- to Read an Economic Calendar it is necessary to follow the Scheduled national and worldwide events that may influence the price and popularity of specific markets or assets are outlined in detail on economic calendars. In addition, the kind and timing of each event on an economic calendar may serve as a trading indicator to help you make the most money possible since some events have been shown to significantly and predictably affect trade.

- The most apparent indications are usually those based on recurring news occurrences due to the predictability of their influence on trading mood and volume. However, when the federal government makes choices on interest rates, trade balances, and inflation, for instance, this may significantly impact the market.

- Individual events may be more challenging to trade because of the uncertainty around their economic effect and timeline, even if other global events may also influence market volatility.

- Several economic calendars are accessible online for free. However, dedicated platform traders can access a more dynamic and comprehensive calendar. If you choose an economic calendar randomly, be sure the events listed pertain to the market you’re interested in (s).

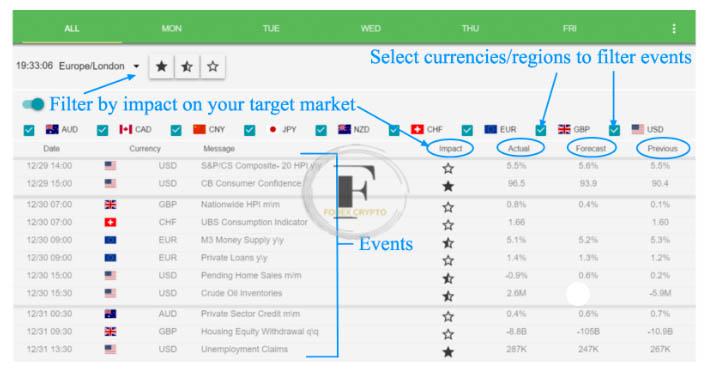

- Due to the global nature of the foreign exchange market, a calendar that enables you to specify your qualifying criteria and filter results by country and currency utilized is invaluable.

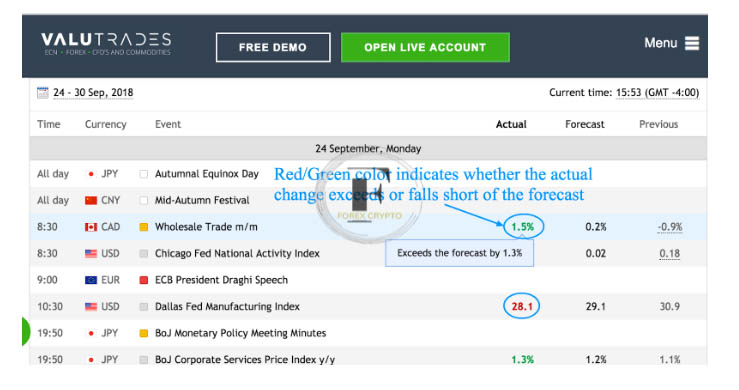

- The majority of economic calendars provide summaries of each event, as well as current, anticipated, and historical values. The “forecasted” figure indicates how much of an effect, positive or negative, on the market is expected the event to have. For example, this figure might shift the way traders act in the moments before a major news release. This is because the “previous” value is recorded after the previous news event of the same kind, whereas the “actual” value measures the objective price movement after the news event in the issue.

- Like the accessible version of our economic calendar below, yours may include context on each event and compare actual market performance versus predicted values.

- More than just presenting this fundamental data, a more advanced economic calendar will let you narrow down results based on how they pertain to your target markets and assist you in assessing the significance of each event as it relates to your unique selection criteria.

- By filtering events by currency and relevance to or influencing your selected market, our bespoke forex economic calendar makes it simple to zero in on the currencies and markets of your choice.

- The Value of Using a Calendar to Predict Economic Events

- The primary benefit of economic calendars is obvious: in the foreign exchange market, your current holdings and the potential for future gains are directly influenced by global economic events. An economic calendar is a valuable tool for tracking events and getting insight into how they could affect the international FX market.

- If you have an accessible calendar, you may factor in impending news and events while arranging trades and anticipating potential market movers. Investors often consult economic calendars to plan ahead and employ a predictive trading technique.

- Although keeping an eye on the future might be helpful to your trading strategy, it’s also vital to avoid making hasty decisions based on information that has just become public. In the foreign exchange market, volatility may spike quickly in response to events on your economic calendar, but if you’re not careful, you might sustain significant losses. Please pay attention to the macroenvironment influencing the market for a currency pair, and try to maintain a level head while you evaluate the news unfolding.

- Trading on the emotions of other traders is a sure way to get burned if you’re looking for rapid rewards.

Top News Events in Forex Trading

Although specific news stories make a difference, others could be better predictors. A select number of events have a more significant economic influence than others regarding currency trading.

Nonfarm Payroll (NFP) Reports

- The bulk of the American workforce is covered by this study on job trends in the United States (omitting farmers, self-employed individuals, nonprofits, federal intelligence, and military factions). The Bureau of Labor Statistics publishes these reports on the first Friday of every month, including data from the previous month. The NFP report details the net national unemployment rate, the number of people actively looking for work, and the labor force participation rate in the United States during one month. The market’s perspective and the value of the U.S. dollar are profoundly affected by all three figures because of their significance as indicators of the nation’s economic health.

Central Bank Interest Rate Decisions

- When talking about the financial system in the United States, the Federal Reserve, or simply the Fed, is what is meant. Forex traders’ ability to make a profit or loss when borrowing a given currency or holding a position is affected by interest rate decisions made by any of the world’s other seven major central banks (the European Central Bank, Bank of England, Bank of Japan, Swiss National Bank, Bank of Canada, Reserve Bank of Australia, and the Reserve Bank of New Zealand).

- Market sentiment and volatility for related currency pairings are both likely to be affected by upcoming interest rate decisions or news releases from any of these significant global institutions. This Washington Post piece, published a few hours before the U.S. government report was issued on September 26, 2018, is an example of the widespread press coverage of quarterly projections that affect market volatility leading up to an interest rate decision.

Durable Goods Orders

The United States Census Bureau’s monthly report is an excellent barometer of manufacturing activity in the country. In addition, the durable goods figure provided in the report may be used to accurately indicate economic health. As measured in billions of dollars, a more prominent figure indicates that the economy may be strengthening or recovering. At the same time, a lower amount is often linked with a stagnant or declining economy.

Retail Sales Index

The retail sales index, as the durable goods orders report, is published monthly by the United States Census Bureau. It is a measure of consumer spending power that reflects the previous month’s retail sales in the United States and, by extension, the health of the economy and the level of consumer confidence.

Consumer Confidence Index

The index uses several indicators to produce a single score that measures consumers’ optimism about the economy in the United States as a whole. Scores over 100 indicate that customers are more optimistic about the economy and are more inclined to make purchases than save their savings. Conversely, consumers’ choices to cut back on spending, save more, and shore up their finances in anticipation of a probable economic downturn are consistent with lower scores (below 100), reflecting increased economic anxiety and uncertainty.

News Events as Trading Indicators

- Choose a significant currency pair affected by news events as a first step towards profiting from them. As the NFP data gauge U.S. markets, you should look for a big USD currency pair, for instance.

- Finding a currency pair to trade in is easy; choosing a direction to trade in is more complicated. So, instead of blindly making orders based on anticipated numbers or market bias, consider this data with your other technical indicators and market analysis.

- Analyze the market’s strength, direction, trend, and existing support and resistance levels in the hours before and after the news event. You may observe a dramatic increase in price activity just before a news event widely expected to give favorable market information and a dramatic decrease in price action if the news turns out to be unexpectedly negative.

- Timing is essential for any successful trading strategy. Short-term traders may attempt to profit from the increased volatility in the market that occurs before significant events, while longer-term traders are more likely to use cautious techniques.

- They are waiting to initiate a position until just after the event, allowing traders to profit from the volatility created by the event and utilize the actual vs. projected numbers to predict reactive market movement.

Comments (No)