What Is Short Selling?

Definition, Pros, Cons, and Examples

- An investing or trading strategy based on betting that the value of a stock or other asset will fall is known as short selling.” It’s a complex tactic that only seasoned traders and investors should try.

- Both speculative traders and investors/portfolio managers may benefit from short selling. Speculation trading is a complex endeavor fraught with the potential for high losses. Hedging, the practice of taking opposite positions to limit losses, is far more widespread.

- To engage in short selling, an investor borrows shares of a stock or other asset from a third party, expecting the asset’s value to fall. When they are able to find buyers at the current market price, investors will sell the shares that they have borrowed. The trader hopes the share price will continue to fall, so they may buy the shares at a lesser cost before the due date. Any asset’s price may increase to infinity, making the loss on a short sale infinite.

- MAIN POINTS

- When an investor borrows a security and then sells it on the open market to repurchase it later at a lower price, this is known as “short selling.”

- If a security’s price falls, the seller of the short will have made a profit. On the other hand, long-time investors are betting on a rise in the price of the asset they’re buying.

- Margin calls may rapidly and eternally compound losses, making short-selling a high-risk endeavor with potentially enormous rewards.

Understanding Short Selling

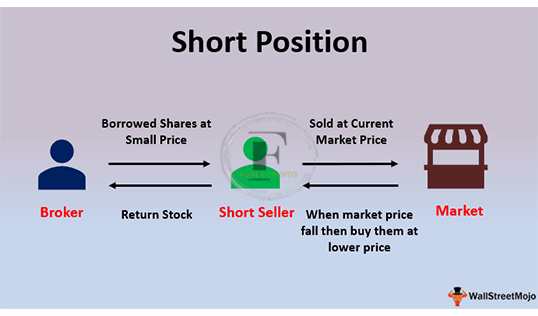

- Sellers who engage in short selling initiate short positions by borrowing shares, often from a broker-dealer, with the expectation of purchasing them back at a lower price and making a profit. Because you can’t sell something that doesn’t exist, borrowing shares is necessary. To “cover” a short position, a trader repurchases the shares on the market, ideally at a lower price than when they borrowed the asset, and then returns them to their lender or broker. Of course, investors must factor in the broker’s interest rate and applicable fees when making a deal.

- A trader needs a margin account to initiate a short position and will often have to pay interest on the value of the borrowed shares. The Federal Reserve, the New York Stock Exchange (NYSE), and FINRA (the agency responsible for enforcing rules and regulations about registered brokers and broker-dealer firms in the United States) have all established minimum values for the amount that the margin account must maintain, also known as the maintenance margin.

- When the value of an investor’s account drops below the maintenance margin, the broker may sell the position unless the client deposits more cash.

- In the background, the broker will find available shares to borrow and return them when the deal is complete. For the most part, you may use your broker’s standard trading tools to initiate and close the deal. Although to participate in margin trading, a trading account must first fulfill the requirements set out by the broker.

Why Sell Short?

- Short selling is often done for speculative or hedging purposes. For example, if speculator bets on the price going down, they do so solely on the expectation that the price will fall. However, if they are incorrect, they will incur a loss when paying a premium to repurchase the shares. Owing to the higher stakes involved in short selling due to the usage of margin, it is often practiced within a shorter time frame and for speculative purposes.

- Selling short is another way to protect an extended position. To lock in profits, you may, for instance, trade short against a long position in which you own call options. Or, you may minimize your losses in a long stock position by selling short stock strongly connected with your original investment.

Example of Short Selling for a Profit

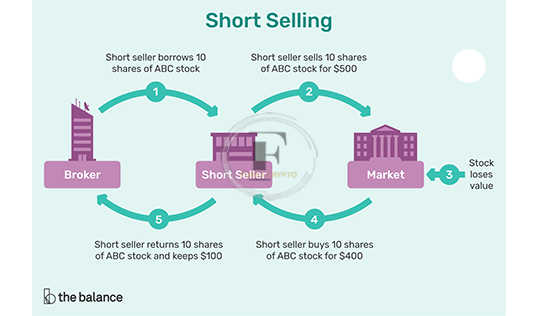

- Suppose a trader predicts a three-month fall in the price of XYZ stock from its present $50. A hundred shares are borrowed and then sold to a third party. Since the investor sold shares they did not own but had borrowed, they are now “short” 100 shares. If other traders are shorting the company, borrowing the shares needed to complete the short sale may be challenging.

- A week later, the shorted business announces poor quarterly financial results, and its stock price drops to $40. The trader chooses to settle the short position and replace the borrowed shares with 100 purchased on the open market for $40. Without considering fees and interest on the margin account, the trader will earn $1,000 ($50 – $40 = $10 100 shares = $1,000) on the short sell.

Example of Short Selling for a Loss

- Consider the preceding example again, but this time assumes the trader opted to keep the short position open at $40, hoping to profit from a further decrease in price. Instead, company shares skyrocket when a rival makes a $65 per share takeover bid to buy the business.

- A loss of $1,500 ($50 minus $65 = negative $15 multiplied by 100 shares) would result from the trader’s decision to liquidate the short position at $65. As a result, the trader was forced to cover their position by buying back shares at a much higher price.

Example of Short Selling as a Hedge

- Hedging is a beneficial side effect of short selling that is sometimes overlooked in favor of the higher-risk but more reputable form of speculating. Compared to the purely profit-driven nature of speculating, the fundamental goal of hedging is protection. Hedging is done to safeguard profits or limit losses in a portfolio, but most individual investors only think about it during routine times because of the high cost.

- Hedging is a double-edged sword, with associated expenses on both sides. To begin with, an outlay of resources is required to put in place, such as the costs involved with short sales or the premiums paid for protective options contracts. But on the other hand, there is also a potential profit loss by limiting the portfolio’s growth if the market continues to rise. By illustration, if half of a portfolio is hedged and the S&P 500 index rises 15% over the following 12 months, the portfolio will only record about half of that gain or 7.5%.

Pros and Cons of Short Selling

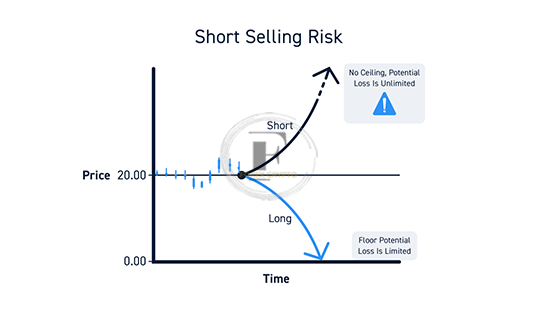

- If the seller makes an incorrect prediction regarding the direction of the price, the sale might be disastrous. When trading stocks, a trader might lose all of their initial investment if the stock price drops to zero.

- In contrast, a trader who shorts stock stands to lose far more than 100% of their initial investment. The danger lies in that stock prices might theoretically go “to infinity and beyond,” to paraphrase the beloved comic book character Buzz Lightyear. The trader was also responsible for keeping their margin account funded while the stocks were being held. In the best-case scenario, traders still need to account for the margin interest expense.

- Potential for substantial gain.

- Low Need for Start-Up Funding

- Possibility of using leveraged investment

- Spread your investments’ risk.

- Negatives Losses might be indefinite.

- required Margin Account

- Interest accrued on the margin.

Contorted into short, tight positions

- If a large number of other traders are shorting the company, or if trading volume is low, a short seller may need help buying enough shares to settle their position. On the contrary, sellers may get trapped in a short squeeze cycle if the market or a specific stock begins to surge.

- However, strategies with a high degree of danger may also result in a substantial payoff if successful. There is no glaring exception when it comes to short selling. Sellers who utilize margin to enter a trade and accurately anticipate price movements stand to earn substantial returns on their capital. Since the trader could initially put up less of their own money, thanks to the leverage provided by using margin, they made a more significant profit. Short selling may be a low-cost hedging strategy that balances out other holdings in a portfolio.

- Until they have gained more trading expertise, novice investors should wait to try short selling. Compared to naked short selling, shorting using ETFs carries a more negligible risk of a short squeeze and is, therefore, a more secure approach.

Additional Considerations with Short Selling

There are other hazards associated with short selling that investors should be aware of, in addition to the risk of losing money on a deal due to a stock price rise.

Shorting Uses Borrowed Money

- Margin trading is another name for shorting. You must create a margin account to borrow money from your brokerage business, using your investment as collateral for short selling. Margin trading is similar to going long on leverage in that it’s possible for losses to snowball if you don’t have at least 25% of your account in the money at all times. A “margin call” will require you to replenish your account with more funds or sell your stake if it drops below this level.

Wrong Timing

It may take some time for a company’s stock price to fall, even if it is overpriced. Your situation is precarious because of interest, margin calls, and being called away.

Short Squeeze

An additional risk factor for a short squeeze is a stock’s short float and days-to-cover ratio (both of which will be discussed further down). Short sellers “squeeze out” their losses by “buying back” their short positions when a stock they are short begins to rise in price. A virtuous cycle of purchasing may result. The increased demand for the stock encourages purchasers to bid up the price, prompting more short sellers to cover their bets.

Regulatory Risks

To prevent panic and undue selling pressure, regulators may sometimes prohibit short sales throughout the whole market or within a specialized industry. Short sellers risk massive losses if stock prices suddenly jump due to such manipulation.

Going Against the Trend

Stocks, on average, exhibit an upward trend over the long term, as seen by historical data. The vast majority of equities see price appreciation over the long term. Indeed, even if a firm shows only modest improvement over time, inflation or the pace of price growth in the economy should push its stock price significantly. That’s because when you short, you’re essentially betting against the market’s general trend.

Costs of Short Selling

Compared to buying and owning stocks or investments, short selling comes with hefty charges on top of the standard trading commissions paid to brokers. The following are only some of the expenses that may arise:

Margin Interest

When buying stocks on margin, the interest on the borrowed money may add up quickly. Likewise, interest payments on short trades may accumulate quickly, mainly if short positions are held for an extended period since they can only be paid via margin accounts.

Stock Borrowing Costs

- The “hard-to-borrow” fees on shares that are difficult to borrow due to heavy short interest, restricted float, or any other reason may add up to a significant sum. The cost is calculated as a fraction of a percent of the short trade’s value every year, with the total amount due dependent on the number of days the trade is openly multiplied by 365.

- It may be difficult to predict the precise cost of the charge since the hard-to-borrow rate may change dramatically from day to day and even over the course of a single trading day. The broker-dealer often charges the fee to the client’s account at the end of the month or at the conclusion of the short transaction, which may significantly reduce the profits from or increase the losses from the trade.

Dividends and Other Payments

In the event of a dividend payment on the borrowed shares, the short seller must remit the payment to the lender. In addition, the short seller is also liable for payments in the case of share splits, spinoffs, or bonus share issuance, all of which may occur at any time and have no effect on the value of the short stock.

Short Selling Metrics

Short-selling activity on a stock may be monitored using two metrics:

- The short interest ratio (SIR), also known as the “short float,” measures the current number of shorted shares relative to the total number of outstanding shares in the market. As a result, stocks are declining or looking to be overpriced with a higher SIR.

- Total shares shorted divided by the average daily trading volume of the company yields the short interest to volume ratio, commonly known as the days-to-cover ratio. The days-to-cover ratio indicates stock weakness when it has a high number.

- Traders may learn more about a company’s general bullish or bearish sentiment by looking at either measure related to short selling.

- For instance, General Electric Co.’s (GE) energy businesses started to weigh on the company’s performance once oil prices began to fall in 2014. Late in 2015, short sellers started predicting a decrease in the stock price, and the short interest ratio rose from under 1% to over 3.5%. The share price of GE continued to increase throughout 2016, reaching a high of $33 before commencing a gradual decline. At its February 2019 low of $10 per share, GE had made short sellers who had bought at the stock’s July 2016 peak a nice $23 profit.

Ideal Conditions for Short Selling

- When short selling, timing is everything. Typically, stock prices fall at a considerably quicker rate than they rise, so a significant gain in a stock may be erased in a matter of days or weeks if the company reports disappointing profits or faces some other kind of negative news. Therefore, the short seller has to have almost flawless timing for the short transaction. If you wait too long to enter the trade, you risk missing out on a lot of potential profit since the stock’s price drop may have already happened.

- However, if the stock price suddenly rises, the fees and losses of maintaining a short position might become prohibitive if you begin the trade too early.

- Success in shorting may be more likely under certain conditions, such as when:

During a Bear Market

In a bear market, investors generally expect a further decline in the value of their holdings across the board. Thus, “the trend is your friend,” and traders have a higher chance of earning money on short-sell transactions during a prolonged bear market than during a prolonged bull market. As shown during the global bear market of 2008–2009, short sellers like conditions in which the market declines rapidly, broadly, and deeply.

When Stock or Market Fundamentals Are Deteriorating

- Slowing revenue or profit growth, increased difficulties for the company, rising input prices that are putting pressure on margins, and so on are all factors that might weaken a stock’s fundamentals. In addition, weaker data pointing to a likely economic slowdown, adverse geopolitical events like danger of conflict, and bearish technical signs like achieving new highs on declining volume and poor market breadth constitute worsening fundamentals for the broader market.

- For this reason, seasoned short sellers may wait for negative trend confirmation before initiating short transactions in anticipation of a downward move. This is because, as is often the case in the late phases of a bull market, there is a chance that a company or market can trend upward for weeks or months despite worsening fundamentals.

Technical Indicators Confirm the Bearish Trend

- When many technical indications point to a negative trend, it may be an excellent time to make a short sale. Breaking below a significant long-term support level or a bearish moving average crossing, such as the death cross, are examples of such indications. When the 50-day moving average of a stock drops below its 200-day moving average, this is an example of a bearish moving average crossover. A moving average is a stock’s average price over a specific period. A change in price trend may be indicated if the current price moves significantly above or below the moving average.

Valuations Reach Elevated Levels Amid Rampant Optimism

- When expectations for a particular industry’s future are very high, or for the economy, the market’s valuation of that industry or the economy may rise to unsustainable heights. Investors will inevitably be dissatisfied when their unrealistically high expectations are not met. Hence this phase of the investment cycle is known as “priced for perfection” by market experts. Professional short sellers sometimes wait for the market or sector to roll over and start their negative phase before jumping in.

- British economist John Maynard Keynes profoundly impacted the field, and his ideas are still widely used today. Short sellers might take comfort in a phrase attributed to Keynes: “The market can remain crazy longer than you can stay solvent.” When all of the above come together, it’s the perfect opportunity to make a quick buck in the short-sale market.

Short Selling’s Reputation

- Short sellers are often seen as heartless businesspeople whose only goal is to ruin firms, which leads to criticism of the practice. But the truth is that short selling gives liquidity to markets (enough sellers and buyers) and may assist in keeping poor companies from benefiting from over-optimism. Asset price bubbles, which cause market disruptions, are examples of this advantage in action. Unfortunately, it is sometimes difficult or impossible to short assets that contribute to bubbles, like the mortgage-backed securities (MBS) market before the 2008 financial crisis.

- Insight into the market’s emotion and demand for a stock may be gleaned from short sellers, who are not always manipulators. However, investors might be blindsided by unexpected events or a fundamental deterioration if they don’t have this knowledge.

- Misconduct by unethical speculators is to blame for short selling’s negative reputation. These shady actors have artificially depressed prices via short-selling and derivatives and then conducted bear raids on weak equities. Though prohibited in the United States, such market manipulation occasionally occurs.

- In contrast to short selling, which requires using margin or leverage to profit from a falling stock price, put options may be purchased without such resources being required. If you’re just getting started in the world of options trading, Investopedia’s Options for Beginners course is an excellent place to start learning the ropes. There are simple techniques to raise return consistency and improve the likelihood of investing success in its five hours of on-demand video, exercises, and interactive material.

Real-World Example of Short Selling

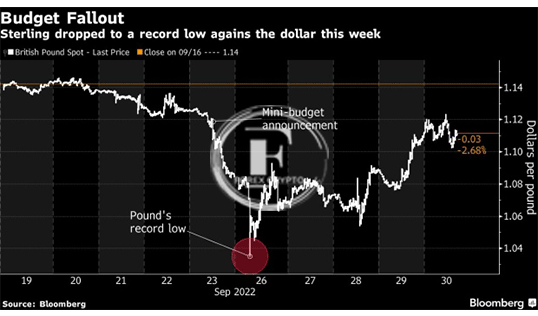

- An unexpected incident in the news might cause a short squeeze, which can cause short sellers to purchase at any price to meet their margin calls. In October 2008, for instance, Volkswagen became the world’s most valuable publicly listed business amid a historic short squeeze.

- In 2008, VW shareholders were aware that Porsche was attempting to increase its stake in the company to obtain control of it eventually. As a result, short sellers massively sold the shares because they anticipated their value would drop after Porsche gained control of the firm. However, Porsche suddenly disclosed that it had bought more than 70% of the firm through derivatives, which caused a significant feedback loop of short sellers purchasing shares to close their positions.

- There were fewer shares available on the market (float) for short sellers to purchase back since the government held 20% of Volkswagen and wasn’t interested in selling, and Porsche controlled 70%. As a result, the stock price jumped from the mid €200s to over €1,000 overnight, primarily due to short interest and the days-to-cover ratio increase.

- Short squeezes are notoriously short-lived, and Volkswagen’s stock had returned to its pre-short-squeeze levels within a few months.

Why is it called “selling short”?

One might “go short” by betting that prices will fall and, in this way, make money. Selling short is a kind of betting. This is in contrast to taking a long position when one buys an asset with the expectation that its value will increase over time.

Why do short sellers have to borrow shares?

Nothing can be sold if it doesn’t exist. Since there are only so many shares in circulation, a short seller needs to get their hands on them before they can be sold. So, the short seller borrows the stock from the long seller and pays interest to the lender for using the short seller’s borrowed shares. One’s broker typically acts as a silent facilitator in such a transaction. Interest expenses to sell short will be greater if only a few shares are available for shorting (i.e., easy to borrow).

Is short selling bad?

Even though betting against the market is seen as immoral by some, short sellers are generally seen as beneficial since they increase market efficiency by increasing both liquidity and price discovery.

Can I sell short in my brokerage account?

It’s possible to short-sell stocks using a margin account at several brokers.

What is a short squeeze?

Due to the leveraged nature of short sales, even minor losses may quickly escalate into substantial margin calls. In the event of a margin call, a short seller is forced to repurchase their stock at ever-increasing prices. The result is a further increase in the bid price of the stock.

The Bottom Line

Investors and traders may profit from a falling market by engaging in short selling. Those with a pessimistic outlook might sell shares they have borrowed on margin and hope to repurchase them at a reduced price.

Short selling has been called a “bet against the market,” but many economists disagree, saying that it increases market efficiency and may even operate as a stabilizing influence. Traders and analysts that rely on technical analysis typically use ratios related to short positions, such as short interest, to help them decide whether to buy or sell a company. But margin calls might put a damper on holding many short positions. Moreover, the purchases necessary to settle short positions have the potential to drive prices higher and speed up a rally, worsening the plight of short sellers.

Comments (No)