What may be found on this page?

- WHAT EXACTLY IS THE TERM “CURRENCY CARRY TRADE,” AND HOW DOES ONE EXECUTE ONE?

- AN EXAMPLE OF A CURRENCY CARRY TRADE

- THE DANGERS THAT ARE ASSOCIATED WITH CARRYING TRADES

- CARRY TRADE IS A FOREX TRADING METHOD

- CONCLUSION

- USE OUR MANY TOOLS AND GUIDANCE TO MAKE YOUR FOREX TRADING TECHNIQUE MORE EFFECTIVE

A currency carry trade is when an investor borrows one currency with a low yield to purchase another with a higher yield to profit from the interest rate difference between the two currencies, This method is often called “rollover” and is an essential component of carry trade, Traders are drawn to this technique in the expectation that they will be able to receive daily interest payments in addition to any currency gain that may result from the actual deal.

This article gives a leading carry trade method for you to use in your trading and uses examples to illustrate carry trades in foreign exchange markets.

WHAT EXACTLY IS THE TERM “CURRENCY CARRY TRADE,” AND HOW DOES ONE EXECUTE ONE?

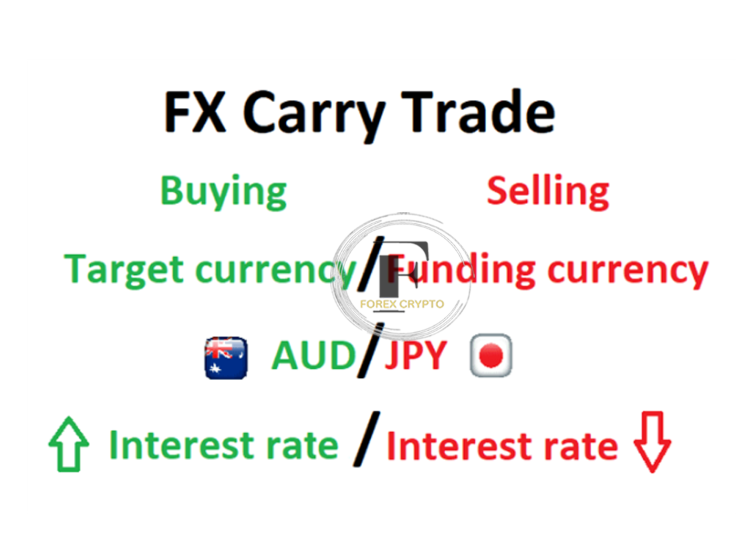

A foreign exchange carry trade is when one borrows a currency in one nation that has a low-interest rate (low yield) in order to finance the purchase of a currency in another nation that has a high interest rate (high yield), The “positive carry” of the transaction will result in the trader receiving an interest payment if they maintain this position overnight, This payment will be dependent on the “positive carry” of the deal.

“target currency” refers to the currency with the greater yield, while “funding currency” refers to the currency with the lower yield.

Rollover

The term “rollover” refers to the procedure by which brokers prolong the settlement date of open forex positions maintained beyond the daily cut-off time, The direction of the deal (long or short) and whether the interest rate difference is positive or negative determine which of two possible actions the broker takes about the client’s account: either a debit or a credit, Because interest is often expressed yearly, these modifications will be the daily adjusted rate.

The rates of interest

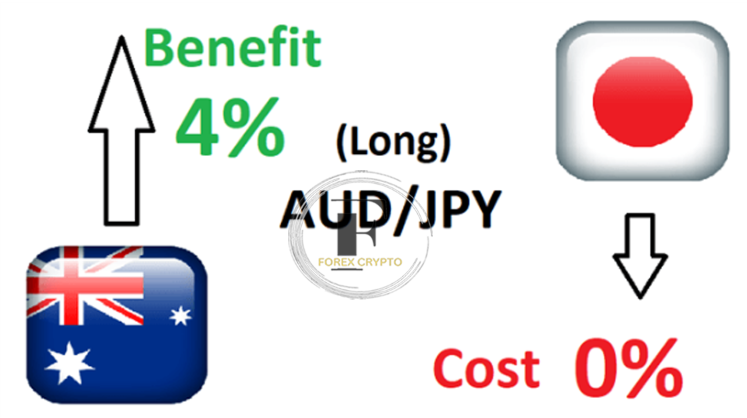

A country’s central bank determines interest rates in line with the mandate of that nation’s monetary policy, the specifics of this mandate will vary from nation to nation, When a trader longs the currency in the pair with the higher interest rate, they will then earn money on the position they have taken, For instance, if the interest rate offered by the Australian dollar is 4% and the interest rate offered by the Japanese Yen is 0%, then currency traders might attempt to purchase (long) AUD/JPY to capitalize on the 4% net interest rate disparity.

The foreign exchange carry trade is comprised of two primary elements:

- Variations in interest rate structures

The difference in interest rates offered by the two currencies being carried in a transaction is the primary focus of the carry trade as a financial instrument, Even if there is no change in the rate at which the two currencies are traded against one another, the trader will still profit from the interest payment made overnight, Nevertheless, over time, central banks have determined that it is essential to change interest rates, which presents a possible danger to the strategy of carry trading.

- The appreciation or depreciation of the currency exchange rate

The second facet of the carry trade strategy concentrates on the difference in value between the two currencies, When holding a long position, a trader hopes that the target currency will appreciate (grow in value), When this occurs, the compensation given to the trader consists of the daily interest payment in addition to any unrealized profits made from the currency, However, the trader will be able to realize the profit from the target currency’s appreciation after the transaction has been closed out, This is because the trader has to close out the position before the profit can be realized.

If the value of the target currency falls relative to the value of the funding currency, it is conceivable for a trader to incur a capital loss, This occurs when the trader’s capital falls in value to the point that generating positive interest payments is no longer viable.

AN EXAMPLE OF A CURRENCY CARRY TRADE

To continue with the example that was presented before, if the Australian Official Cash Rate is now at 4% and the yield on the Japanese Yen is 0%, a trader may choose to enter a long trade on the AUD/JPY currency pair if there is a likelihood that the pair would go up.

Traders who want to profit from the interest rate disparity will, in essence, borrow Yen at a much lower rate and get the higher interest rate connected with the Australian dollar, Retail forex traders will get less than 4% since forex brokers often apply spreads.

Please read our article on comprehending rollover in foreign currency for a more in-depth illustration of how to compute the estimated charge or gain associated with the overnight interest rate.

THE DANGERS THAT ARE ASSOCIATED WITH CARRYING TRADES

A currency carry trade, just like any other trading strategy, involves some degree of risk and, as a result, calls for the use of effective risk management practices, Since the global financial crisis 2008 2009, risk management has taken on an even greater significance, This is because the global financial crisis led to lower interest rates for industrialized countries, which forced carry traders to go to riskier, high-yielding currencies in developing markets until interest rates normalized.

- Exchange rate risk: Traders who are long the pair will see the trade move against them if the target currency declines in value compared to the funding currency, but they will still get the daily interest payment on their position.

- The risk associated with interest rates: If the nation that issues the target currency lowers its interest rates while the nation that issues the funding currency raises its interest rates, the positive net interest rate will decrease, and the profitability of the foreign exchange carry trade will likely suffer.

CARRY TRADE IS A FOREX TRADING METHOD

One such approach that successful traders use is filtering foreign exchange carry trades in the direction of the trend, Because the carry trade is a deal conducted over an extended period, it is helpful to analyze markets characterized by significant trends.

Traders should first aim to confirm the uptrend to increase their chances of entering trades with better likelihood, This trend is confirmed in the chart below when a higher high and higher low is shown.

The diagram illustrates higher highs and higher lows, and the uptrend is confirmed when the horizontal line, established at the first higher high, is broken, After that, traders can locate perfect entry positions for a long trade using several time frame analyses and indicators.

CONCLUSION

Traders participating in currency carry trades can benefit from two separate sources (the exchange rate and the interest rate difference), Still, it is vital to control risk since losses may occur when a pair goes in the opposite direction of traders or when the interest rate disparity is reduced.

Traders should search for entry opportunities in the direction of an upswing if they want their trades to have a better possibility of success, Additionally, traders should protect themselves from losses using sound risk management strategies.

USE OUR MANY TOOLS AND GUIDANCE TO MAKE YOUR FOREX TRADING TECHNIQUE MORE EFFECTIVE

- Because profitable foreign exchange carries trades and depends on currency pairings that are moving in an upward direction (target currency/funding currency), traders must be able to recognize trends.

- Learn the fundamentals of foreign exchange trading with our no-cost guide, “New to Forex,” designed specifically for those just getting started in the field.

- In addition, we provide a variety of trading tutorials that may enrich your understanding of forex and help you build new strategies.

Comments (No)