- Stop-loss and take-profit orders are a great technique to manage your open positions while investing in cryptocurrencies or publicly traded firms on the stock market. By placing a stop-loss order, you may limit your potential losses on a single transaction to an acceptable amount. Meanwhile, by locking in gains on either short- or long-term price movements with a take-profit order, you may avoid succumbing to greed’s adverse effects on your trading.

- In this article, we’ll discuss the importance of using stop losses and take-profit orders while trading cryptocurrencies, equities, FX, and commodities with eToro and how to implement them into your exit plan.

What are stop-loss and take-profit orders?

You need a stop-loss plan to limit the amount of money you lose on a stock or cryptocurrency investment. On the other hand, a take-profit order specifies the price at which you would be willing to sell your cryptocurrency or stock holdings. You can create a risk ratio formula that works for your investments over the long run by combining stop losses and take profit orders, ideally keeping your potential downside smaller than your potential gain.

How to stop loss works in trading

- An explanation of a stop-loss order Those who aren’t willing to take any chances with their money should think about creating a stop-loss plan. When the price of an asset falls below the stop price established by the trader, the order to sell is executed. In this case, the market order to sell at the next available price below the stop-loss level would be filled.

- Take the hypothetical case of investing £500 (10 x £50) in Company ABC. Following this, you place a stop-loss order at £40. Following your first position opening, the share price of Company ABC continues to fall, eventually falling below your £40 stop loss. Your position is closed at £39.95, a loss of £10.05 per share, since the stop-loss order was activated.

What does “take profit” mean?

- A limit order, also known as a take-profit or stop-loss order, ensures that a trade is concluded at or above a specified price. For example, if the price of a cryptocurrency or stock rises above the predetermined “take profit” threshold, the holder of that position will sell it. Take-profit orders are the most time-efficient method of completing a transaction and removing the human factor from maintaining an open position, making them particularly appealing to short-term traders who watch price movements daily or even hourly.

- More on how to manage the risk-to-reward ratio of your trades with stop loss and take profit orders in a moment.

How can stop-loss strategies help minimize risk?

Take profit and stop loss trading are crucial concepts to understand so you can manage your open positions like a master. With a stop-loss in place, you can stop worrying about your portfolio’s every move. After deciding on a stop-loss level, you may place an order in the market and forget about it until it’s time to act.

- A stop-loss order isn’t without its risks. For example, your stop loss may be triggered in highly volatile markets after a brief but significant price increase, only to see the value gradually rise to break even or turn a profit in the medium to long term.

- It follows that stop-loss orders are most useful in the following types of trading situations:

- Speculative purchases of stocks or cryptocurrency during a prolonged bull run when there is little or no danger in sight.

- Fundamental analysis-based trading opportunities, such as press releases or news items, may be leveraged to achieve substantial profits. These articles will often appear in the news feeds of successful eToro investors.

- Market uncertainty when firms otherwise have strong foundations.

- Bearish downtrends in stocks, cryptocurrencies, or shares are predicted by technical analysis to be part of a market correction.

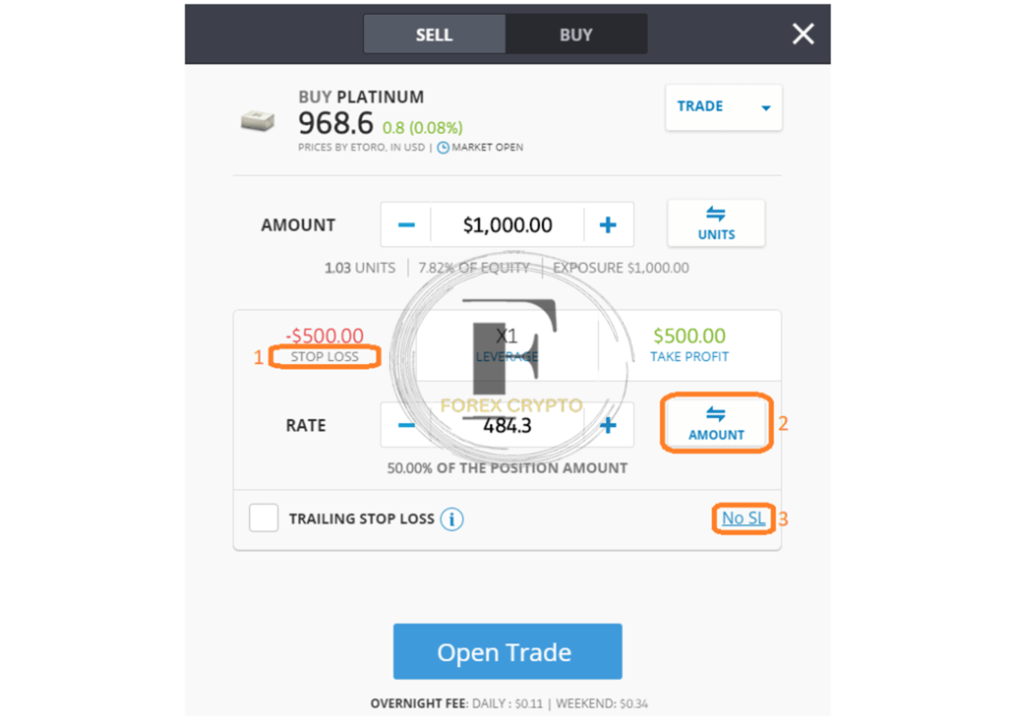

Stop loss trailing techniques

- One might also utilize a stop loss to safeguard gains. Trailing stops, a variant of the standard stop loss order, are placed at a specified distance (in percentage terms or terms of dollars) below an asset’s current market price. For example, a “trailing stop loss” is a stop loss order placed below the current market price of a stock you want to acquire (go long on). Conversely, when shorting (selling) a stock, a trailing stop loss order is placed above the stock’s current price.

- Whenever your open trade is trading the way you anticipate, your trailing stop will also be trading in that direction. If the market recovers part of the stock’s gains or losses, it will automatically cancel your trade and return you to the opening price.

How to calculate the risk ratio when trading online

- Once you understand how stop-loss and take-profit orders work, calculating the risk and potential return of each trade you make is a breeze.

- One of the main reasons inexperienced traders lose money is that they need to learn how to manage their capital correctly.

- Calculating your risk ratio is as easy as dividing your desired net profit by the price at which your stop-loss order will be activated. For example, if an investor has to put in £1 to make £2, they may not be willing to take the risk. It may seem like playing it safe, but that’s the most excellent method to ensure your money lasts through the market’s ups and downs.

How to set stop-loss targets

- Again, your comfort level with risk will determine where you should set your stop-loss order. After all, a stop-loss is meant to be used in the worst-case scenario as a market indication that your assessment of a stock’s price was incorrect.

- Stop-loss orders may be easily placed after establishing a minimum acceptable risk-to-reward ratio. For instance, if your risk-to-reward ratio is 4:1, you could lose 25% of your original investment to achieve your take-profit target.

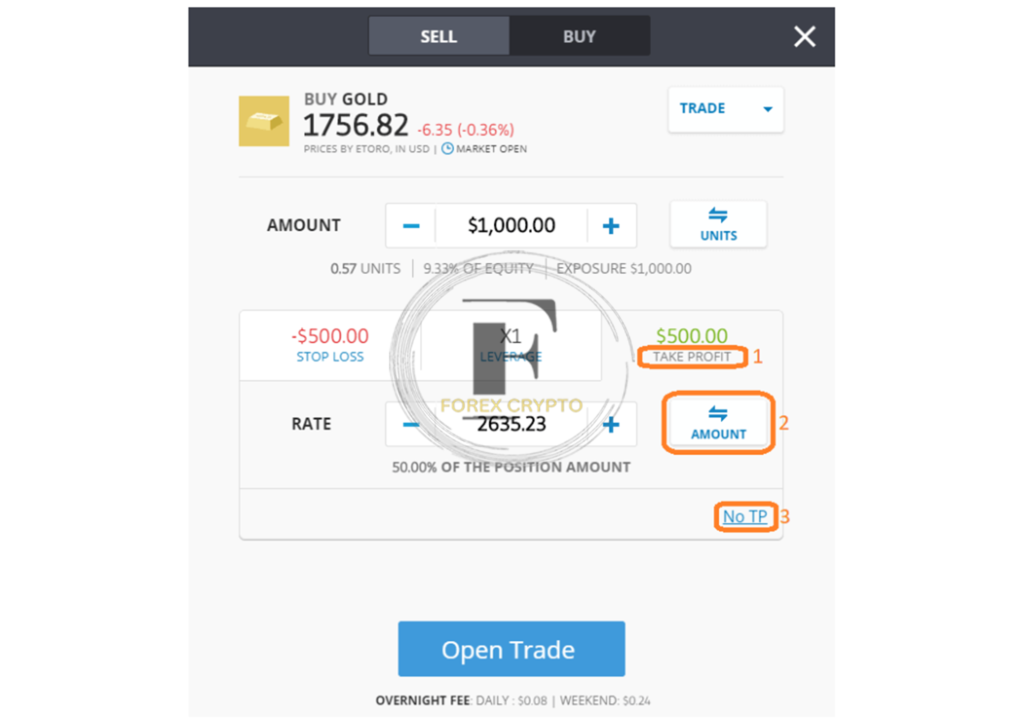

How do take-profit strategies work?

- Traders who engage in speculative, short-term transactions hoping to profit from the price changes of volatile assets like stocks and cryptocurrencies sometimes use take-profit orders. It might be difficult for some traders to discern when to cash in their winnings because of all the “noise” in the market. As a result, they lose everything because they waited too long to cash out at the optimal time.

- The open position is closed for a profit after the take-profit order triggers, which might be a percentage or dollar amount. No more worrying about whether or not now is the time to sell that asset you’ve been holding on to.

Setting your own take-profit

- Take-profit orders may be used in many different ways. However, here are some of the most common strategies used by seasoned traders:

- Putting them at crucial points of support or resistance

- Traders often utilize technical analysis to locate areas of support and resistance and then place take-profit orders around the previous day’s or week’s highs or lows.

- Learning to Interpret Fibonacci Cycles

- Using Fibonacci extensions, you may project how long stock trends are likely to continue to determine how profitable the stock could be.

- Putting them where they belong based on the average recent

- When a stock falls well below its medium-term moving average during a trending market period, some investors may execute a take-profit order around the moving average to recoup some of their losses.

- At points when the market’s pricing activity indicates a change in mood

- Price action signs, such as engulfing bars and rejections at highs or lows, may also be used to gauge shifting market mood.

- Learning about these market orders and confidently putting them into action is a breeze if you observe the actions of seasoned traders. eToro’s social trading platform simplifies entry into the stock, FX, and cryptocurrency markets for inexperienced traders. Moreover, it facilitated the transfer of knowledge from experienced traders to novices, allowing the latter to pick up tips on how to make money in the markets.

- To take things even further, we offer Smart Portfolios, which customers may utilize to trade and diversify their assets automatically.

- When you understand how to set stop-loss and take-profit orders, you’ll be able to initiate a trade using your eToro account with complete confidence. When it comes to the markets, knowledge is power.

- Join eToro to get some hands-on experience with stop-loss and take-profit orders

- This material is not intended as investment advice, a personal recommendation, an offer to sell, or a solicitation to purchase any security. This content has yet to be generated in line with the legal and regulatory obligations to encourage independent research. It has been prepared without considering any specific investment goals or financial position. The historical performance of a financial instrument, index, or investment product is not indicative of future outcomes and should not be relied upon as such. Neither the author nor eToro can guarantee that the information included in this guide is correct or thorough. Before you invest money in trading, be sure you fully grasp the potential downsides. Take just the amount of risk that you can afford to lose.

Comments (No)