- Best Forex trading strategies account is like setting out on a journey without a map; you have no idea where you’ll end up. Likewise, you can’t predict whether you’ll earn or lose money, so you should prepare for either.

- One of the main benefits of developing a forex trading strategy is that it reduces the amount of uncertainty involved in the process. Learn more about the top forex trading techniques and how to choose the right one for you in the following text.

Picking a Forex Strategy

- Choosing a forex trading strategy is crucial to your success as a currency trader, so you should give it some thought.

- Only some enjoy staring at trading screens all day or can handle the pressure of aggressive, high-stakes methods.

- After settling on a few potential Forex strategies, it’s time to evaluate their efficacy. First, you should use the leading MetaTrader 4 platforms for backtesting each approach.

- Most online brokers will let you create a risk-free “demo” account to try out your trading approach. Then, if any of your remaining trading methods still seem promising, you may put them to the ultimate test by trading with real money.

- It would help if you began trading with a small amount until you are comfortable with the strategy’s success and your ability to use it in actual trading consistently.

5 Best Forex Trading Strategies

- Although several profitable forex trading tactics exist, not all will work for you. While making your choice, consider your time constraints, personality, and willingness to take risks. We’ll go through each of them, from short-term to long-term, depending on the average time commitment required.

1. Scalping

- Scalping is a trading method where several modest gains are taken from trades that last just a few seconds. Due to the fact that scalpers often enter and exit deals within a matter of seconds or minutes, they need reflexes that are lightning-fast. Unfortunately, only some people are cut out for such a fast-paced, high-stress endeavor.

- Additionally, scalpers devote a lot of time to studying price charts in search of recurring patterns that may be used to forecast the direction of future currency market fluctuations. Tick charts like the one below for the EUR/USD are often used by these traders for analysis. As a rule of thumb, scalpers do best with brokers that provide low or nonexistent order slippage, assured order execution times, and low or no spreads.

2. Day Trading,

- in which you only trade during a single trading session, is another kind of intraday trading. Usually, day traders do not hold open deals overnight but close them at the end of each trading day. When a trader needs to pay more attention to the market, this reduces risk.

- Most day traders use trading strategies based on technical analysis of intraday price activity on short-term charts. “Breakout trading” refers to a standard method used in day trading. Trades are initiated when the price of a currency pair rises over a predetermined level on the chart and are confirmed when an increase in trading volume meets this price rise.

- A breakdown below the lower of the two converging trend lines of a red triangle formation can be seen on the 30-minute candlestick chart of GBP/USD. It’s important to note that the breakthrough was confirmed by a rise in trading volume when it happened.

3. News Trading

- Although news trading tactics are generally not the best choice for forex novices, more experienced traders with substantial wallets and a healthy stomach for risk may find them helpful. Strategies like this may be grounded in either fundamental or technical research, and they often profit from the high degree of volatility that exists in the foreign exchange market just after significant news releases.

- In most cases, news traders need to keep tabs on economic calendars detailing the dates and times of significant data releases. Then, they keep a close eye on the market leading up to the event, identifying necessary support and resistance levels so they may move swiftly in response to the outcomes. News traders must exercise extreme self-discipline in volatile markets while managing their currency holdings via stop-loss and take-profit orders.

- The publication of U.S. jobless claims is an example of a data release event on an economic calendar that a news trader may anticipate. The revelation of this information caused significant changes in the foreign exchange market, notably during the COVID-19 shutdown in the United States. The market cared more about the result’s deviation from the market’s consensus than it did about the number of jobs created or lost.

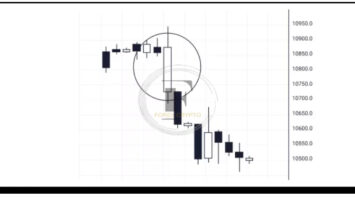

- In the scenario shown below, the last number of jobless claims was 3,176K, the anticipated amount was 2,500, and the outcome was worse than predicted at 2,981K. Once this was made public, the value of the U.S. dollar should have dropped against other currencies.

4. Swing or Momentum Trading

- Swing trading, often called momentum trading, is medium-term trading that tries to profit from price fluctuations in the market. Swing traders achieve this by taking overnight positions with and against fundamental movements, which requires them to be patient.

- Momentum indicators that suggest buy and sell prices are often used by swing traders. Traders rely on them to help them identify overbought and oversold markets. Swing traders may also anticipate the emergence of support or resistance levels on the exchange rate charts for a currency pair and act accordingly.

- The moving average convergence and divergence (MACD) histogram and relative strength index (RSI) is popular momentum indicators. Below is a daily candlestick chart for the GBP/USD exchange rate, which also includes the Moving Average Convergence/Divergence (MACD) and Relative Strength Index (RSI) in boxes as indicators.

5. Trend Trading

- Long-term forex traders sometimes use “trend trading,” which entails capitalizing on price fluctuations by betting on the market’s direction for a particular currency pair. Using this tactic, investors may profit from either up or down trends by purchasing on a reversal or selling on a rally.

- A trend trader’s typical course of action after entering a position in the direction of a trend is to maintain that position until either the market hits the trader’s predetermined profit target or the trend begins to reverse. In addition, trend traders often use trailing stop-loss orders to protect their winnings in the event of a sudden reversal.

- Many trend traders use technical analysis indicators like the Average Directional Movement Indicator (ADX) and moving averages to detect better trends, which average out price fluctuations. One strategy is to utilize moving averages with different time frames and look for crosses to indicate a possible reversal.

- After a steep drop, the Euro/Yen exchange rate shows signs of stabilizing in the 4-hour candlestick chart below, which also has a red 10-day moving average and an ADX indicator.

Best Forex Brokers for Trading

Check out the table below for Benzinga’s top selections for forex brokers, whether you’re ready to start trading forex right now or just seeking a better online broker to partner with. Start creating an account now; most brokers provide risk-free trading in the form of “demo” accounts that may be used to test their services before depositing any money. Consider Benzinga’s analysis of FOREX.com as an example of what to search for in a reliable forex broker.

Comments (No)