- Trading and investing in foreign currency occurs on the foreign exchange market, a worldwide electronic network. It’s open nonstop, five and a half days a week, yet there needs to be an actual address for it.

- The foreign currency market is a vital part of the global financial system. Their function within the framework of global monetary exchange is crucial. Their credibility in business transactions and operations is essential to the success of their mission. Honoring one’s end of the bargain is a critical element of trustworthiness. For instance, both parties to a forward contract of a currency pair (where one is buying and the other is selling) must be prepared to uphold their respective obligations under the terms of the agreement.

Spot Market

- These are the foreign exchange market’s fastest currency exchanges. All transactions in this market are settled instantly at the going exchange rate. Over a third of all currency exchange occurs on the spot market, and deals typically take one or two days to settle. Between the time of agreement and the real deal, the traders can take advantage of any increases or decreases in price caused by currency market volatility.

- The number of spot transactions in the foreign currency market is rising. Currency notes, travelers’ checks, and wire transfers are the most common trade methods. Lastly, over 90% of all spot transactions are conducted just for banks.

- It is estimated by the Bank of International Settlements (BIS) that around 50% of all transactions in the foreign currency markets occur daily in the spot market. The international foreign exchange market is centered in London. Consequently, it has the most significant trading volume and the broadest range of currencies.

Major Participants in the Spot Exchange Market

The most important players in the spot exchange market will now be discussed.

Commercial banks

These financial institutions dominate their respective industries. Commercial and investment banks conduct most foreign currency transactions and act as market makers and takers for their clients. The bank engages in extensive currency trading to profit from fluctuations in exchange rates. An interbank transaction may be necessary if the amount being transferred is very large. In addition, an FX broker may be sought out for low-volume FX intermediation.

Central banks

- The Reserve Bank of India (RBI) and other central banks worldwide intervene in the foreign exchange market to keep their respective national currencies (such as the Indian rupee, or INR) stable and guarantee that they trade at a rate that meets the needs of their respective economies. For instance, if the rupee starts to lose value, the central bank (RBI) may issue (sell) some foreign currency to stabilize the market (like the dollar). This influx of foreign dollars will halt the rupee’s decline. However, if the rupee’s value starts to rise too quickly, it may be necessary to do the reversal procedure.

- The Dealers, Brokers, Arbitrageurs, and Speculators

- Traders engage in the practice of arbitrage, in which they purchase at a discount and sell at a profit. These dealers operate primarily in the wholesale sector, with the vast bulk of their dealings being interbank. The dealers may have to interact with corporations and government institutions. They feature a small spread and cheap transaction fees. Ninety percent of the total value of FX agreements comprises wholesale transactions.

Forward Market

In a forward contract, the buyer and seller agree to transact at a specific future date at an agreed-upon price and quantity. As no funds are exchanged upon the signing of the agreement, there is no need for a security deposit.

Why is forward contracting useful?

- Hedging and speculating may both benefit significantly from the use of forward contracts. A wheat farmer selling his crop at a predetermined price to remove price risk is a typical example of a hedging application using a forward contract. Similarly, a bakery would benefit from making advance bread purchases to help with production planning and avoid price changes. Others hope the price will rise because they have insider information. So, they choose to purchase on the forward market rather than the cash market. This trader would buy in the forward market, hope for a price increase, and then sell at a higher price.

disadvantages of forward markets

- There are drawbacks to the forward markets. The drawbacks are briefly discussed below:

- Illiquidity caused by a lack of centralized trading (because only two parties are involved)

- possibility of a counterparty (the risk of default is always there)

- The primary difficulty with the first two is how open and generalized the solutions are; the forward market pits buyers and sellers against one another, just as in a real estate transaction. The two parties’ preferences now determine the arrangement’s contract conditions. However, the contracts may be non-transferable if more than two parties are involved. Participants in the forward market are exposed to counterparty risk if one of the two parties to the transaction files for bankruptcy.

- Another widespread issue in the forward market is that the longer the time frame of the forward contract, the greater the possible price swings and, by extension, the greater the counterparty risk.

- While illiquidity is avoided in forward markets because of standard contracts, counterparty risk is always there.

Future Markets

- Many issues that arise in the forward markets may be resolved with the aid of the futures markets. This is because the forward and futures markets follow the same fundamental principles. Yet there are central exchanges and standardized contracts (on a stock exchange like the NSE, BSE, or KOSPI). Each deal is guaranteed by a clearing business that acts as the counterparty to both buyers and sellers on the exchange. Moreover, as opposed to forward markets, futures markets are more liquid since many traders may simultaneously participate in the same transaction (like buying a FEB NIFTY future).

Option Market

Defining an option is a prerequisite to studying the options market.

What is an option?

- To purchase an option is to enter into a contract granting the buyer the right, but not the duty, to acquire the underlying asset at a specified future date (and time) and price. The difference between a call option and a put option is the ability to purchase or sell. Because of the way currency pairs work, another must be sold whenever one currency is acquired.

- To illustrate, a USD call and an INR put make up a currency pair option to purchase one US dollar (the base currency) for one Indian rupee (the counter currency). For this pair, the ticker will read USDINR or USD/INR. A put option on the US dollar and a call option on the Indian rupee make up a currency swap option. The exchange rate between the Indian rupee and the US dollar will be represented by the sign INRUSD or something similar.

Currency Options

Options on currencies are currency derivatives, a relatively recent but potentially lucrative investment opportunity. A currency option allows you to “call” the exchange rate, which may be used for investing and risk management.

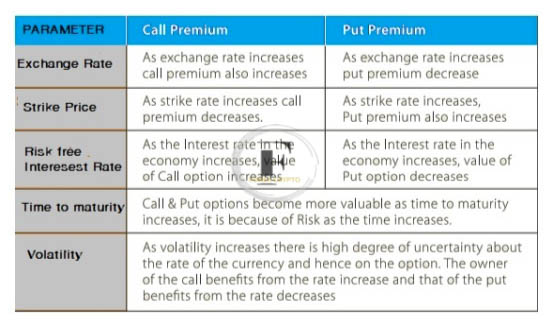

Factors affecting the currency option prices

The following table details the variables contributing to currency option pricing fluctuations.

Comments (No)