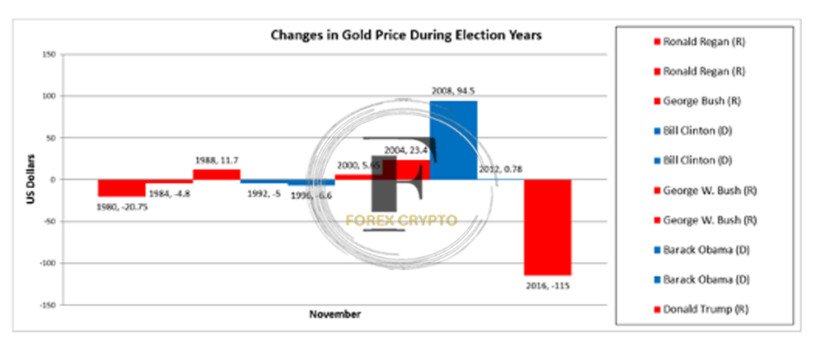

Presidential elections in the United States have a historical pattern of affecting financial markets since a change in leadership often brings about a change in fiscal policy. Since President Richard Nixon began dismantling the Bretton Woods system in 1971, the price of gold has been more sensitive to changes in the broader macroeconomic environment. This has resulted in higher price volatility.

However, when looking at the historical effect of the US Presidential election, there needs to be more evidence of a linear link between the price of gold and the result depending on party membership, This is the case when looking at the historical impact of the US Presidential election, When President Clinton was in office, the bullion market was not doing well, but when President Obama was in office, the price of gold reached an all-time high, It is possible to say the same thing about Republican candidates, just as it is possible to say that gold prices fell during the Reagan administration but rose during both of George W, Bush’s periods in office.

Attempts to correlate a particular market response to a candidate’s party membership are nuanced, mainly when external fundamental considerations such as seasonality and the economic cycle are considered, As a result of the fact that different regimes have seen bubbles and collapse in the financial markets at different times, several observations that contradict one another may be made.

However, one observation that can be applied to the unusual circumstances of the present conditions is that gold prices have become more volatile in the 21st century, It is currently unknown whether this trend will continue through the election in 2020, given the economic jolt caused by the COVID-19 pandemic, which clouds the macroeconomic outlook.

Data obtained from Bloomberg as the source

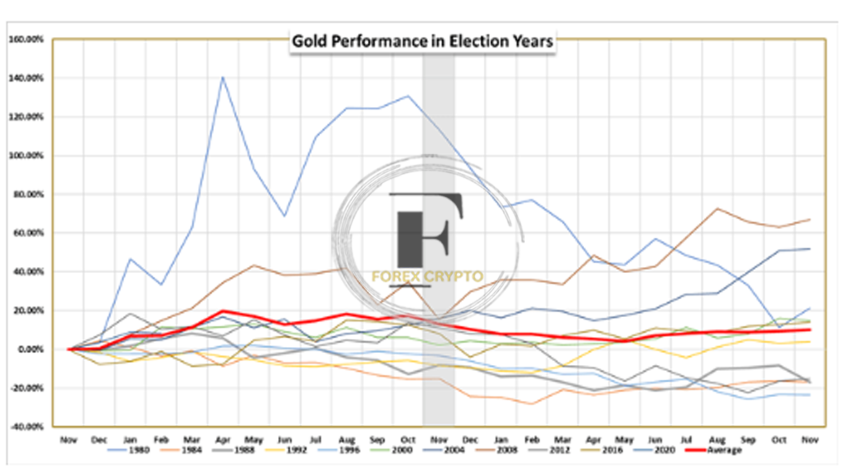

Examining the historical performance of gold prices in the years leading up to and immediately after elections since 1980 may illuminate the topic. One way to do this is to monitor the behavior of gold prices during election years. The precious metal (shown by the red line) had a price increase at the beginning of the year, but it reached its highest point during the second half of the year before beginning a downward trend in November.

Data obtained from Bloomberg as the source

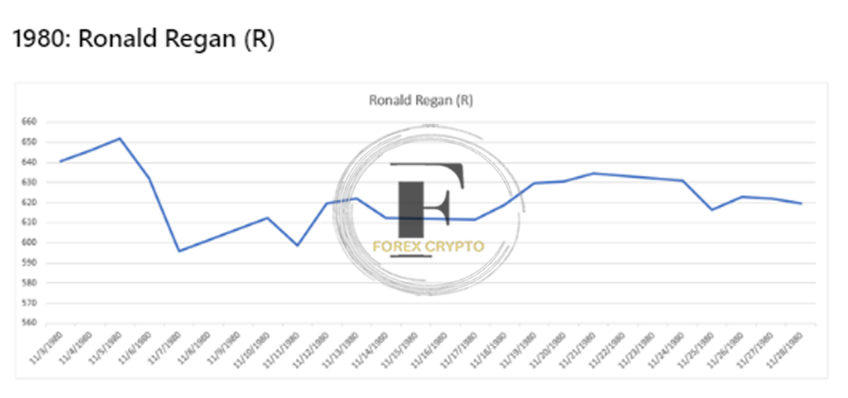

The price of gold reached its all-time high of $850 in January of 1980. This occurred about the same time the Federal Reserve, led by Chairman Paul Volcker, was planning to drive US interest rates above 20% to limit inflation. However, the increase from the beginning of the year was short-lived, and the precious metal posted its 1980 low of $482 in March. The bullion price rallied to trade over $600 before the election on November 4, but it remained pretty stable during the rest of the year, hovering around $590 in advance of 1981.

Data obtained from Bloomberg as the source

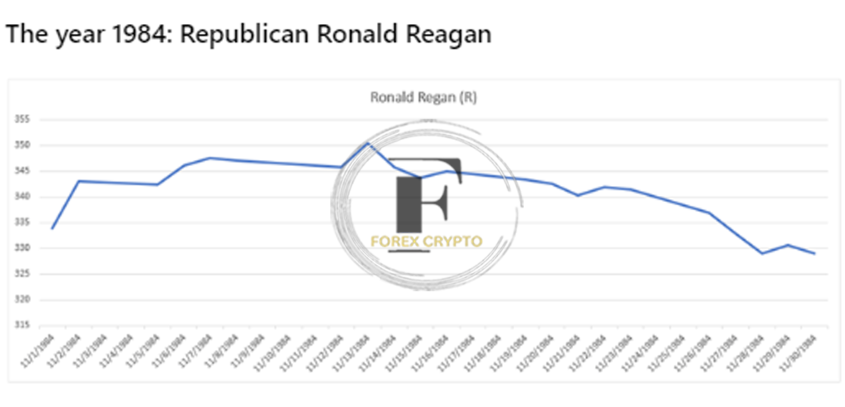

In March 1984, gold prices temporarily traded over $400 when the Federal Reserve raised the benchmark interest rate above 10%. At the time, Chairman Volcker was still in charge of the Federal Reserve, having been nominated to serve a second term in 1983. Even though President Ronald Reagan was victorious in his bid for a second term in the election held on November 6, the price of precious metal steadily declined over the following months. This was even though the election did nothing to buoy the price of gold. Following the election results in 1984, the price of gold maintained its downward trend and reached its annual low of $308 in December.

Data obtained from Bloomberg as the source

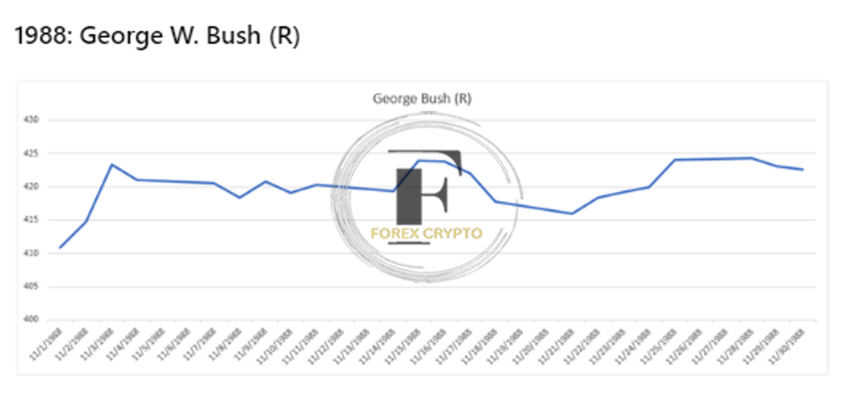

In 1988, the price of gold reached its annual high of $482 in January, but it dropped below $400 in September as the effective Federal Funds rate climbed ahead of the election on November 8. At the time, Alan Greenspan was serving as the president of the United States Central Bank, which had been appointed by Ronald Reagan in 1987. The triumph of George H.W. Bush had little effect on gold prices, with bullion moving flat for the rest of the year to wind up at approximately $410 by the year’s conclusion.

Data obtained from Bloomberg as the source

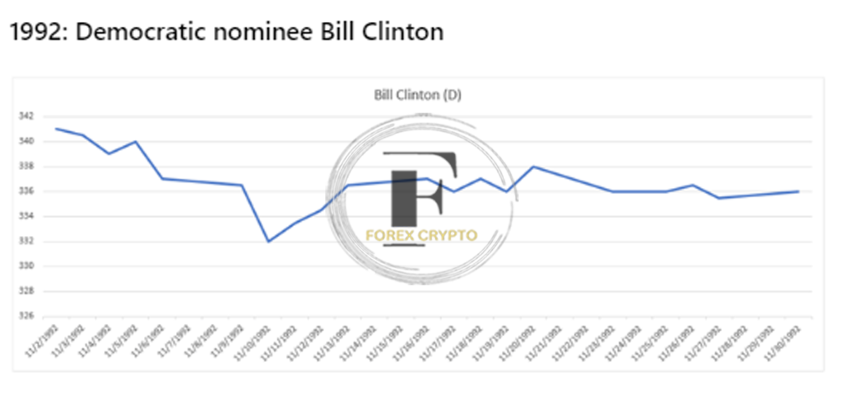

In 1992, bullion remained over $350 until March, despite the Federal Open Market Committee (FOMC) maintaining its rate-lowering cycle after the recession in the early 1990s, Despite this, the precious metal declined in value during the year’s first half.

After being reappointed by Bush in 1991, Chairman Greenspan decreased US interest rates ahead of the election on November 3, However, the price of gold remained under pressure after Clinton was elected president, with the precious metal reaching the annual low ($332) only days after the election, This occurred just days after the election, Gold prices were contained within a relatively small range for the balance of the year, with bullion closing the year at about $335.

Data obtained from Bloomberg as the source

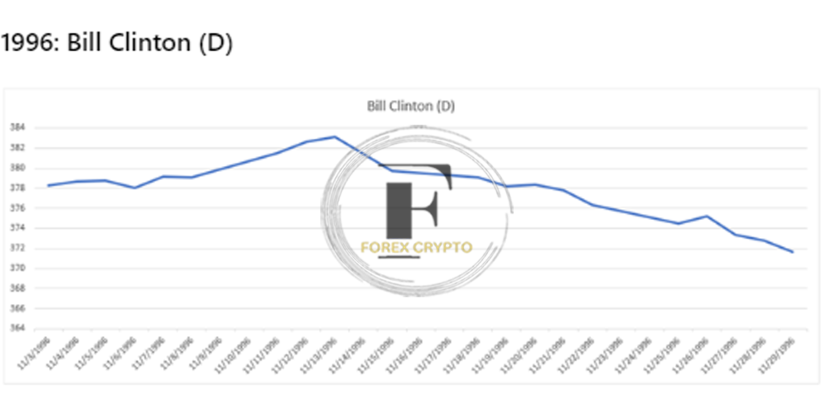

Gold prices rose over $400 during the first quarter of 1996 as the Federal Open Market Committee (FOMC) decided not to adjust interest rates in the United States, Chairman Greenspan was still in charge of the committee even though President Clinton had reappointed him for a third term earlier in the year.

Despite Clinton’s victory in the election for a second term, the price of gold remained below $400 during the balance of the year, Bullion immediately gave up the recovery that it had experienced after the election on November 5 and finished the year at approximately $368.

Data obtained from Bloomberg as the source

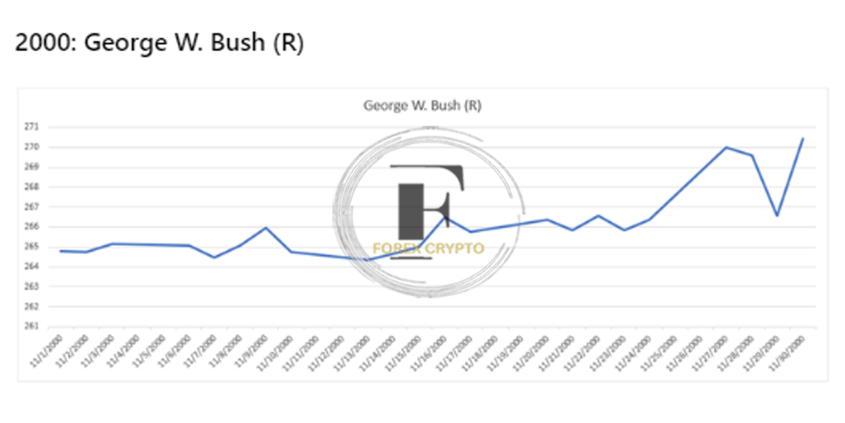

Even though the Federal Open Market Committee (FOMC) continued to engage in its rate-increasing cycle from 1999, the price of gold rebounded at the beginning of the year 2000, with the precious metal trading at over $300 in February.

However, the price of bullion fell in the following quarters, even though the FOMC had enacted its most recent rate rise in May. The precious metal marked its annual low at $264 only a few days after the election on November 7. As a result of Federal Reserve Chairman Alan Greenspan’s decision to maintain the status quo on interest rates in the United States after being reappointed to his position by former President Bill Clinton for a fourth term, the price of gold inched its way up throughout the rest of the year and finished the year at $272.

Data obtained from Bloomberg as the source

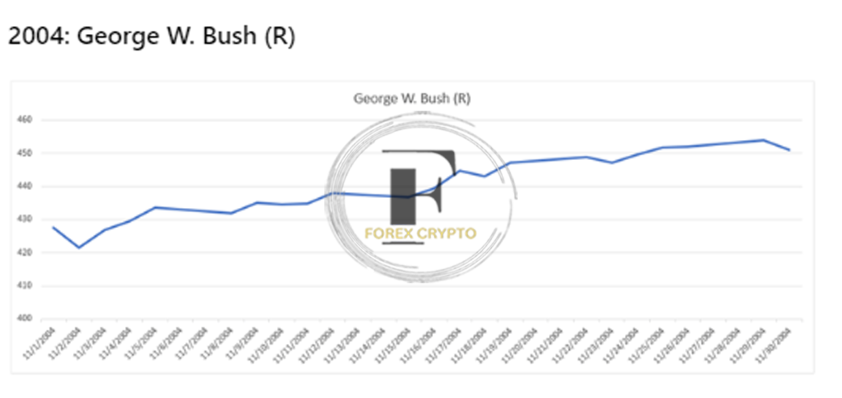

During the first quarter of 2004, the price of gold reached a high of $426 as the Federal Reserve kept US interest rates at 1.00%. However, the price of gold fell below $400 on multiple occasions before the November 2 election as Chairman Greenspan, who was serving an unprecedented fifth term after being reappointed by George W. Bush, began raising rates. As a result of Bush’s reelection, gold prices rose, with December recording the yearly peak ($456).

Data obtained from Bloomberg as the source

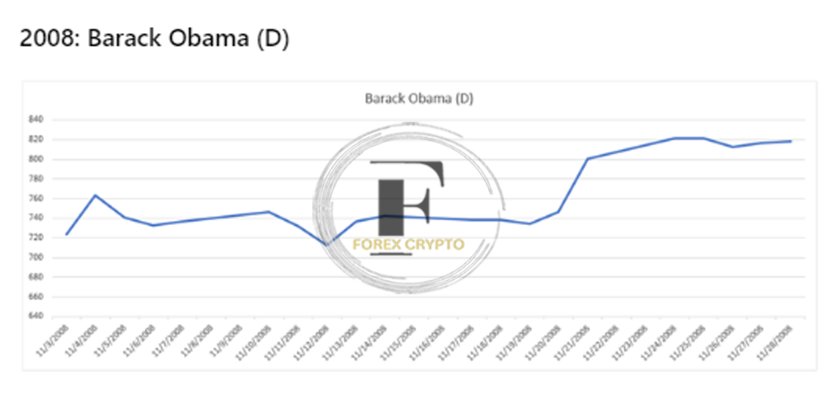

November 4, 2008

In 2008, the price of gold reached a high of $1000 for a short period in March when the Federal Open Market Committee (FOMC) dropped US interest rates in reaction to the subprime housing crisis. However, the price of gold traded as low as $721 before the November 4 election, even though the central bank under Chairman Bernanke delivered two consecutive rate cuts in October. Just a few days after Barack Obama was declared the presidential election winner, gold reached its annual low of $712; nevertheless, the bullion price rebounded for the rest of the year to end the year at $882.

Data obtained from Bloomberg as the source

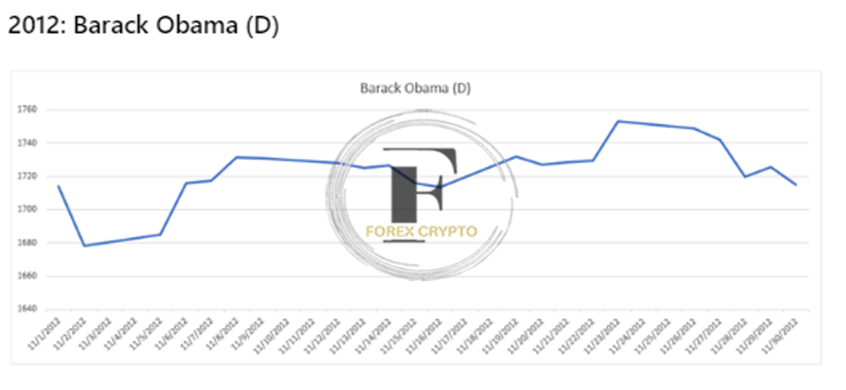

November 6 in 2012

In 2012, the price of gold began the year slightly around $1600 and peaked at $1781 in February before falling to a low of $1540 in May, This occurred even though the Federal Open Market Committee (FOMC) maintained US interest rates very near zero, Gold prices rose ahead of the November 6 election to trade back over $1700, but the rally unwound despite Obama winning a second term as the precious metal finished the year at $1675, Gold prices concluded the year around $1675 per ounce.

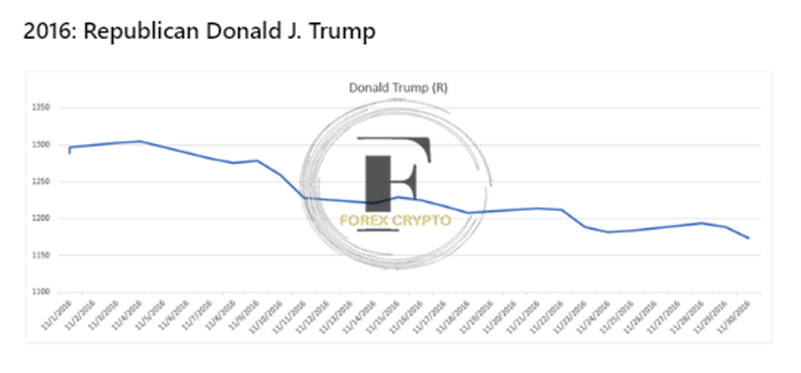

2016: Republican Donald J. Trump

Data obtained from Bloomberg as the source

November 8, 2016

In 2016, the price of gold began the year below $1100 as a result of the Federal Open Market Committee (FOMC), headed by Chair Janet Yellen, increasing US interest rates at the end of 2015. However, the price of gold traded as high as $1366 in July as a result of the central bank keeping the Federal Funds rate in a range of 0.25% to 0.50%. However, gold prices fell below $1300 before the election on November 4, and the triumph of Donald Trump did nothing to shore up the precious metal as bullion finished the year at $1148. The election result did little to support the precious metal.

2020 -?

Even though the precious metal has become more responsive to the macroeconomic environment, a look at the timeline of the US presidential election needs more evidence of a linear relationship between bullion and party affiliation. This is even though various fundamental factors have been attributed to the changes in the price of gold since the collapse of the Bretton Woods system.

The research does suggest that gold prices have grown more volatile in the 21st century, and it remains to be seen whether the pattern will continue beyond the 2020 election as the precious metal trades to new record highs this year. In addition to this, the study also indicates that gold prices have gotten more volatile in the 21st century.

Comments (No)