- Assist in strengthening your position. For example, Using stop orders may help you minimize losses, lock in profits, and enter the market at a specific price.

- Stop orders are used most commonly to assist in safeguarding an unrealized gain or to minimize possible losses on an existing position. Here, we’ll cover how to utilize them in your portfolio to safeguard extended equity holdings.

What are stop orders, and how do I utilize them?

- Standard stop orders, stop-limit orders, and trailing stop orders are the three most common kinds of stop orders. You may place stop and stop-limit orders on the firm’s trading platform or speak with a trading professional there. For example, when you place a trailing stop order with Schwab, it will be queued on a server until the criteria you set are satisfied or exceeded, and then it will be sent out as a market order.

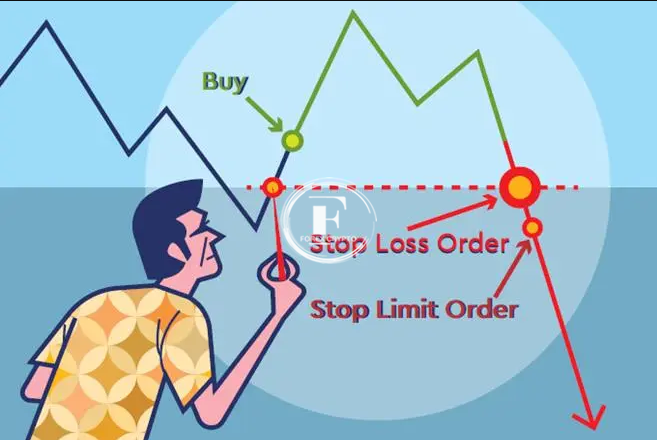

- Stop orders may be visualized with the stop price functioning as a trigger. When your stop order is executed at the trigger price, it automatically converts into a market order to purchase or sell the stock at the current market price. Until the predetermined price is achieved, stop orders remain dormant and invisible to other traders.

Three types of stop orders

Stop order

Both stop (or stop-loss) orders and stop-limit (or limit) orders function similarly until the stop price is reached. After that, any execution at or below the stop price will trigger a regular sell-stop order. Then, a market order to sell is executed to close your position at the next available price.

Stop order example:

- The price per share as of right now is $90.

- Your goal is to hedge against the possibility of a severe market drop. Place a sell-stop order at $85 if you want to sell immediately.

- Your stop order will be activated, and a market order to sell will be issued at the next available market price if the order is executed at $85 or below.

- All features applicable to market orders apply to the stop order now that it has been converted into one.

- If your stop order is activated, your stock will be sold at a cost often very close to the current market price. But remember that a stop order automatically converts to a market order. Therefore, your execution price may be much lower than your stop price if the stock is falling fast, if trading is paused and then resumes, or if the stock gaps down (falls more than the previous day’s closing price) at the start of the trading day.

Stop-limit orders

- Once a security’s price reaches or exceeds a predetermined “stop” price, stop-limit orders are often placed to sell the security at the “stop” price. As a result, it consists of two parts: the stop price and the limit price.

- For a stop-limit order, you’ll need to provide a stop price and a limit price in addition to the usual stop price. When placing a sell stop-limit order, the limit price will often be lower than the stop price. If the stock price continues to fall and a transaction occurs at or below the stop price, the order will convert to a limit order to sell at the limit price.

- Since it has changed to a limit order, it will be filled once the position can be sold at the price you’ve set (or better). As soon as the stop price is hit, if the next available price is lower than your limit price, your order will only be executed once the price reaches your limit price. Other features of limit orders also apply.

- With a stop-limit order to sell; you may raise the probability of your order being filled by setting your limit price lower than your stop price if you want to maximize your chances of getting your order filled in a falling market, set your limit price below the stop price.

- Stop-limit orders and other limit orders are not guaranteed to be completed if the stock price drops before the order is placed. For example, this often happens when trading is resumed after being temporarily suspended owing to the release of important news or when a stock begins for the day at a much lower price than the previous day’s close. As a result, the stop-limit order may be executed as a limit order into the market, but the limit price may never be achieved.

Stop-limit order example:

- The price per share as of right now is $90.

- Selling 100 shares with a stop price of $87.50 and a limit price of $87.50 is a stop-limit order.

- Your sell order will convert to a limit if it is filled at or below $87.50.

- If the stock you ordered decreases and the subsequent transaction happens at a price lower than $87.50, your order may still need to be completed.

- A stop order at $87.50 and a limit order at $87 would typically be executed at the next transaction following the $87.50 trigger, regardless of the price.

- Remember that even if your limit enables it, your order will not be executed at a price lower than the current market price. So, your order might be completed at $87.50 or more significantly if the market is progressively falling

Trailing-stop order

- When you place a sell order with a trailing stop, the stop price increases in tandem with the stock’s bid price; as long as the stock is moving upward, the stop price will automatically adjust to stay below the market price by the amount you choose. When a decline in stock price is detected, the stop loss is locked in at the previous high point.

- The stop price may rise to any height, but it can never fall below the current level. The order is issued to the market and executed only if the stock price drops to the stop loss level. A trailing-stop order is preferable to a standard stop order since it does not need to be canceled and re-entered when the stock price rises. This order is kept on a Schwab server until the stop price is hit (the trigger).

Trailing-stop order example:

- You bought some stock and now have a trailing stop order to decrease your loss to 5%.

- If the bid retraces (falls) by 5% while the stock’s price rises, a market order will be placed for the amount you selected.

- For example, let’s say you placed this order when a share of stock costs $100.

- A market order will be placed if the bid price goes up by 9% to $109 (presuming it doesn’t fall by 5% on the way up to $109), then declines by 5% to $103.55.

- Once the trailing-stop order is implemented, the effective change from when the order was placed until the order was triggered will be 3.55% higher than where you first placed the order.

- When activated, a trailing stop order acts similarly to a stop order in that it converts to a market order.

Where should you set your stop order?

- You must specify how many points or what percentage is below the stock price to set a stop, stop limit, or trailing-stop order.

- Many dealers stick to a predetermined strategy, trading 5% or 10% below the market. Point values may be preferable to percentages for traders who base their deal sizes on the total dollar amount invested rather than the number of shares bought or sold.

- Disciplined investors may limit their losses as a proportion of their portfolio’s worth. Any investor, for instance, may decide to allocate 1%–3% of their portfolio’s worth to this or some other amount they deem suitable. In addition, if you’ve been losing consistently, you may wish to tighten your stop-loss levels for a while.

- Be wary of setting the stop price too near the current price since the order might be triggered by normal day-to-day price variations regardless of your chosen strategy. You also want your stop loss to be within the current price, or you can let your losses mount before closing your trade.

- Paying close attention to the stock’s volatility is one strategy to lessen the chances of any of these happening. For example, if you’re trading a company with a history of daily price swings of up to 5%, setting a stop order at 5% below your entry price is a bad idea. You should only trade that stock if you can afford to lose 5% of your daily investment. On the other hand, a 5% stop order is just right for a stock that moves by that much every month.

- A stock’s average daily price change may be determined by looking at the price history of a few days. See below for a hypothetical six-day stock price history of XYZ’s closing price. As can be seen, the weekly average change in closing price has been a negligible $0.45 (or 0.82%). The weekly change totaled only $0.28, or 0.51%. If you’re concerned about being stopped out of XYZ stock too soon, a stop order placed at 5%, sometimes known as a “three point,” would be the best course of action.

Daily closing prices for XYZ stock

Pricing in System XYZ

Value at Closing as of (Date)

Relative price change

7/22 54.93 0.56 1.01%

7/21 55.49 0.07 0.13%

7/20 55.56 0.36 0.64%

7/17 55.92 0.71 1.29%

7/16 55.21 0.56 1.02%

7/15 N/A N/A Daily Average: 0.45 to 0.82% 7/14 N/A N/A

Variation in the Past Week: 0.28 0.51%

Be defensive: Help protect your position

The three different kinds of stop orders we’ve covered here help drive home the point that you have options for attempting to safeguard your holdings. Whether market volatility is high or low, traders should consider using these protective strategies.

Comments (No)