The high level of leverage offered by forex brokers is one of the primary draws for many individuals to the foreign exchange market, Traders may use leverage to increase their exposure to the financial markets beyond what they need to pay, Regardless of experience level, Forex traders should have a thorough understanding of leverage and how to utilize it responsibly, This article provides a comprehensive discussion of leverage in the foreign exchange market, comparing it to leverage in the stock market and highlighting the significance of risk management.

WHAT EXACTLY DOES LEVERAGE MEAN RELATIVE TO FOREX TRADING?

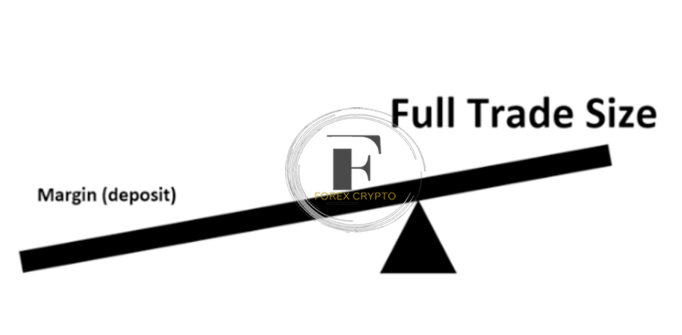

Forex traders may enhance their market exposure beyond the level of their original investment (deposit) by using a beneficial financial instrument called leverage, Leverage is short for “loan.” In a situation with ten-to-one leverage, a trader only needs $1,000 to initiate a position corresponding to the value of $10,000, Nevertheless, it is important to know that when leverage is used, BOTH profits and losses are amplified, When the market conditions are unfavorable, a trader who uses leverage risks losing even more money than they initially deposited.

Traders can get exposure to a notional value or transaction size 10 times greater than the deposit or margin needed to finance the trade when they use leverage with a ratio of ten to one, One analogy that comes to me is making a down payment of 10% on a house, In this scenario, you are granted access to the whole property, but you are only responsible for paying 10% of the total cost.

The following ratios are common ways to indicate leverage:

The level of leverage that is made available to traders in the foreign exchange market is often made accessible by the traders’ brokers, and the amount of leverage will vary according to the regulatory criteria that are in place in various locations.

Comparing leverage in FX trading with that in stock trading

The amount of leverage that is available when trading shares is not the same as the amount of leverage that is available when trading forex, This is because the main foreign exchange pairings are very liquid and, as a rule, display far less volatility than even the shares that are exchanged the most often, Consequently, hedging risk and entering and exiting contracts in the foreign exchange market, which trades at $5.1 trillion per day, are more controllable.

HOW IS THE LEVERAGE IN FOREX DETERMINED?

To determine leverage, traders need the following information:

- The fictitious worth of the deal is often known as the “trade size.”

- The proportion of the margin

Traders often get a margin percentage from their brokers, which may be used to determine the bare minimum of equity required to finance the deal, The terms “margin” and “deposit” are synonymous, Once you know the margin percentage, all you need to do to calculate the amount of equity required to make the trade is multiply this number by the size of the deal.

Equity = margin percentage x trade size

To determine leverage, divide the magnitude of the deal by the amount of equity needed.

Leverage = trade size/ equity

FOREX LEVERAGE EXAMPLE

Using the formulae shown above, the following is an example of how leverage is often calculated:

- Trade size is equivalent to 10,000 units of currency (one mini contract on USD/JPY with a trade amount of $ 10,000 is considered a trade size of this magnitude).

- 10% is the margin percentage.

Equity = margin percentage x trade size

0.1 x $10 000

=$1 000

Leverage = trade size/ equity

$10 000 / $1 000

= 10 times or 10:1

This illustration covers some fundamentals of using leverage while trading foreign exchange, Traders, on the other hand, shouldn’t just calculate the minimal amount required to initiate a trade and then fill their account with exactly that amount, This is something that should be kept in mind at all times, Traders need to be aware of the possibility of receiving a margin call if their position swings in the other direction, bringing the account equity to a level deemed unacceptable by the broker.

Trading foreign exchange with leverage carries the risk of incurring significant losses, We have computed a typical scenario of how using an excessive amount of leverage might influence a trading account, and we have tabulated the results of our calculations.

HOW TO MANAGE THE RISK INVOLVED WITH FOREX LEVERAGE

Using leverage in forex trading may be compared to a double-edged sword since it can result in either favorable or unfavorable results for the trader, Because of this, it is essential to figure out how much leverage is effectively suitable and to implement good risk management.

When trading forex, the most successful traders employ stops to restrict the potential loss they are exposed to, At DailyFX, we advise clients to risk no more than 1% of their account equity on any one transaction and no more than 5% of their account equity across all active trades at any given moment in time.

In addition, effective traders use a good risk-to-reward ratio while making trades to attain a greater probability of transactions throughout their careers.

It is essential to avoid making errors with leverage, if you want to learn how to prevent other problems that traders could encounter, check out our guide to the Top Trading Lessons.

LEVERAGE TRADING TIPS

- If you are new to foreign exchange, make sure that you familiarize yourself with the fundamentals of currency trading by reading our guide that is titled “New to FX.”

- When trading with leverage, it is essential to implement stop losses to protect your capital, When markets are exceptionally volatile, negative slippage may be eliminated by using guaranteed stops.

- Reduce your level of debt as much as possible, At DailyFX, our recommendation for maximum leverage is 10%.

- To prevent getting a margin call, you should familiarize yourself with the forex broker’s margin policy.

Comments (No)