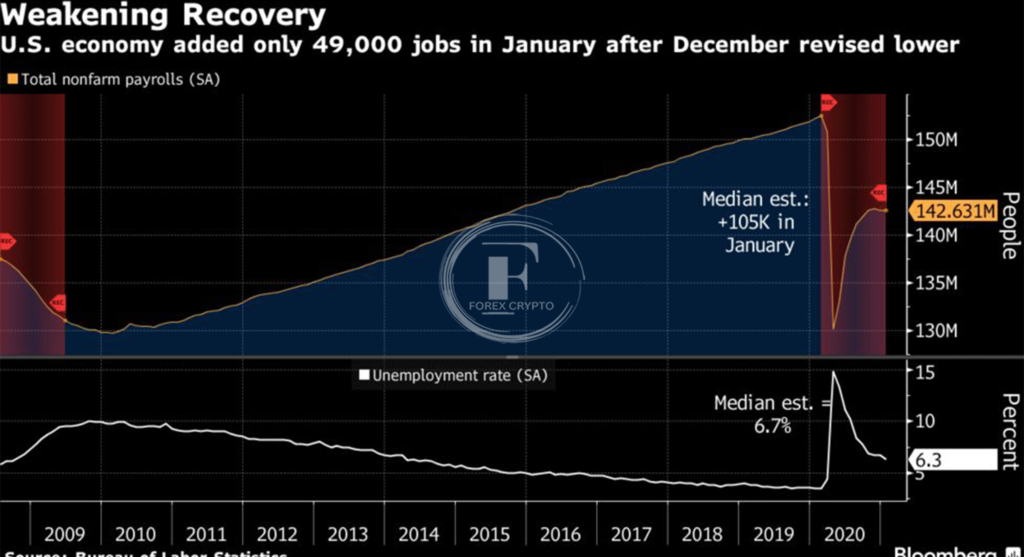

The number of salaried employees in the United States outside of the agricultural sector, the federal government, private households, and nonprofit organizations are reported in the Nonfarm Payroll (NFP) report, an important economic indicator.

In the foreign currency (FX) market, the nonfarm payroll data often generates one of the most significant rate changes of any news event. Because of this, the NFP figure and its potential effect on the currency market are closely watched by analysts, traders, funds, investors, and speculators.

On the first Friday of every month, the NFP report is published, detailing the monthly growth or shrinkage of salaried U.S. employees across most firms.

If the numbers are going up, it may indicate economic growth, but investors could also be worried about inflation if they keep going up, and if they’re going down, that would indicate a more significant economic issue.

MAIN POINTS

- The number of payrolls made by companies other than farms is a widely watched economic measure of how many people are working in the United States.

- There may be an increase in activity in the foreign currency market as a result of the announcement of NFPs data, which is based on changes in employment.

- The NFP report is suitable for technical analysis with either a 5- or 15-minute chart time frame.

The Numbers Behind the Nonfarm Payroll Report

The United States nonfarm payroll data may be broken down in three distinct ways:

- Increases in payroll indicate more job creation and economic development in the United States. Money managers and investors in the foreign exchange market anticipate a monthly increase of 100,000 employees. Gains in the U.S. dollar would be aided by a release that was higher than either that target or the expected consensus.

- The market’s response to news of an anticipated shift in payroll numbers is complex. Many foreign exchange traders will look to the unemployment rate and the manufacturing payroll subcomponent of the NFP report for guidance or insight if they think the NFP report will change. U.S. economic growth is aided by a stronger dollar, which investors like if the unemployment rate falls or manufacturing payrolls increase. Investors will avoid the U.S. dollar in favor of other currencies if the unemployment rate rises and manufacturing jobs fall.

- The United States and its currency, the dollar, take a hit when the job situation worsens. If the non-farm payroll data indicates a decrease of 100,000 jobs or fewer, investors would likely see the U.S. economy as sluggish and seek better-yielding currencies to trade against the U.S. dollar.

Profiting from Market Movements Caused by News Stories

News-based trading has the potential to be very lucrative but also quite risky. However, after the first wave of speculators has cashed out their gains or losses, those who are patient enough to wait for the rates to stabilize may benefit from the market’s actual direction.

On the first Friday of the month at 8:30 in the morning. EST, the NFP data is released, creating an ideal setting for aggressive traders with almost certain tradable movement after the announcement.

Considering the market’s reaction before entering a transaction may help you achieve more consistent outcomes than trying to predict the market’s direction of movement in response to an occurrence.

So, How Do You Trade Using the NFP?

Although the NFP data has an impact on most major currency pairings, the British pound/U.S. dollar (GBP/USD) is a particular favorite of traders. The news event is available to all traders since the forex market is open around the clock.

Market participants will enter a trade in the direction of the preponderant momentum and a signal signaling that the market has picked a direction after it has processed the importance and early swings of the information. This reduces the risk of getting spooked out of the market before it has settled on a course, and it helps you avoid making a premature investment.

The Regulations

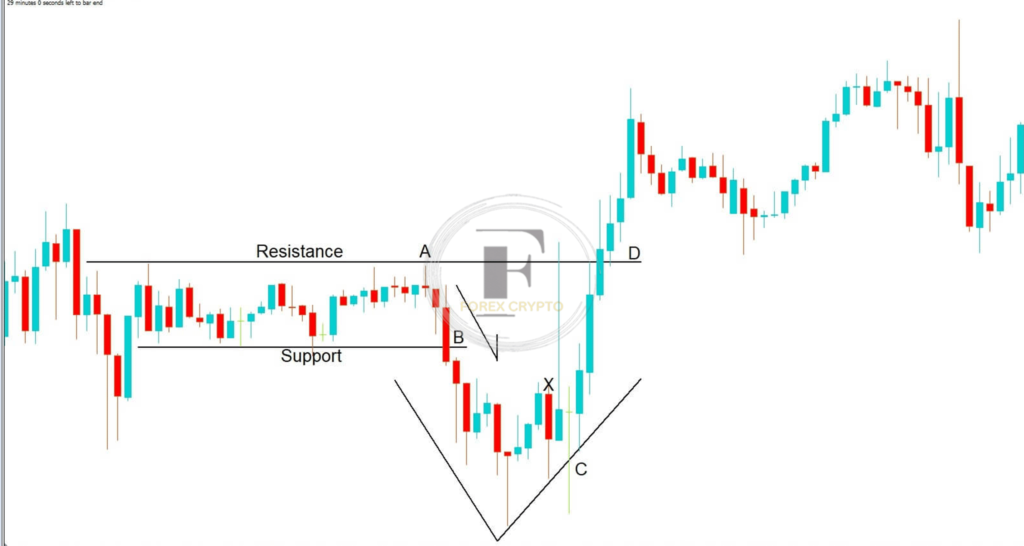

The approach is suitable for trading on 5- or 15-minute timeframes. Criteria and examples are provided for a 15-minute chart, although the same rules apply to a 5-minute chart. It’s essential to maintain uniformity even if signals emerge at various times.

- After the NFP report, there is a lull of one bar in which no action is taken (8:30 to 8:45 a.m. in the case of the 15-minute chart).

- The extensive morning bar will be made between 8:30 and 8:45. Once this first bar has occurred, traders watch for an inside bar (it does not need to be the very next bar). That is, they are watching for the range of the most recent bar to fall entirely inside the range of the bar before it.

- The high and low prices of this inner bar provide you with prospective entry points into the market. Market players enter a trade in the direction of the breakout when the succeeding bar finishes above or below the inner bar. They don’t have to wait for the bar to shut to make an investment but may instead join the market as soon as the bar crosses above or below its high or low. Stay within your chosen approach.

- You should set a stop loss of 30 pips on the transaction you just made.

- Pick no more than two swaps. If you’re both kicked out, don’t try to get back in. High and low from the preceding inside bar are utilized again to place a second trade, if necessary.

- The goal is a specific elapsed time. Most of the report’s impact is seen in the first four hours after its distribution. The typical trading exit occurs four hours following the first deal. If a trader decides to remain in the transaction despite the stop being hit, they may use a trailing stop.

Example

In the above graph, the vertical line denotes the time when the NFP report was made public (8:30 a.m. EST; 1:30 p.m. GMT). Three bars, or 45 minutes, of fluctuation, can be observed on the chart after the release. Traders wait for an inside bar before making any moves during this period. A square appears on the chart near the inner bar. The price range of this bar is entirely confined by the range of the preceding bar. Market participants will enter when the price of a bar closes higher or lower than the inner bar. There is a circle around the close of the next bar, which is where they will enter if it closes above the high of the preceding bar. Their entry price is shown by a solid black horizontal bar, and their stop loss is 30 pips below that.

Entry was at around 9:45 a.m. EST (2:45 p.m. GMT); thus, they will exit four hours later. Traders that entered the trade at 1.4670 and exited it at 1.4820 made a profit of 150 pips while only losing 30 pips on the deal. However, it should be recognized that only some deals will be this successful.

Traps in the Strategy

Despite the potential for high returns, there are a few snares you should avoid while pursuing this course of action. First, by the time an investor sees an inside bar indication, the market may have already slowed from an earlier, more pronounced rise in one direction. If a significant price change happens before the inner bar, the change may fizzle out before the signal is given. Even after waiting for a pattern to establish up, rates may suddenly reverse during periods of severe volatility. For this reason, a barrier must be constructed.

A Brief Explanation of the Non-farm Payroll Report

Payrolls from businesses that do not directly engage in farming, as well as those from a small number of other industries, are known as non-farm payrolls (NFPs) in the United States. The Federal Bureau of Labor Statistics (BLS) measures this by conducting payroll surveys of commercial and public organizations throughout the United States. Every month, the Employment Situation report puts out the non-farm payroll figures from the BLS.

When the non-farm payroll increases, how does it affect the forex market?

When the BLS releases its non-farm payroll data on the first Friday of each month, it may have a significant effect on the FX markets. Why? Because traders are always keeping an eye on economic indicators like inflation, housing starts, GDP, and the monthly payroll report, which details a wide range of information on the state of the American labor market.

What Time of Month Does the Non-farm Payroll Report Typically Publish?

On the first Friday of each month, at 8:30 a.m. EST, the government releases its non-farm payroll report.

Briefly Summing Up

Waiting for a brief consolidation, the inner bar, after the initial volatility of the NFP news has faded and the market is determining which way to move, is vital to the technique of trading on the report. You may maximize your profit potential while minimizing loss by using a stop-loss order of a reasonable size when trading the NFP data.

Investopedia is not a financial advisor and does not give tax or investment advice. Information may only be appropriate for some individuals since it has not been tailored to the unique investing goals, risk tolerance, or financial circumstances of any individual person. Loss of principal is a risk while investing.

Comments (No)