Source: tradersunion.com

Best ETFs 2024

Overview of Best ETFs 2024

The Best ETFs 2024 is a list of exchange-traded funds that offer investors potential returns in the coming year. These funds represent various sectors and investment strategies, providing diversification and potential growth opportunities.

The list includes ETFs such as the Vanguard Total Stock Market ETF and the iShares Global Clean Energy ETF. It is compiled based on factors such as past performance, expense ratios, and assets under management.

Why invest in ETFs

Investing in ETFs offers several advantages to investors, They are affordable, providing exposure to a diversified portfolio of assets without the high costs of traditional mutual funds, Additionally, they offer flexibility in trading and transparency in holdings.

Furthermore, ETFs offer the potential for returns that can outperform the market, making them a popular choice for investors seeking passive income streams, With Best ETFs 2023, investors have the opportunity to choose from a carefully selected list of funds that offer potential growth in the coming year.

Introduction to Best ETFs 2024

Overview of Best ETFs 2024

Investors looking for potential returns in 2024 can explore Best ETFs 2024, which is a list of exchange-traded funds. The list contains a diverse range of ETFs from various sectors and investment strategies. The selection is based on past performance, expense ratios, and assets under management.

Why invest in ETFs

Investors can benefit from investing in ETFs as they provide affordable exposure to a diversified portfolio of assets compared to traditional mutual funds, ETFs offer flexibility in trading and transparency in holdings, which makes them a popular choice for investors seeking passive income streams, Investors can select from the carefully selected Best ETFs 2023 list to potentially benefit from growing markets and diverse sectors.

Vanguard Total Stock Market ETF

Vanguard Total Stock Market ETF Basics

Vanguard Total Stock Market ETF (VTI) is an ETF consisting of over 3,500 U.S, securities, tracking the CRSP US Total Market Index, VTI provides investors with a broad representation of the U.S, stock market, with a low expense ratio of 0.03%.

Investment Strategy of Vanguard Total Stock Market ETF

VTI uses a passive approach to track the performance of the CRSP US Total Market Index, This strategy offers investors a way to invest in the entire U.S, stock market, VTI provides exposure to large, mid, and small-cap companies that represent key sectors of the economy.

Note: This blog section only covers a small part of the Vanguard Total Stock Market ETF, Investors are advised to perform thorough research before investing in the VTI or any ETF.

Source: weinvests.com

Best ETFs 2024: Further Insights

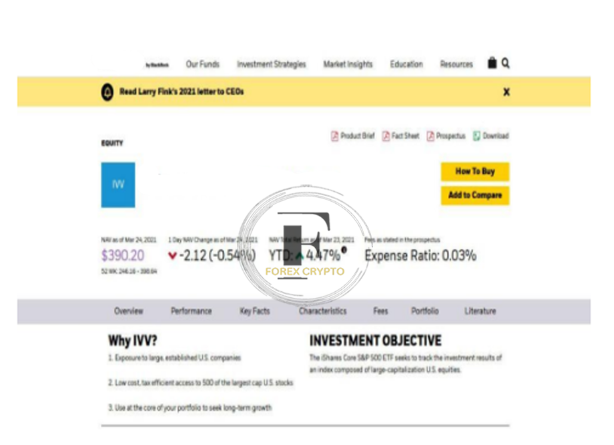

iShares Core S&P 500 ETF Fundamentals

The iShares Core S&P 500 ETF (IVV) is an ETF consisting of 500 of the largest publicly traded U.S, companies, IVV aims to track the performance of the S&P 500 Index and has an expense ratio of 0.03%, making it one of the most affordable ETFs in the market.

Performance and Holdings of iShares Core S&P 500 ETF

IVV has been a consistent top performer and offers a strong potential for growth. Its holdings are well diversified, with the information technology and healthcare sectors having the largest weight. With over $285 billion in assets under management, IVV remains a popular choice for investors who seek exposure to large-cap U.S. equities.

Source: blog.tipranks.com

Invesco QQQ ETF

Invesco QQQ ETF Overview

The Invesco QQQ ETF (QQQ) tracks the performance of the Nasdaq 100 Index, which consists of 100 of the largest non-financial companies listed on the Nasdaq stock exchange, QQQ has an expense ratio of 0.20% and assets under management of over $150 billion, making it a popular choice for investors who want exposure to predominantly technology-focused companies.

Technology Heavy Portfolio of Invesco QQQ ETF

QQQ has a technology-heavy portfolio, with almost 48% of its assets invested in the technology sector. This ETF’s top holdings include the likes of Apple, Microsoft, Amazon, and Facebook. With its strong focus on technology, QQQ has maintained its position as a top-performing ETF and has the potential to continue to provide growth for investors looking for exposure to the technology sector.

Source: investingnews.com

SPDR Gold Shares ETF

SPDR Gold Shares ETF Features

The SPDR Gold Shares ETF (GLD) tracks the price of gold and gives investors exposure to the performance of the precious metal, GLD has an expense ratio of 0.40% and holdings of over 400 metric tons of gold, making it a popular choice for those interested in investing in the commodity.

How to Invest in Gold through SPDR Gold Shares ETF

Investors can buy and sell shares of GLD on major stock exchanges, The ETF holds physical gold bars in vaults in London, New York, and Toronto, ensuring investors have access to the underlying asset, GLD provides a convenient and cost-effective way for investors to gain exposure to gold without having to physically own the metal.

Source: d3it91zw76pwp5.cloudfront.net

Schwab International Equity ETF

Schwab International Equity ETF Details

The Schwab International Equity ETF (SCHF) provides exposure to international equity markets, excluding the United States. With an expense ratio of 0.06%, SCHF holds over 1,400 stocks across various developed and emerging markets.

Diversifying with Schwab International Equity ETF

Investors can use SCHF to diversify their portfolios with international equities, The ETF offers a low cost and convenient way to invest in markets outside of the United States, reducing overall portfolio risk and increasing potential returns through exposure to different markets and currencies, SCHF can be bought and sold on major stock exchanges.

Source: d3it91zw76pwp5.cloudfront.net

ProShares S&P 500 Dividend Aristocrats ETF

ProShares S&P 500 Dividend Aristocrats ETF Introduction

The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is designed to track the performance of the S&P 500 Dividend Aristocrats Index, which includes companies in the S&P 500 that have increased their dividends every year for at least 25 consecutive years, With an expense ratio of 0.35%, NOBL offers a way to invest in established companies with a history of reliable dividend payments.

Dividend Investing with ProShares S&P 500 Dividend Aristocrats ETF

Investors seeking income from their investments can use NOBL to gain exposure to stable, income generating companies, By investing in a diversified portfolio of dividend-paying companies, investors may benefit from regular income payments and potential growth in value over time, NOBL can be bought and sold on major stock exchanges, providing investors with a convenient and low-cost solution for dividend investing.

Source: stocknews.com

ARK Innovation ETF

ARK Innovation ETF Fundamentals

The ARK Innovation ETF (ARKK) seeks to provide investors with exposure to innovative companies with disruptive technologies that are transforming the way industries work. With an expense ratio of 0.75%, ARKK invests primarily in US-listed companies that are in the areas of genomics, industrial innovation, fintech, and the internet.

Investing in Innovative Companies with ARK Innovation ETF

Investors interested in investing in innovative companies can consider ARKK, as its holdings provide exposure to companies like Tesla, Square, and Roku. By investing in these high-growth companies, investors can potentially benefit from significant capital appreciation over time. ARKK can be bought and sold on major stock exchanges, providing investors with a convenient and low-cost solution for investing in innovative technologies.

Source: www.thestreet.com

ARK Innovation ETF

ARK Innovation ETF Fundamentals

The ARK Innovation ETF (ARKK) aims to provide exposure to companies with disruptive technologies that are transforming industries, with an expense ratio of 0.75%, Its holdings are primarily US-listed companies in the areas of genomics, industrial innovation, fintech, and internet.

Investing in Innovative Companies with ARK Innovation ETF

Investors can consider ARK as it provides exposure to high-growth companies like Tesla, Square, and Roku. Potential capital appreciation is a benefit of investing in these companies, and ARKK can be easily bought and sold on major stock exchanges.

Comments (No)