We first discussed risk management and its applications to trading a little over a week ago. Stop-loss and take-profit orders, which help simplify risk management, are the focus of today’s post.

What Are Stop Loss and Take Profit Orders in Crypto and Forex?

Stop-loss and take-profit orders allow a trader to cancel a position automatically whenever the price hits a predetermined target. With such resources, investors may place trades and go on to other projects without worrying about the market’s potential for sudden decline or increase. In addition, when the market price hits the take-profit level, the trader’s winnings are locked in, while the stop-loss level prevents additional losses.

How Do You Set Stop Losses and Take Profits in Crypto and Forex?

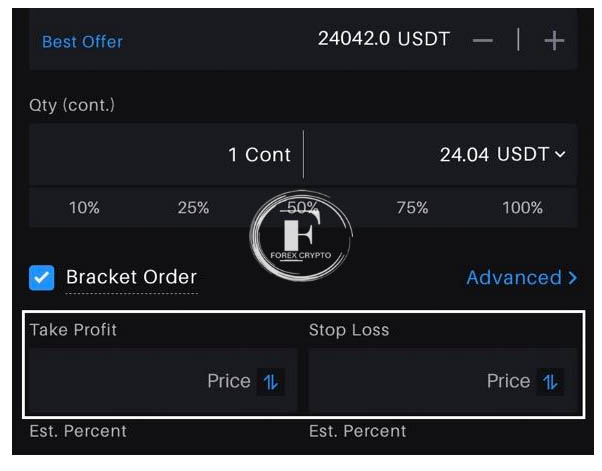

Stop-loss and take-profit order placement operate differently among trading venues. Most trading platforms employ a UI similar to what is seen below, where the TP and SL levels are required fields when initiating a trade. The interface might take various forms, but the basic concept is always the same.

Traders set their stop-loss and take-profit points by price goals and trade cancellation. They use various analyses, such as price movement, moving averages, and the relative strength index, to determine their aims.

Why Place Stop Losses?

Stop losses automatically end a losing deal when the market moves against the trader. A trader may use a stop loss to free up mental bandwidth and concentrate on other tasks without worrying about being forced to sell at a loss.

Why place profit targets?

When a deal works in their favor, they have predetermined profit goals to help them cash out. When the price hits the take-profit level, the trading platform immediately closes the order.

Types of Stop Loss Orders

Stop-loss orders come in many forms and may be used in various scenarios. Order types such as sell stop, stop limit, and trailing stop are included. So let’s compare and contrast the two!

Sell Stop Order

To sell an asset at market price, investors might use a sell-stop order, also known as a stop market order, when it reaches a specific price. The term “stop price” is used to describe this determined value. Upon activating the stop, the order is filled, and the asset is sold at the current best market price.

Stop Limit Orders

- A stop limit order is similar to a stop market order but with a different execution. Setting a limit-sell order ensures that the item will be sold at the predetermined price rather than the current market price. This implies an order will be fulfilled only if a specific price is attained.

- Due to the infrequency with which limit orders are completed, many investors find that sell-stop orders are a more convenient alternative to stop-limit orders. Limit-sell orders sometimes get fulfilled during sudden price decreases, leaving traders stuck in an unanticipated slump. If you want to close your position at the best possible price, use sell-stop (or market) orders.

Trailing Stop Order

- Last but not least, the trailing stop order is a type of stop order that is gaining popularity. This order only moves upward from a certain percentage below the current market price. For example, if one buys Ethereum at $1,000 and then sets a 5% trailing stop, the order will be executed with a $950 stop. The stop loss has been set at $1,092 and will increase to $1,150 if the price increases by 15%.

- The transaction will be executed as a market order at $1,092 if the price drops and the stop loss does not follow the price. Those that trade with the trend and like to have a position open for extended periods without constantly adjusting their stop employ this stop order.

Examples of Placing Stop-Loss Strategies

Stop measures may be implemented in several contexts. In this piece, we’ll examine a few of the most common tactics. Stop losses should be in place whether you’re trading the bounce, breakout, or trend reversal. In any event, it entails deciding where to exit a transaction if the market moves against you.

Trading the Bounce

Stops are often placed below the low while trading the bounce since it makes the most sense. When the price tests a support level, it usually bounces back up, allowing traders to go long.

- But you shouldn’t just blindly set your stop below the lows. Using the preceding example, the author of this article entered a trade only after a higher low was printed, providing further evidence of a potential bounce. An investor who blindly goes long on the first bounce may have already been stopped from the trade in the highlighted region. It’s helpful to have additional information that suggests a rebound is coming, whether that’s a market structure or something else. Because of this, over time, considerable cost savings will be generated.

Trading the Breakout

The placement of your stop loss order during breakout trading may be challenging, mainly when dealing with a trending asset. Generally, it would be better to set your stop loss below the previous low, which is what most traders do. However, when the market structure is unfavorable, you might employ a trailing stop or set a stop loss below a moving average.

Trading the Trend Reversal (Failure Swing)

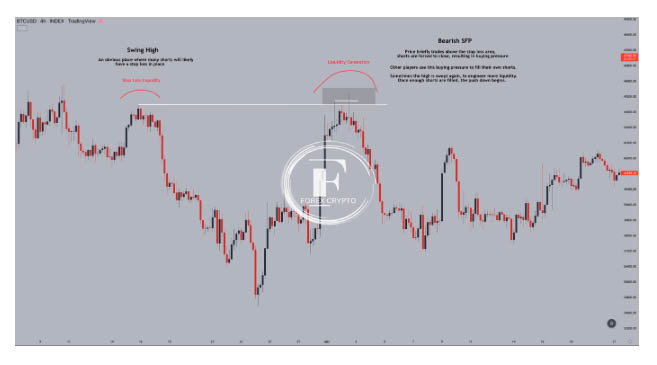

- The market often displays the price pattern of a failed swing. The number of analysts who use it is rising. In a nutshell, the swing failure pattern is a technique in the field of liquidity engineering for satisfying bulk requests. That happens when the price is manipulated into areas of little liquidity to fill other positions.

- When supplies are low, merchants create artificial demand to satisfy customer requests. Is there a more straightforward method than using stop-loss orders? As seen in the image below, a bearish swing failure pattern has formed when the market absorbs liquidity above the prior swing high before reversing course and falling.

While trading these SFPs, stops are often set above the new swing high that forms following the liquidity grab. As a result, these transactions develop rapidly and are best concluded as the correction begins to ease.

What is the General Profit Target Placement Theory?

- As we covered in our previous post on risk management, the general profit target placement theory discusses the trade-off between risk and reward. After determining where to stop and where to take profit, traders must determine if the trade’s risk-to-reward ratio is satisfactory for their win rate.

- Market circumstances, price activity, indications, support and resistance, and other types of analysis are studied to establish profit objectives. To maximize profits, traders look for resistance levels in the market and place take-profit orders there.

What Is the 1% Rule in Trading?

- It is commonly accepted that a trader should not lose more than 1% of their initial investment. According to the guideline, you should only risk one percent of your trading money on a single deal. For example, with a $25,000 trading account, Felicia should only risk $250 in a single deal.

- Considering your entry price and the location of your stop loss, you may apply this method to determine your trading position size. For example, if Felicia has a 5% stop loss below her entry price, she should invest $2500 (20 x $250). The loss she will incur when her stop loss is reached is $250, or 1% of her trading account.

Conclusion

- Trading tools such as take profit and stop loss orders are great for automating a portion of the process. For traders, this means entering transactions and moving on to other duties without worrying about the impact of rapid price swings. When the price hits the take-profit level, the trader’s earnings are locked in, while the stop-loss level prevents additional losses.

- This post is based on my fundamental understanding of the subject. This work was created with the intent of fostering learning. It is not intended to be taken as professional advice of any kind.

Comments (No)