Currency Trading Works in any financial market is highly challenging, as shown by the fact that most new traders lose money. However, success can be attained if one has the necessary training, experience, and practice. Then, what exactly is the practice of trading currencies, and should you consider doing so?

The largest investment market in the world, known as the forex market (FX), sees annual growth as more than $4–5 trillion in notional value is traded daily.

In contrast, the New York Stock Exchange’s daily volume is only $25 billion (NYSE). The market may be significant, but until recently, professional traders accounted for the majority of the volume. However, as currency trading platforms have advanced, more retail traders have discovered that forex is a good fit for their investment objectives.

KEY LESSONS

- The world’s largest and most liquid asset market is the forex market because it allows currency pairs to be traded around the clock.

- Despite being the biggest market in the world, the majority of volume and activity is driven by just 20 or so currency pairs.

- Currency pairs (such as EUR/USD) are traded against one another, and each pair is typically quoted in pips (percentage in points) to four decimal places.

- Currency prices are impacted by a wide variety of factors, including but not limited to trade and financial flows, geopolitical risk and instability, and the economic condition of the participating countries.

How Does Currency Trading Work?

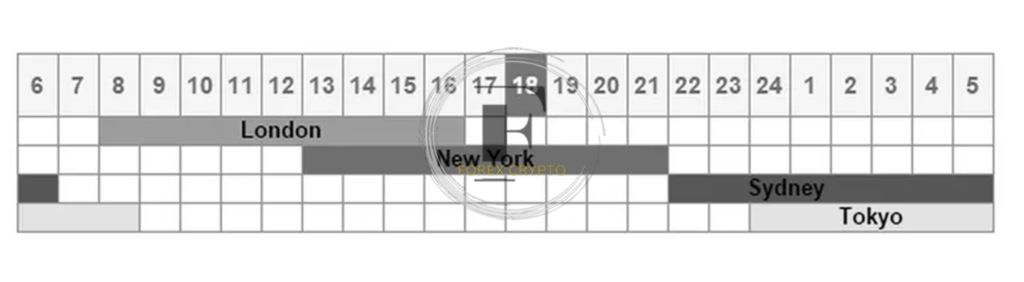

The 24-hour trading sessions in the currency market are deceptive; they are only closed from Friday evening to Sunday evening. As a result, the European, Asian, and American trading sessions are three separate timeslots.

The primary currencies in each market are traded mostly during those market hours, notwithstanding some session overlap. This indicates that particular currency pairings will have more volume during particular sessions. The most significant activity will be in the U.S. trading session among traders who stick with pairs focused on the dollar.

Pairs and Pips

- Trading currencies is always done in pairs. In contrast to the stock market, where you can buy or sell a single stock, the forex market requires you to buy one currency and sell another. After that, the values of the prices are rounded to the fourth decimal place in almost all currencies. Finally, the lowest unit of measurement in trading is a pip or percentage point. Typically, one pip is equal to 1/100 of 1%.

- Different lot sizes are used while trading currencies. One thousand of a currency constitutes a micro-lot. One micro lot is equivalent to one thousand dollars worth of your base currency, which is the dollar if your account is funded in dollars. A standard lot is 100,000 units, whereas a tiny lot is 10,000 units of your base currency.

- The smallest unit of measurement in trading is the pip (percentage in a point). The fourth decimal place, or one pip, is often equal to one-hundredth of one percent. The fourth or fifth decimal point is used to price the majority of currencies. Currency pairs with the Japanese Yen (JPY) as the quote currency are an exception to this rule. Usually, these pairs are priced to two or three decimal places, with the second decimal place standing in for a pip.

- Because one pip in a micro lot only reflects a price change of 10 cents, retail or beginning traders frequently trade currency in micro lots. If the trade doesn’t yield the desired results, this makes managing losses easy. For example, one pip in a micro lot equals $1, while one in a standard lot equals $10. In addition, trading in micro or mini lots makes the potential losses for the small investor much more manageable because some currencies move by as much as 100 pips or more in a single trading session.

Far Fewer Products

Compared to the hundreds of stocks available on the global equity markets, most currency trading volume is restricted to only 18 currency pairs. The eight major currencies that are traded most frequently are the U.S. dollar (USD), Canadian dollar (CAD), euro (EUR), British pound (GBP), Swiss franc (CHF), New Zealand dollar (NZD), Australian dollar (AUD), and Japanese yen. There are other traded pairs besides the 18 currencies (JPY). Although no one would argue that trading in currencies is simple, managing trades and portfolios is made simpler by the presence of fewer trading options.

What Moves Currencies?

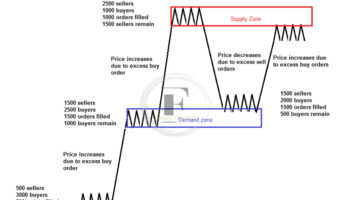

A growing number of people who trade stocks are getting interested in the foreign exchange market since many of the same variables that drive the stock market also affect the foreign exchange market. The largest of these is supply and demand. The dollar’s value rises when the world needs more and falls when too many are in circulation.

Other factors that could impact currency prices are interest rates, new economic data from the biggest economies, and geopolitical concerns.

Why Is Currency Trading Called “Forex” or “FX”?

Both FX and Forex are acronyms for “foreign exchange.” These abbreviations are frequently used in currency trading.

Who Invented Currency Trading?

Foreign currency exchange dates back to the dawn of trade routes, commerce, and early human civilization. However, the adoption of free-floating currencies and the abandonment of the gold standard of foreign exchange marked the beginning of modern forex trading in 1973.

How Are Currency Pairs Quoted?

Because currencies are traded in pairs, one currency is swapped for another in every transaction at a fixed rate set by the market. These pairs resemble the EUR/USD pair at 1.08. As a result, one euro is equivalent to USD 1.08. The quote currency (or counter currency) appears after the base currency. The quote currency in a direct quote is the foreign currency, whereas it is the domestic currency in an indirect quote.

The Bottom Line

Learning about currency trading is simple, but developing profitable trading methods requires a lot of practice, much like anything else in the investing world. Most forex brokers will let you open a free virtual account that lets you trade with fake money until you figure out the tactics that will make you a profitable forex trader.

Investopedia does not offer tax, investment, and financial services. The material is provided without considering any specific investor’s investing goals, risk tolerance, or financial situation, so it might not be appropriate for all investors. Investing comes with a number of risks, one of which is the possibility of losing money.

Comments (No)