The demand for cryptocurrency trading remains strong as new digital currencies flood the market. So you’ve come to the perfect place if you’re looking for a Bitcoin trading strategy.

Crypto trading: what you need to know

- Cryptocurrencies are produced and backed by a distributed network of computers rather than a centralized authority like a government; they are exchanged on decentralized exchanges (called a blockchain). Cryptocurrencies, since they are decentralized, are immune to many of the economic and political risks that plague more conventional currencies.

- Yet this doesn’t imply that cryptocurrency is immune to the world around it. Contrarily, the supply-demand dynamics of cryptocurrencies, the visibility of related media, the integration of e-commerce payment systems, and significant events all significantly impact their value.

- Because of this, you must ensure that your Bitcoin trading techniques include both a means of coping with volatility and a commitment to portfolio diversity. For example, you may diversify your portfolio by trading in several asset types, such as cryptocurrency.

- Spreading out your investments makes you more resilient to negative market swings while allowing you to profit from upswings.

Trader’s Maze: crypto trading strategies

- Owing to the high volatility and unpredictability inherent in cryptocurrency markets, it is crucial to have a cryptocurrency trading plan in place before entering the market.

- The term “crypto trading” describes using a CFD trading account to speculate on the price of cryptocurrencies. You may speculate on price changes with these leveraged derivatives without owning the underlying asset.

- Learn more about our CFD trading services here.

- You may also acquire cryptocurrency directly from an exchange. You’ll need to sign up for a cryptocurrency exchange, deposit the entire amount required to open a position and keep the tokens in your cryptocurrency wallet until you’re ready to sell. Directly Purchasing cryptocurrency is not recommended for novice traders due to the high learning curve.

Moving Average Crossovers

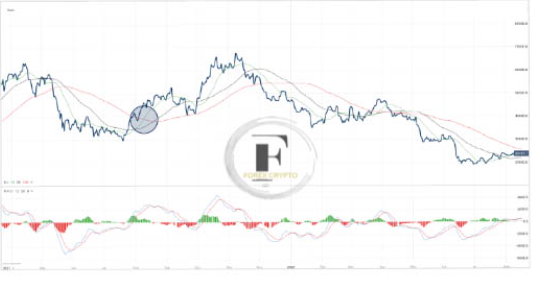

- Crossover trading methods based on moving averages (MAs) need familiarity with MAs. So, to begin from the very start: To create a single trend line, technical analysts use a lagging indicator called a moving average, which adds up the prices of a financial instrument over a specific period and divides the total by the number of observations.

- Using just one trend line, you can see the market’s overall direction while ignoring temporary price fluctuations. Also, you may analyze past price action to investigate areas of support and resistance.

- How can you use this metric in your Bitcoin plan? Crossovers are a common way to apply the moving average. When an asset’s price moves above or below a moving average (MA), this is known as a “price crossover.”

- Please wait for the price of a cryptocurrency to cross above or below its moving average, and then trade long or short on the cryptocurrency using a CFD or other financial instrument.

- Two moving averages, one short-term and one long-term, may also be used in a chart as a helpful tactic. A golden cross, which occurs when the shorter MA rises above, the longer MA, indicates an upward trend and is often seen as a buy signal. Conversely, a death cross occurs when the shorter MA falls below the longer MA, signaling a downward trend change.

Relative Strength Index (RSI)

The relative strength index (RSI) is a technical indicator that spots bullish and bearish market momentum and overbought and oversold states. It may also highlight divergence signals or concealed divergences in the stock market. Trend trading is another name for this kind of investing.

- The Relative Strength Index (RSI) is a statistic that reflects how often prices closed higher than they did lower.

- The formula for determining RSI is as follows: RSI = 100 – (100 / [1+RS]).

- As a percentage out of 100, the indicator shows if the market is oversold or overbought. A smaller percentage indicates an oversold position, while a more significant proportion shows an overbought one.

- So, what is the optimal cryptocurrency RSI trading strategy? It, of course, depends on your comfort level with risk and your trading preferences. The RSI may provide trading indications for short and long positions even when prices are rangebound.

- But, as markets tend to move in trends, you may use an RSI indicator to help you choose when to enter and leave a trade.

Event-driven trading

- Media attention paid to a particular coin or crypto exchange may affect the cryptocurrency market. The main goal of this Bitcoin trading method is to capitalize on these “events.” It’s a go-to tactic for beginners in the trading world.

- Cryptocurrency values and those of fiat currencies, stock indexes, and commodities may be affected by news coverage of breaking events. However, several savvy investors will likely profit from this not-just-speculative effect.

- Market participants often wait for signs of consolidation in the hours leading to anticipated news releases (such as earnings reports) before making any moves. However, owing to the volatile and unpredictable nature of cryptocurrencies, it may be necessary to wait until after such a news release has been published before participating in the transaction.

- Put another way, you purchase your cryptocurrency when good news is reported and sell it when bad news is released.

Scalping

- Scalping is the process of repeatedly entering and exiting the market to profit from price fluctuations as they occur in response to a developing trend. This is a very short-term trading strategy, with each deal being held for seconds or minutes.

- If you are a day trader, you will succeed with this method. The goal of scalping is to profit from rapid, sometimes minute-to-minute, fluctuations in price. But, of course, you would get out of the deal as soon as it started making money.

- You can’t sit around and wait for the market to “depict patterns” since you’ll need to act quickly and get out of deals that are losing money as soon as possible. So when market volatility is high, scalping is most effective.

- During scalping, tearing off tickets might be helpful. You may use them to position yourself in another way, ready to take gains or cut losses.

- Remember that many transactions made in a short time frame (a “scalping” strategy) might be dangerous. Therefore, careful risk management is a must.

DCA (Dollar Cost Averaging)

- Dollar-cost averaging (DCA) may be of interest if you seek an indicator-free cryptocurrency trading method. Both newcomers and seasoned traders alike find success using DCA.

- Instead of putting your money into one asset at a time, you spread it among many different assets. Then, these funds are invested periodically over a set period, always at the same time each week, on the same day, etc.

- How does this work in practice? Suppose you’ve made up your mind to put money into Bitcoin. With the $15,000 you’ve put up, you’ve decided a DCA approach is your best bet. Hence, you would split your entire investment by the desired strategy’s duration in weeks.

- For example, let’s pretend you want to invest $15,000 over six months. The weekly cost would be $625 if the total sum were divided by 24 (the number of weeks in six months). Every Tuesday at 2 pm during the following six months, you will invest $625 into Bitcoin until your starting balance is gone.

- Assuming risk like this, why? Your eventual investment return will likely be higher if you invest in an asset over time rather than all at once due to the reduced influence of market volatility.

- It’s worth noting that to take full advantage of this method; you’d need to trade the actual currency in question via an exchange; however, all we provide is trading in derivatives in the form of CFDs.

How to apply strategies in your crypto trading

How can you begin trading cryptocurrencies now that you know the fundamentals? If you’re ready to make your first Bitcoin deal, here’s everything you need to know:

- Join us now by creating an account or signing in to your existing one. Our platform will, after that, provide access to the Bitcoin market.

- Become familiar with the cryptocurrency industry and choose a coin to invest in. Consider the value of a diversified crypto portfolio in light of the abundance of available alternatives.

- Create a trading strategy using the methods mentioned earlier. Choose the one that best expresses who you are and how willing you are to take risks.

- Choose the exchange where you want to trade cryptocurrencies. Our state-of-the-art, multiple-award-winning* platform is available whenever you need it, every day of the year.

- Keep an eye on it and open, then shut, a first position. Instead, you may establish a demo account to trade cryptocurrencies with fake money.

Comments (No)