position hits a price you specify, the order is closed automatically (thus the name “stop order” or “stop loss”). Likewise, a deal that is going against you may be terminated automatically, preventing losses from growing to the point where a margin call is necessary.

- The risk may be controlled using a stop-loss order. For example, if you acquire 100 shares of a CFD at $100 each, you may use a stop-loss order to force a sale when the price drops below a certain threshold, say $95.

- If your short trade goes against you and the asset’s price begins to climb, you may protect yourself by placing a stop-loss order at a higher price, say $105.

- A stop-loss order will only be activated at the specified level but will be carried out at the next available price. For instance, if there is a gap in the market, the trade will be halted, and the position will be closed at a less favorable level. The term “slippage” describes this phenomenon. Stop-loss orders with guarantees may be used to prevent this from happening.

- Guaranteed stops are similar to standard stops in that they both limit the loss and ensure that the trade is closed at the specified price, but they are immune to slippage. Remember that there is a fee associated with guaranteed stop-loss orders.

How do I trade on margin?

Buying on margin is a common practice in conventional investing and entails borrowing money from a broker to pay for an asset. Moreover, derivatives such as contracts for the difference may be traded on margin. You may speculate on the rise or fall in the value of equities, commodities, currencies, indexes, and digital currencies through Contracts for Difference (CFDs) (not available to UK retail clients).

These are the actions you need to take to start trading with margin:

Step 1: Open a margin account

- An individual needs a margin account to engage in margin trading.

- A margin account is a loan from your broker that allows you to increase the size of your transactions. Unfortunately, by increasing the number of possible gains, margin accounts also increase the size of possible losses.

- Using a margin account with a stockbroker, you may borrow up to 50% of the stock’s purchase price. One may borrow even higher percentages using a CFD margin account.

The second step is to make a financial deposit in accordance with the broker’s criteria.

Your first deposit at Capital.com has to be at least $20 using a credit card, debit card, or Apple Pay or $250 using a bank transfer.

Step 3: Choose an asset you want to trade on a margin

Capital.com offers CFD trading on 4,202 equities, 25 commodities, 20 indices, 138 currency pairings, and 154 cryptocurrencies (excluding those accessible in the UK) as of June 1, 2022.

Step 4: Meet a maintenance requirement

You should always have enough money in your margin account to cover your open trades. To rephrase, you should always have enough equity to pay for the margin plus 100%.

Using margin for different asset classes

Margin trading is available for various assets, including stocks and CFDs.

Stocks and shares

- The broker may need a 50% margin if the shares you wish to purchase are those of a large corporation. For example, for a total of £100,000 shares, your broker would need £50,000 from you.

- If the share price increased by 20%, you would make £20,000 (albeit somewhat less after interest and transaction costs were deducted).

- A 20% drop in share price means a loss of £20,000, in addition to interest on the £50,000 borrowed and transaction costs. So the risk of using a margin is that you may quickly make or lose a lot of money.

Contracts for difference (CFD)

- Margin trading in shares is only recommended for sophisticated traders who have already been screened by their broker and have an excellent credit history. The same margin trading approach applies to individual investors when trading CFDs and other derivatives.

- If a shareholder is concerned about the value of the shares they own declining, they may engage in CFD trading as a risk management strategy.

- Through a Contract for Difference (CFD), the investor might “short” the asset. Selling shares short involves borrowing shares from a lender and then selling them at the current market price with the expectation that their value will decrease.

- You wait for the share price to decline, then purchase what you owe, return the borrowed shares, and pocket the profit.

- Trading CFDs allows investors to short assets without having to borrow or physically own them, resulting in significant cost savings.

How hedging with CFDs works

- If an investor with 1,000 shares of Company ABC expects the price to decline, they may execute a “short” investment in the stock using a contract for difference.

- Investors who choose to hedge their bets using CFDs stand to recoup some of their losses in the event of a share price decline (less interest on the borrowed money and transaction fees).

- Yet, investors do not just use hedging strategies to counteract the risk of a decline in share price. The use of margin allows one to bet on the relative values of several currencies. Likewise, you may bet on the increase or fall of a market index. A commodity’s price is open to speculation, and it’s possible to bet on an increase or a decrease.

- Margin may be used with several asset types.

Margin trading for retail traders

- Retail investors may increasingly participate in margin trading based on contracts for difference (CFDs), using streamlined, automated margin trading platforms accessible online and through mobile applications.

- It’s possible to start trading with very little capital, and most deals are completed before the day’s end. However, because of their overnight costs, CFDs are best used for day trading and other short-term investments.

- There is a lot of oversight on the systems, and the leverage ratio is limited to prevent abuse.

- The optimal usage of leverage is when it allows you to reap the substantial advantages that margin trading may provide without incurring the potentially amplified losses that can also arise.

- It is possible to trade prudently by substituting limit orders for market orders or using stop-loss orders to restrict exposure. In addition, you may keep tabs on your trades and cancel losing orders immediately to prevent a margin call and closeout.

- You can lose everything in your margin account plus additional funds if the market unexpectedly turns against you while you have an open deal.

- Even if your broker does everything in their power to close out all your positions, they may need more time to do it quickly enough to prevent further losses.

- If your broker’s closeout fails to keep your maintenance margin losses to a minimum, specific retail trading platforms, such as Capital.com, may forgive the difference.

- In such a scenario, all you’d lose is the initial deposit you made with the broker.

What is margin closeout?

- As your losses start to snowball, you may close your margin account to prevent further damage. You will be forced to shut down your margin account when you have negative equity of 50% or less.

- If your broker promises to keep your losses to no more than what you’ve deposited, then the margin closeout will shield the broker from further losses. In the absence of such a promise from your broker, you may find yourself obligated to pay them even after the closing of the trade. You must realize the 50% closeout is never a sure thing. Closeouts are executed by liquidating open positions at today’s market prices and levels of liquidity. If your stock falls below the needed margin level and the market is gapping at the time, the closeout might be executed at an even lower level.

- Margin closeout levels are predetermined for all margin traders. Realizing these thresholds helps prevent financial setbacks. Check your trading platform’s margin levels often. When you make transactions, and as the value of your assets changes, so does the closeout level.

How is margin closeout calculated?

Your account balance and unrealized gain or loss on active positions are used to establish your margin closeout level, which is then compared to the current midpoint rates. All foreign currency transactions are converted into the account’s base currency.

See how your UPL (unrealized profit or loss) measures up using the following calculation:

- Equal weight is given to both profitable and unprofitable investments. Therefore, your account balance must be greater than the sum of your transactions if you expect to incur a loss. It would help if you had a margin level of 100% (meaning that your equity fully covers the margin call).

- Through the Capital.com app and on the web trading platform, you may see your margin % at any time. By signing up, you’re promising to retain your equity at or above 100% via constant monitoring and maintenance.

- When your available margin falls below the amount needed to keep your open trades open, you will be required to close them. Capital.com will close out your positions to prevent you from incurring infinite losses and reduce your potential legal responsibility.

- You may use them as benchmarks:

- A high percentage of protection: If your margin is more than 100%, you have enough money to keep all your trades open without making any further deposits.

- A margin call will be issued if your margin level falls below 100%, at which point you will need to either liquidate your holdings or add more money to your account.

- An automatic closure and alert will occur when your margin falls below 50%. It’s the area where you can count on being shut out.

- Stop without prior notice: If your open positions are affected by a quick shift in the market, your maintenance margin might fall below 50%. There is no time to issue you a warning before your account is terminated.

- Prices in turbulent markets tend to fluctuate rapidly. Because of this, you may get a slew of margin calls and margin closeout emails in a short amount of time.

How margin closeout works

- Your broker will start a closeout if you ignore a margin call or if, after increasing your total margin, your positions continue to deteriorate and your margin falls below 50%.

- For this reason, it pays to be ready for unexpected swings in the market. While you have no say over the direction of prices, you may protect yourself against closeouts by setting stop limits.

- In the event of a closeout, your broker will start liquidating your margin accounts. The following is a list of the sequence in which the closeout will occur automatically.

- I was finished with all open orders.

- All lost open market transactions are terminated as soon as the relevant markets open if the margin level is below 50%. Likewise, all winning open market trades are closed if the margin level is below 50%.

- Keep in mind that there are a variety of market hours. Hence, a lucrative transaction may be closed before losing it.

- Your broker aims to close your open position quickly at the best market price. If you wait, the market may have already recovered, and your transactions may be lost. So they’re going to be shut down at a loss.

How to recover from margin closeout

- Margin closeouts are only fun for some of the participants. Just keep in mind that you have support from other people. For example, half of Capital.com’s trading platform customers have had a margin closeout occur at some point.

- By May 2022, Capital.com was closing down between 800 and 3,000 losing deals each day. This is for the safety of our patrons.

- A margin closeout is not the end of the world, so don’t freak out if it happens to you. Instead, look at your past trades and see what you can do to avoid a closeout in the future.

- Maybe you needed to have a solid trading strategy or employ more risk management tools, or you let your emotions get the best of you and didn’t keep to your plan. Recognizing your errors and using that knowledge to aid your recovery is essential.

- You must keep an eye on your account and any available vacancies. An easy-to-use, quick-loading tool to monitor your transactions might save you a lot of bother. If you get a margin call and need to determine whether or not to add cash to keep your trades open, you must do it quickly.

- The first step in preventing a margin closeout is a firm grasp of what one is and how it occurs.

Benefits and risks of margin trading

Is it wise to trade on margin?

- Leveraging your trading power is a crucial advantage of margin trading over non-margin trading. With a little outlay, your trading potential is greatly amplified, boosting performance.

- The margin indeed magnifies profits and losses equally. Margin trading amplifies the risks and rewards associated with investing in price fluctuations.

- With leveraged trading, even little changes in the market may have a significant impact on your earnings or losses. Therefore, it’s essential to monitor your finances often. In addition, the price may fluctuate widely in volatile marketplaces.

Margin trading best practices

- Margin trading may increase earnings, but only if handled sensibly and backed by thorough investigation and risk management measures. Yet, it also carries the risk of severe financial damage. Margin trading carries the risk of complete account destruction in the worst-case scenario.

- Always keep an eye on your available vacancies.

- While trading, monitoring your positions and quickly exiting them if the market goes against you or setting up automated stop orders is essential.

- Tend to a maintenance margin of 100% or greater.

- Remember that many traders begin with too little money in their margin accounts, which may amplify losses in specific scenarios. A margin call is more likely if you keep the bare minimum in your account. Reduce your reliance on withdrawals during market volatility by keeping a larger cushion in your account.

- It would help if you avoided situations in which your broker is forced to liquidate your investments at a time when they are severely undervalued. There is little likelihood of a price recovery. Leave some money in your account if you don’t want your positions canceled without your permission.

- Set up a plan for your trade.

- Trading choices may be made with less emotion if you have a well-researched and well-developed trading plan. Before making any trades, you should do your homework by reading up on technical and fundamental analysis, recent news, and expert opinions.

- Set stop-loss orders

- Stop-loss orders remove the human element from trading by making decisions for you automatically. Put a stop order on your account to protect yourself against a margin call or closeout if the market starts to drop.

Start your margin trading journey with Capital.com

- While trading on margin, you may double your profits if the asset’s price moves in the desired direction, but you can also multiply your losses if the deal goes against you. When this happens, you may rely on the negative balance protection offered by Capital.com.

- In CFD trading, you may “go long” (purchase) if you anticipate a price increase and “go short” (sell) if you anticipate a price decrease.

- Think about what assets you’d want to trade and familiarize yourself with the mechanics of CFD trading. For example, you may trade on margin using various equities, indices, commodities, and foreign exchange pairings.

- If you’re unfamiliar with margin trading but interested in learning more, consider opening a practice account at Capital.com. Then, get a real trading account and make your first margin trade when ready.

- Use risk management strategies to keep your margin trading account safe from margin closeouts and margin calls.

FAQs

When someone asks, “What is margin trading?”

Margin trading is leveraged trading in which you use money borrowed from a financial institution. With margin trading, a small initial investment is required before the broker advances the remaining funds for the deal in your name. However, bear in mind that leverage might increase your gains or losses.

Margin vs. leverage – what’s the difference?

Money is put down as a “margin” to initiate a trade. A trade’s potential loss ratio to the account’s equity is called its “leverage.” If you choose a leverage ratio of 2:1, for instance, you would pay just 50% of the asset’s worth and borrow the other 50% from your broker. The relationship between margin and leverage may be seen in the leverage ratio, expressed as a margin percentage.

In trading, what is an example of a margin?

Money is put down as a “margin” to initiate a trade. For instance, the margin on silver CFDs is offered at 10% by Capital.com. So trading $1,000 in silver CFDs requires just $100 to start.

Is it wise to trade on margin?

There are both advantages and disadvantages to trading on margin. You may trade more expensive assets and establish more significant holdings. On the other hand, the possibility of further losses is also raised. Your risk appetite and trading objectives should be considered when deciding whether margin trading suits you.

Can you become wealthy trading on margin?

If the asset price you’re trading in aligns with your position, margin trading may let you profit even with a smaller initial commitment. On the other hand, market volatility means that more considerable losses are possible if the trend reverses.

For example, what is the definition of a margin call?

A broker will issue a margin call when the value of your margin account drops below the maintenance margin requirement.

Comments (No)