HOW TO READ AND COMPREHEND THE CONSUMER SENTIMENT INDEX [CONSUMER SENTIMENT INDEX]

CONSUMER SENTIMENT AND ITS CONNECTION TO PRICE INCREASES ARE DISCUSSED

HOW TO TRADE CONSUMER SENTIMENT

A ROUGH DESCRIPTION OF CONSUMER FEELINGS

WHAT EXACTLY IS SENTIMENT AMONG CONSUMERS?

Consumer sentiment, often known as consumer confidence or the Index of Consumer Sentiment (ICS), is a measurement that market players use to gauge the general state of the economy based on how consumers feel about their financial situations. The reading covers consumer and household attitudes based on various survey questions, including past, present, and future economic perspectives on personal finances and the economy. The report will read quite similarly to the economic calendar shown below, and it will also include projections for inflation.

DailyFX’s Economic Calendar is the Original Source

In the past, economic surveyors would approach customers and ask them questions that were quite similar to the ones that are included in the present set of questions that are listed below. The question’s purpose is to elicit customers’ responses about their perspectives on their financial situations.

The consumer sentiment survey in the United States was first used in 1946 and was devised by Dr. George Katona from the University of Michigan. It was designed to address the emotional condition of customers as opposed to strictly quantitative measurements, which is where the term “Michigan Consumer Sentiment” came from. To effectively administer the country’s policies, conducting this kind of survey is necessary to better understand how individuals arrive at their economic choices. The following survey questions are universal in that they apply to respondents living in the 1960s or the current day.

The University of Michigan initially published them.

HOW TO READ AND COMPREHEND THE CONSUMER SENTIMENT INDEX [CONSUMER SENTIMENT INDEX]

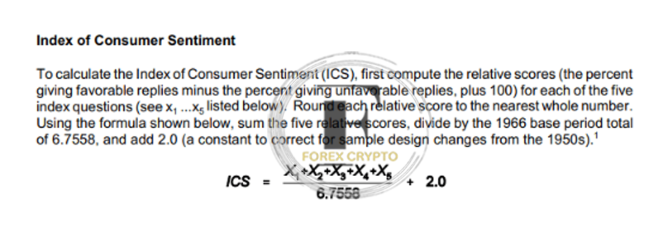

The reading of consumer sentiment is relatively straightforward and simple for those not trained in economics, The various readings in the report are arrived at by compiling the survey responses and doing the appropriate calculations. The Index of Consumer Sentiment (ICS) may be calculated using the formula shown in the graphic that can be seen below. Although the formulas for the other elements vary, for the sake of this study, we will be concentrating on the primary print and formula.

The University of Michigan originally published them.

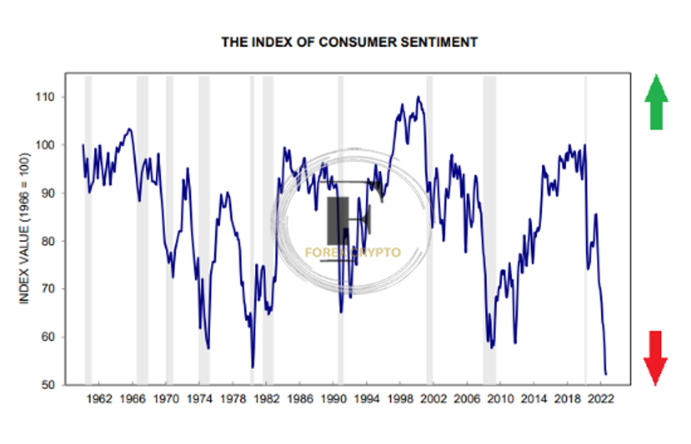

The data is visually shown (see chart below), illustrating recessionary times (gray) against the ICS. Negative consumer sentiment may be an early indicator of economic downturns. To put it more simply, a higher sentiment score indicates that customers have greater confidence in their current economic condition (and vice versa).

The University of Michigan originally published them.

The consumer mood index is sometimes a leading indicator because falling consumer data typically comes just before economic downturns.

CONSUMER SENTIMENT AND ITS CONNECTION TO PRICE INCREASES ARE DISCUSSED

As we can see from the comparison chart for 2020 and 2022 below, rising inflationary pressures may be unsettling for consumers, The pressure being put on prices to go up shows a matching drop in consumer mood, building worries about a recession in the financial markets. Because of this knock-on impact, the work of central banks is not made any easier since the conventional approach to monetary policy, which is to raise interest rates to tame inflation, often leads to a further decrease in consumer sentiment due to higher borrowing costs.

To effectively administer monetary and fiscal policies, it is essential to have a solid grasp of the consumer market and how it works. For instance, when consumers ‘think’ that inflation is unlikely to abate, the natural response is to stockpile and purchase more things now to prevent paying higher costs later on. This helps them avoid having to pay higher prices in the future. This, therefore, contributes to increased inflation, underscoring the significance of central banks’ role in inspiring consumer confidence that they would control inflation. The language central bank officials use is of the utmost importance if they are to effectively influence consumer behavior in the manner they intend for the desired result.

Refinitiv is the cited source.

HOW TO TRADE CONSUMER SENTIMENT

Michigan Consumer Sentiment vs. the S&P 500 Index vs. DXY (2017–2022)

Refinitiv is the cited source.

The link between the U.S. consumer sentiment index, the Dollar Index (DXY), and the SPX index is shown in the chart above. Let’s take a look at each one right now.

THE IMPACT OF CONSUMER EMOTIONS ON THE STOCK MARKET

Throughout history, the sentiment of U.S. consumers and the S&P 500 index have had a connection that is somewhat opposite to one another. This is because big upswings often follow significant decreases in consumer sentiment in the S&P 500 index. This makes perfect sense, considering that a scary market situation often presents chances for investors to make money off equities trading at a discount. The opposite is true in an overconfident environment, where “smart” or bigger institutional investors tend to be scared. At the same time, greedy individuals continue to invest, which results in substantial losses if the market reverses.

In conclusion, when the stock market in the United States displays profound changes, a contrarian indication for the market that may be employed is the consumer mood. There are exceptions to this general rule, and they are dependent on the circumstances that were present at the time. Traditional economic concepts may sometimes need to be in sync with one another.

THE INFLUENCE OF CUSTOMER EMOTIONS ON THE FOREX MARKET

When seen through the lens of foreign exchange, the level of optimism shown by consumers in the United States is often correlated favorably with the value of the dollar, According to this hypothesis, a decline in consumer sentiment ought to result in an easing of monetary policy in order to encourage consumer spending on long-lasting items, hence, lower interest rates ought to result in a depreciation of the domestic currency (DXY) and vice versa, As was discussed in the section on the link between stocks and prices, there are margins for error, The year 2022 serves as a paradigmatic illustration of the ineffectiveness of this traditionally accepted connection, High inflation, worries about a recession, geopolitical uncertainty, and declining consumer morale will be the background in 2022, In this instance, the Federal Reserve has maintained its aggressive and hawkish approach to battle inflation while consumer confidence has declined, This has strengthened the dollar from both a safe-haven perspective and a rise in interest rates.

A ROUGH DESCRIPTION OF CONSUMER FEELINGS

The consumers’ emotions give researchers a window into various other essential aspects of an economy, which in turn leads to a deeper comprehension of the financial markets. Whether you like to trade using fundamental or technical analysis, you may benefit from this leading indicator as a significant trading tool to boost your trading style. At DailyFX, we often analyze consumer sentiment overviews and deconstruct what the data implies for markets. However, if you are uncertain about the principles underlying specific economic ideas, feel free to return to our trading education area to enhance your knowledge.

Comments (No)