Candlestick Patterns

Candlestick patterns serve as a vital tool in the field of technical analysis, aiding in the recognition of potential trends and patterns within financial markets. These patterns are composed of a sequence of candlesticks, with each one depicting a specific time frame, typically spanning a day or an hour, Each candlestick boasts two significant components: the body and the wick. The body encapsulates the opening and closing prices of a particular security, while the wick denotes the range between the highest and lowest prices throughout the given time interval.

Candlestick patterns hold immense importance in the realm of technical analysis as they serve as valuable tools in assisting traders in identifying possible trends and making well-informed decisions regarding the optimal timing for buying or selling a security. These patterns, when scrutinized meticulously in candlestick charts, empower traders to delve deeper into market sentiment, thereby enabling them to craft more precise predictions regarding future price fluctuations. Among the plethora of candlestick patterns available, several frequently encountered ones consist of the doji, hammer, and engulfing patterns, among others. Embracing these candlestick patterns can truly enhance a trader’s ability to navigate the complexities of the market.

Types of Candlestick Patterns

Doji Candlestick

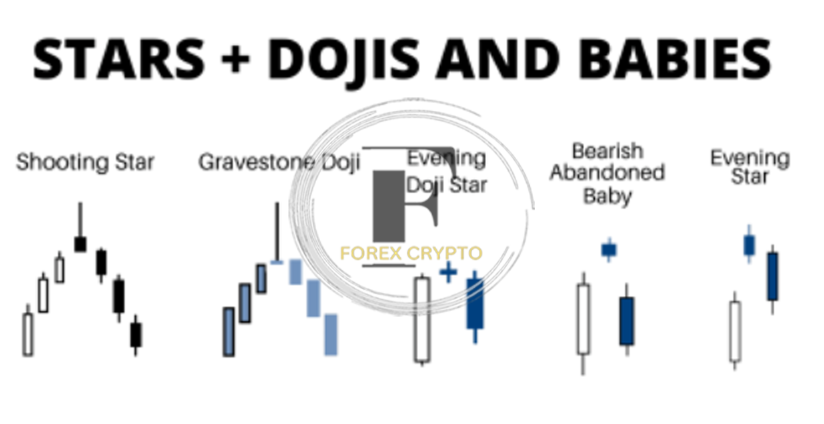

A candlestick with a small real body and a long upper shadow or a small real body and a long lower shadow.

This pattern indicates a potential reversal in the trend and can be used as a signal to enter a trade in the opposite direction.

Harami Candlestick

A candlestick with a small real body and a large upper shadow or a small real body and a large lower shadow.

This pattern indicates a potential reversal in the trend and can be used as a signal to enter a trade in the opposite direction.

Engulfing Candlestick

A candlestick with a large real body and a small real body, or a large real body and a small real body with a long upper shadow or a long lower shadow, indicates a potential reversal in the trend and can be used as a signal to enter a trade in the opposite direction.

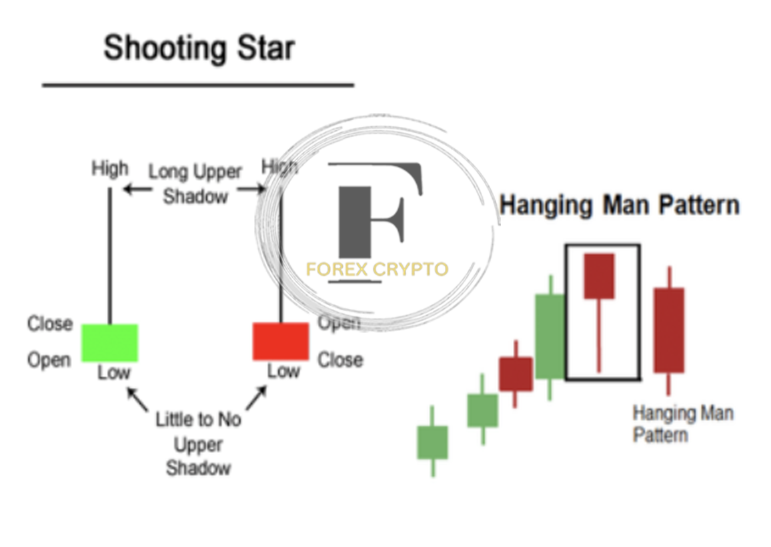

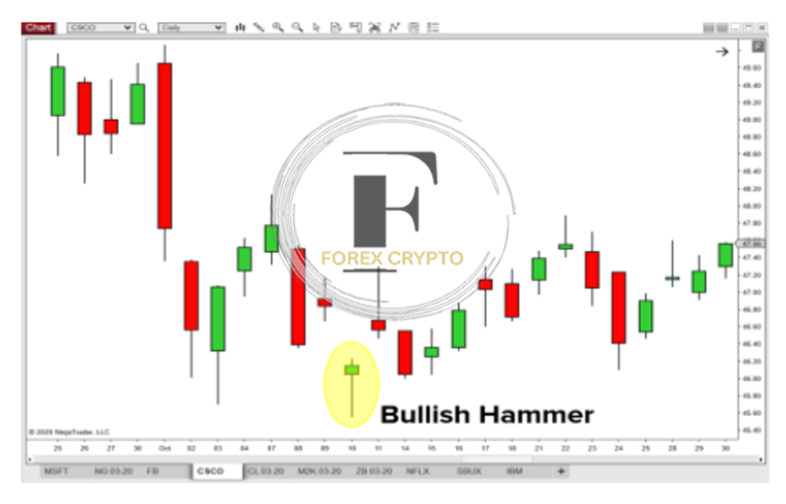

Hammer Candlestick Pattern

A bullish candlestick pattern is a pattern that occurs when there is a small real body followed by a larger real body. This pattern suggests a possible reversal in the market trend, where the buyers may take control of the sellers. It is important to analyze this pattern within the context of the overall market conditions to make informed trading decisions.

Using Daily Candlestick Patterns for Swing Trading

Introduction

Swing trading is a popular strategy for traders who want to capitalize on short-term price movements, One effective way to identify potential trading opportunities is by using daily candlestick patterns, In this case study, we will explore how daily candlestick patterns can be used for swing trading.

Case Study: XYZ Stock

The XYZ stock has gained popularity among swing traders due to its potential for profitable trades. Traders frequently employ a strategy where they carefully analyze the daily candlestick patterns of the stock to identify advantageous entry and exit points. By using this technique, traders can make well-informed decisions about when to buy and sell XYZ stock, optimizing their chances for successful trades.

Identifying Trading Opportunities

By thoroughly examining the daily candlestick patterns, we can efficiently recognize and pinpoint promising trading opportunities. For instance, in the scenario where a stock exhibits a bullish trend and subsequently forms a candlestick pattern that is also bullish, it potentially signifies an advantageous moment for entering a long position.

Exiting Trades

In a similar vein, when the stock is experiencing a downward, bearish trend and then presents a significant candlestick pattern indicating further decline, it could be considered a favorable opportunity to conclude a short position and exit the trade.

Reading Charts for Better Trading

Understanding Charts

Developing the ability to read charts is of utmost importance for traders as it greatly enhances their overall performance in the market, Charts serve as a rich source of invaluable insights into various aspects of trading, such as market trends, levels of volatility, and crucial support and resistance levels, By carefully deciphering these charts, traders can gain a deeper understanding of the dynamics of the market, enabling them to make more informed trading decisions.

Types of Charts

In the world of trading, various types of charts are utilized to analyze market data and gain insights into trends and patterns. These include line charts, bar charts, and candlestick charts. A line chart simplifies market data by connecting data points with a line, providing a clear depiction of price changes over time. It is particularly useful in identifying long-term trends and gauging the overall movement of an asset or market. Bar charts, on the other hand, offer a more detailed representation of price action within a specific time frame. Each bar in a bar chart displays the high, low, opening, and closing prices for that period. This information allows traders to examine price volatility, support and resistance levels, and the overall range of price movement. Candlestick charts originated in Japan and have become widely used in the trading community. They provide an intricate representation of price fluctuations, similar to bar charts. Each candlestick consists of a body and wicks or lines, which convey valuable information about the opening, closing, high, and low prices. Candlestick charts are particularly effective in identifying market sentiment and potential trend reversals. By utilizing these different charting techniques, traders can gain deeper insights into market dynamics, make informed decisions, and develop effective trading strategies.

Interpreting Charts

To effectively interpret charts, traders should possess a solid understanding of technical analysis and various chart patterns, This entails the ability to recognize and analyze support and resistance levels, as well as trend lines and candlestick patterns, By grasping these core concepts, traders can make more informed decisions based on the information conveyed by the charts.

Maximizing your trading potential through the power of reading charts.

Any trader who wants to maximize their earnings and make choices based on accurate information must be able to read charts, To get valuable insights into market trends and to make more accurate forecasts regarding future price movements, traders may gain these insights by analyzing price movements and finding patterns.

Candlestick Charts

The candlestick chart is a prominent sort of chart used to illustrate price changes over time, This chart style consists of a body, wick, and shadow, and it may be used to detect trends, support, resistance levels, and possible entry and exit options.

Bar Charts

Bar charts are another type of chart used to display price movements over time, They consist of a horizontal bar for each period, with the height of the bar representing the price movement, Bar charts are useful for identifying trends and support and resistance levels.

Line Charts

Line charts are a simple and easy-to-read type of chart that displays price movements over time, They consist of a straight line for each period, with the height of the line representing the price movement, Line charts are useful for identifying trends and potential entry and exit points.

Comments (No)