CFD trading steps

trading CFDs by buying a certain number of contracts on a market if you anticipate a price increase and selling contracts if you anticipate a price decrease. However, the nitty-gritty specifics are sometimes more complicated, particularly given that each service provider’s platform and features are unique.

Learn how CFDs work.

- Understanding the mechanics of CFDs is the first step to entering the market. Trading CFDs successfully requires an appreciation of the many subtleties that set them apart from traditional trading methods.

- Learn the basics of CFD trading with a free online course from IG Academy or by reading our brief introduction.

Create and fund an account

- An application for a CFD trading account may be completed in minutes.

- After your information has been validated, you can add funds to your account. Any major credit or debit card will work for topping up your account.

- You may start a demo account with $20,000 in virtual money to practice trading without real risk.

Build a trading plan

- The next thing to do is to create a trading strategy, which will serve as a guide for all of your trading endeavors. Among the many factors to consider are your dedication level, desired outcomes, comfort with risk, financial resources, target markets, and trading style preferences.

- Your trading strategy should include your ideal transaction, intended profit, acceptable loss, and risk management measures, all of which can help you make more competent judgments under pressure.

Find an opportunity.

After creating an account and depositing funds, it is time to look for your first transaction. Among the more than 18,000* markets on which IG clients may buy and sell, positions are:

- Indices\sShares

- Forex\sCommodities\sCryptocurrencies

- Finding your first transaction among all the available marketplaces might be overwhelming. That’s why we’ve provided a variety of resources for you to use while you shop:

- Quickly identify market shifts with our foundational charts, then go further to learn what they represent with our comprehensive set of technical analysis resources.

- Invest in our premium ProRealTime charting package to unlock automatic trading and additional indicators. If you make four or more purchases in a given month, it’s free. *

- You may take immediate action with alerts if the market reaches a threshold or changes by a certain percentage.

- Gain insight from our industry experts as they analyze the latest market data and discuss the most exciting trends unfolding in real-time on live video.

- Use the platform to see a live Reuters feed and sort the most recent news by category, topic, and more.

- Gain insight into significant developments and upcoming prospects using third-party signals and delve into clear, insightful reports.

- Check out our economic calendar to see all the big and little things that affect the markets.

- Trader mood, corporate updates, and live streaming pricing may all be found in the market data you have direct access to.

- Using the market screener, you may find stocks you might be interested in trading based on criteria such as the strength of the company’s fundamentals, its placement in the market, and the industry in which it operates.

Choose your CFD trading platform.

Multiple trading platforms are available to you with IG:

- Internet-based system

- MetaTrader 4 Advanced Mobile Platforms for Traders

- Personal alerts, interactive charts, and risk management instruments are some of how these may be adapted to your trading style and preferences.

Open, monitor, and close your first position

- Trading may begin after you’ve settled on a market to participate in. Choosing between a long and short approach is the first step. Let’s use trading the FTSE 100 as an example. Sell (or “go short”) if you anticipate a price decline; purchase (or “go long”) if you anticipate a price rise. One of the most significant advantages of trading CFDs is that you can do either.

- If you enter a position and the market price changes, your gain or loss will reflect that. Keeping tabs on your open positions is easy, and you can always cancel them by selecting the appropriate option on the trading interface. Manually doing the identical deal in the other way is another option (unless you force open the new position). If you bought to initiate a position, you may “exit” by selling the same number of contracts at the “sell” price, and visa versa.

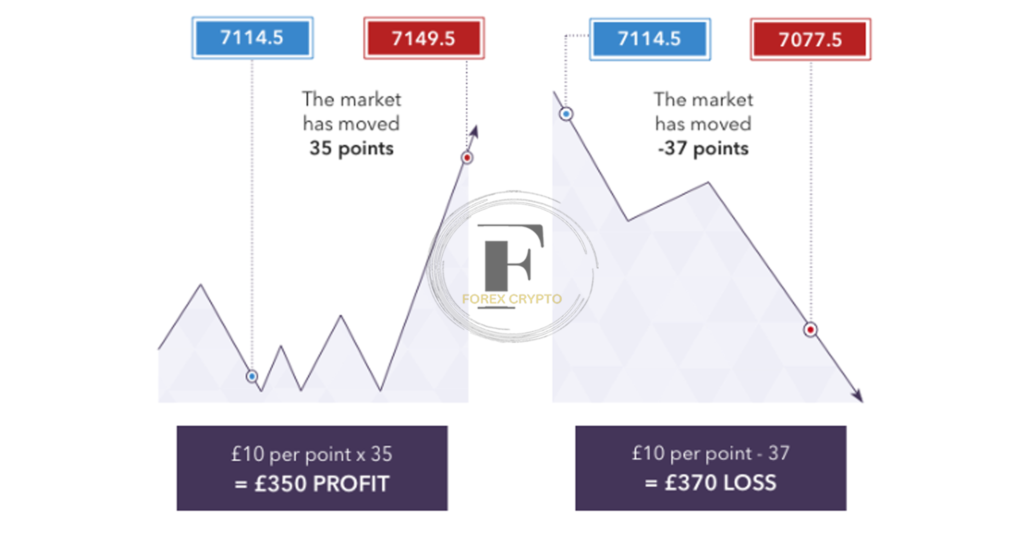

- Multiplying the market’s percentage change by the magnitude of your deal in pounds per point yields your gain (or loss). You can see this in action in the following illustration:

It is important to remember the following while making a trade:

- Price to buy and sell.

- There are always two prices shown to you while trading: the purchase price (the “bid”) and the selling price (the “ask”) (the “offer”).

- The purchase cost will always be higher than the underlying value, while the sale cost will be lower. The “spread” is the price differential between the two options. With IG, the spread is how you’ll pay for most CFD transactions, while the commission is what you’ll pay for share trading.

- Amount of Agreements

- The number of contracts you trade in CFDs is up to you. The smallest number of contracts that may be traded on the FTSE 100 is 1.

- One contract here is worth $10 per point. However, this fluctuates widely depending on the market. If the value of the index changes by one point, you will either gain or lose $10. You may also trade in smaller increments thanks to our micro-contracts on significant marketplaces.

- It is important to remember that contracts for difference (CFDs) are leveraged contracts. Therefore, a small initial investment will provide you access to the total value of the transaction. Because of this, your money will go farther, but you risk losing more than you invested.

- Limits and restrictions

- You may install a stop to assist in limiting your exposure to loss. Your position will be closed immediately when the market goes against you by the amount you’ve set in your stop. A variety of stops are available for your convenience, such as

- Fundamentally, it will get you to buy at or around the price you choose. However, overnight or during periods of significant volatility, gaps might undermine the effectiveness of an essential stop.

- Sure: It always sells at the price you choose, no matter how the market fluctuates. Of course, this will be a premium, but it will only apply if the stop is made.

- When the market is trending in your favor, a trailing stop loss order follows along, but when the market turns against you, the stop loss order locks in.

- In contrast, stop-loss orders force you to sell when the market swings against you by a certain percentage. Profits may be protected against the risk of fluctuating markets by using limits.

CFD trading examples

- Initially, a CFD transaction may appear more complicated than a standard trade; therefore, here are some examples to help you get started.

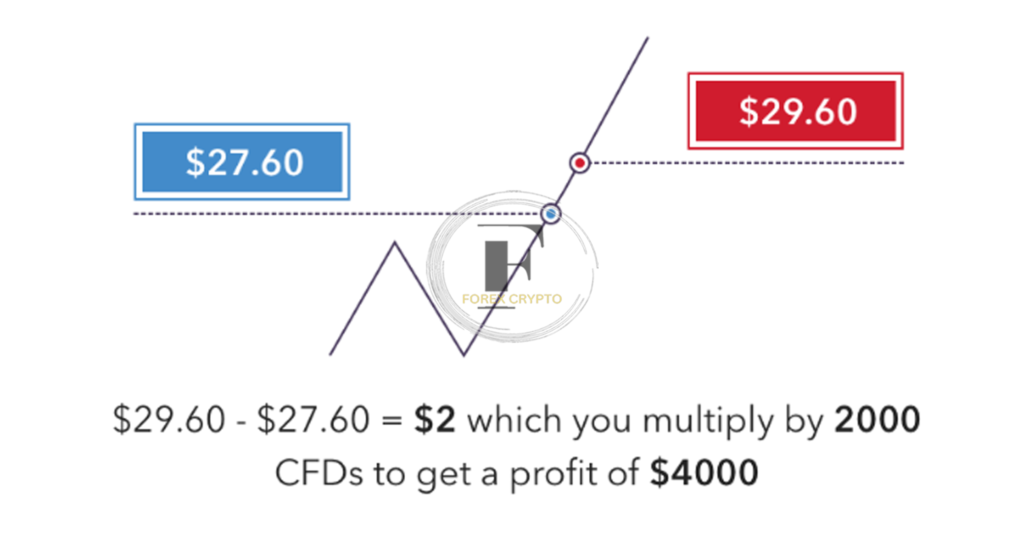

- For illustration purposes, let’s say you want to purchase CFD BHP shares, and the sale price is $27.59, and the buy price is $27.60.

- The following earnings report from BHP is drawing near, and you anticipate positive news. To speculate on a rise in the share price, you pay $27.60 for 2000 shares of the company’s CFDs. That’s like spending $2000 to get 2,000 shares in BHP.

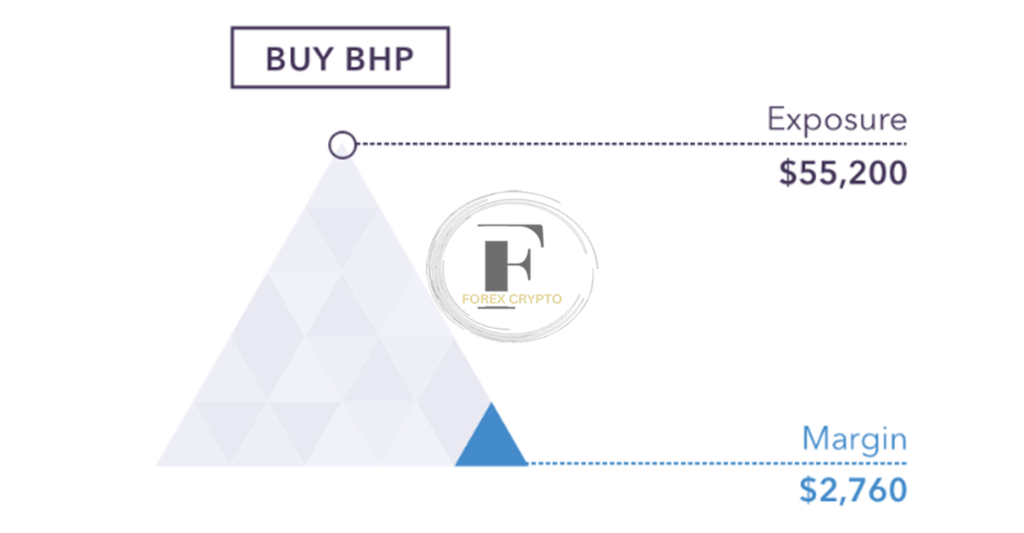

- The real value of these shares is not required as collateral since CFD trading is a leveraged instrument. Therefore, to cover the margin, which is determined by multiplying your exposure by the margin factor for the market you are trading in, you need only deposit a fraction of the whole amount.

- Your margin would be 5% of your overall exposure (2000 share CFDs x $27.6 = $55,200), or $2760, assuming BHP has a margin factor of 5%.

If your prediction is correct

- Upon BHP’s quarterly earnings release, it is evident that the firm has had a great quarter, and your forecast of a rise in the stock price comes true. Therefore, with a purchase price of $29.61 and a selling price of $29.60, you decide to exit your position at $29.60.

- You decide to exit a position by selling 2000 CFDs at the current market price of $29.60, so you execute a reversal transaction.

- The amount of your position multiplied by the difference between the closing and beginning prices gives you your profit. For example, if you buy 2,000 CFDs at $29.60 each and sell them for $27.60, you’ll make a profit of $4,000.

- Keep in mind that in addition to the agreed-upon price, there will be a commission fee and any applicable overnight finance fees. Seek the assistance of an expert if you are having trouble with your taxes.

Calculating profit from your CFD shar

If your prediction is wrong,

When BHP’s earnings fall below expectations, the stock price drops instantly. So you look at the market and end at $26.60 for your 2000 CFDs. This is an excellent place to get out of a losing position.

A $1 shift against you is a $2,000 loss (in addition to your commission fee and any overnight charges).

Calculating the loss from your share CFD

Trading Costs $27.59 / $27.60\sDeal CFDs on 2000 shares for $27.60

Commission $55.20 ($2,000 x $27.60 = $55,200 x 0.08% = $44.16) Margin $2760

Example 1 CFDs on 2000 shares * 2 = $4000 Closing price = Sell at $29.60 $29.60 – $27.60 = 2

$4000 minus $44.16 in fees is $3955.04

The bottom line: a profit of $3955.04

Second Example: Settlement Price = Selling at 26.60 27.60 – 26.60 = -1 2000 Shares CFDs * -1 = -$2,000

There was a loss of $205.20 ($2000 less the commission of $55.20).

Example: selling the Australia 200

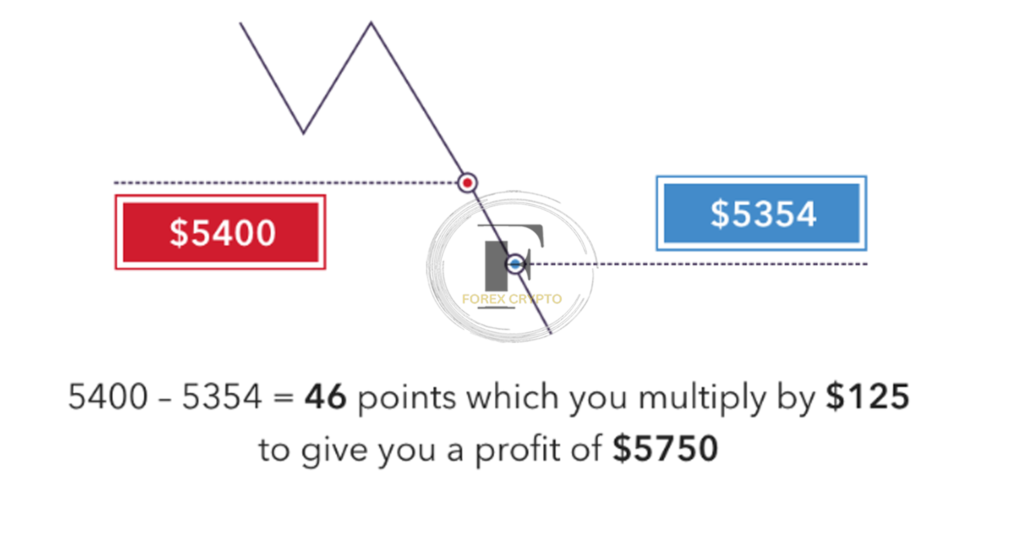

Our selling price for the Australia 200 is $5400, and our buying price is $5401.

You believe that the RBA’s announcement of interest rates will hurt the index. Therefore, you decide to sell five futures (worth $125 at the current price of $5400) to hedge your position.

The margin requirement for the Australia 200 is 0.50%, or $3375 ($125 times 5400 multiplied by 0.50%).

If your prediction is correct,

- Upon hearing the news, Australian investors dumped the currency, sending the purchase price down to $5354 and the selling price down to $5353. So you’ve decided to purchase five contracts at $5354 to lock in your profit.

- Because this is a short position, the profit is determined by subtracting the final price (5354 – 5400) from the initial price (5400) and then multiplying by the position size (5 contracts at $25 per contract = $125).

- After subtracting 5400 from 5354, you’ll have 46 points; multiplying by $125, you’ll have $5750 in earnings. For CFD transactions on indices, there is no commission to pay since our fees are included in the spread. However, you will still be responsible for overnight financing fees and tax implications.

Calculating profit

If your prediction is wrong,

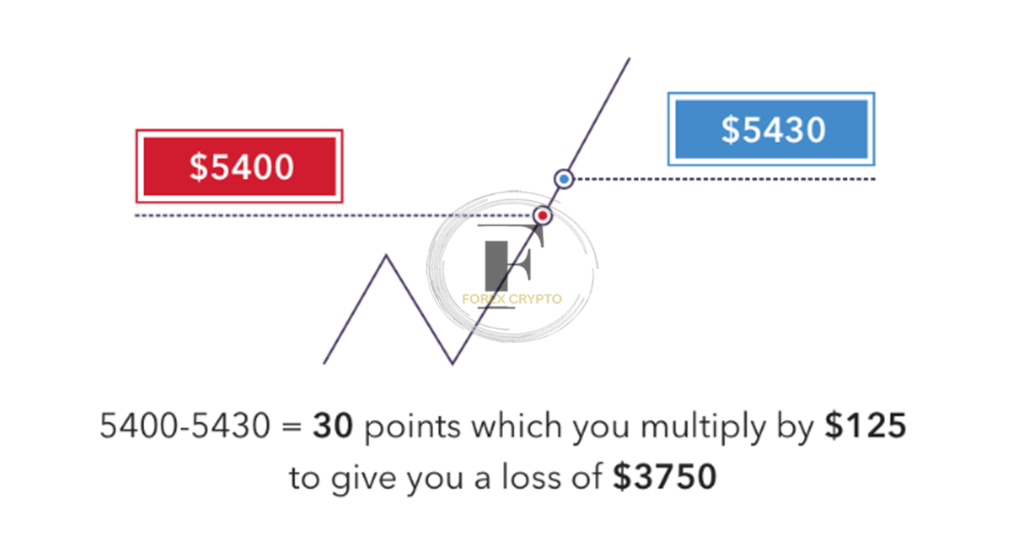

The announcement is good news that is suitable for the index. However, you decide to sell when the purchase price reaches $5,430.

You’ve lost 30 points as the price shifted against you. You’ll lose $3750 plus any overnight financing fees due to this.

Calculating your loss

Example of CFD Trade

Five thousand four hundred dollars to purchase, five thousand one hundred and one dollars to sell.

Deal

Reduced to 5400!

Quantity of Contracts in Deal: 5 at $25 Each

Margin $3375\sCommission

None

Additional possible costs

The cost of keeping a position open for more than one trading day is expressed as a percentage of the initial financing amount. You might be subject to taxation.

This is Exhibit A:

selling at $5354 at the day’s close.

Number crunching: $5750 / 5400 – 5354 = $46.125 / 46.125

$5750 in Gain or Loss

Second Closing Price Example: 5430 USD to Sell

You get -$3750 after plugging in the numbers: (5400 – 5430) *(-30)$125.

Loss in earnings = $3750.

FAQs

- With CFDs, which markets are available for trading?

- CFDs may be traded on more than 18,000* markets with IG, including equities, currencies, commodities, and digital tokens.

- If the market you’re interested in is open after hours, you may trade CFDs to take advantage of corporate news made after the market shuts.

- Trading contracts for difference (CFDs) is an option.

- CFD trading offers several advantages, such as dealing on hundreds of markets without a substantial initial investment, for traders of all skill levels.

- However, you should know that CFD trading is not appropriate for everyone. In addition, due to the leveraging nature of the offering, some of the initial capital may need to be recovered. Therefore, it is paramount to learn about the dangers of CFD trading and take the necessary precautions before beginning to trade.

- Approximately how much do commissions for CFDs cost?

- The prices of contracts for difference (CFDs) vary depending on the market you choose and other criteria, such as the market’s liquidity. In addition, share CFDs typically incur a commission fee, whereas other markets may incur a spread (the difference between the purchase and sell prices). Finally, the minimum number of contracts required to initiate a buy or sell position varies among markets to add to the complexity.

- Funding overnight positions is expensive, as do guaranteed stops (if activated), and specific specialized instruments may incur further costs.

- Please refer to our price list for all the costs and levies.

- How do I trade CFDs, and on what platforms?

- CFD trading is available via IG’s web-based trading platform as well as mobile trading applications. We also support using specialized third-party systems like L2 dealer, ProRealTime, and Metatrader4 with our services.

- Learn more about our several prestigious hosting options.

- I have a CFD account with another company, but I am considering switching to IG. Is there anything I ought to know?

- Filling out a short form will allow IG to assess your trading skills and available cash before opening a CFD trading account for you. Therefore, we guarantee you will have a pleasant business experience with us.

- Switching your account to us is a breeze thanks to our mobile trading applications, cutting-edge technology, and accessible instructional aids. This way, you can register and start trading immediately.

Comments (No)