What is swing trading?

- Many different trading styles are available to assist traders in maximizing their profits in different market environments. The swing trading method is one example.

- A position may be open for many days or weeks for swing trading. Swing traders operate with a medium-term time horizon, seeking to benefit from the ebb and flow of market prices. Since it is crucial to know which way the market will go next and whether it would be lucrative to start the position now and terminate it later, technical analysis is essential for this sort of trading.

Example of a stock swing trade

Swing traders often examine price charts in real time for indications of impending price reversals. This graph demonstrates how the Fibonacci retracement may be used in swing trading. The lines were constructed using standard Fibonacci proportions, as seen here, and a purchase order was placed at the 38.2% line before the transaction was entered. In addition, the trader has placed a Stop Loss slightly below the beginning line to protect against further losses if the uptrend does not continue as expected and the deal is closed above the prior high. Here we have a classic case of a swing transaction.

Swing trading vs. day trading

- Swing trading isn’t truly a long-term trading style, even though positions are maintained open for many days or weeks. This fact has led many to draw parallels between this and other forms of short-term trading, such as day trading.

- When you day trade, you make trades and close them within a day. Some deals only last a few minutes. Day traders often make daily transactions, studying market fluctuations in real time. They aren’t looking to make a killing on every deal. Instead, they try to make a large number of tiny lucrative deals every day. Day traders are often professional investors who devote their whole day to trading and market research.

- Contrarily, swing trading works differently. Swing traders do their research into the market, but they use price chart patterns to capitalize on changing market conditions. When trading, they use fundamental and technical analysis to find investments with the highest potential returns in the shortest feasible time frame. Swing traders take on more danger than day traders, but their rewards are far more significant. In addition, it is ideal for traders who have day jobs and can only devote a limited amount of time to the market.

Five strategies for swing trading stocks

- To optimize their profits, swing traders might utilize various strategies. In addition, swing traders may use various methods to find promising new positions to enter. Here, we’ll look at five of the most well-known swing trading tactics and explain how they may help you make more money in the market.

- Retracement according to the Fibonacci sequence

- Fibonacci retracement is used in this trading approach. This tool is useful for swing traders since it may be used to pinpoint potential price reversal zones. It is healthy knowledge that trends do not consist of a continuous ascent or descent; rather, prices often retrace before resuming the primary trend. Fibonacci retracement lines drawn at the 23.6%, 38.2%, 50%, and 61.8% levels may identify possible turning points in an upward or downward trend. A trader’s strategy may be built around these lines acting as support and resistance.

- Signals triggered by support and resistance

- Numerous indicators may be found in price charts. Lines of support and resistance are one such indicator. The lines indicate the timeframes during which price trends often reverse. For example, once buyers have taken control of the market and the price begins to rise after a downtrend, the market price will have found support at the line on the chart that is the lowest point of the range. Conversely, a resistance line indicates a price level over which buyers often cannot sustain an uptrend, and sellers get the upper hand.

- Swing traders may use these lines to help them develop a winning trading strategy. Their initial tactic should be to purchase on the retracement to the support line and then set their Stop Loss immediately below the line. The second tactic is to set a Stop right above the resistance line and sell when the price rebounds below that level. In all circumstances, remember that the support line becomes the resistance line if the price breaks through it (and vice versa).

- Buying and Selling Through Channels

- Traders should also pay close attention to trend channels while examining charts. Price activity may be confined inside a trend channel, which consists of a series of parallel trend lines, by staying within its upper and lower bounds. When a price moves to the channel’s edge, it will spin until it reaches the other side.

- Channel trading may help swing traders determine the optimal entry point for a trade. You are noticing that buying at the support line (i.e., lower line) of an uptrend channel and selling at the resistance line (i.e., higher line) of a downtrend channel increases the likelihood of initiating a profitable transaction. As a swing trader, you should always look to trade with the trend and avoid missing your opportunity to exit.

10- and 20-day SMA

- This method, which relies on comparing two or more simple moving averages, is often used by swing traders (SMAs). Simple moving averages provide an average price over a specified time frame. Since prices and SMAs fluctuate daily, the line connecting the two may be used to analyze price trends.

- When determining their next move, swing traders often use the same chart’s 10-day and 20-day simple moving averages. The correct method involves locating the intersection of two SMAs. When the 10-day SMA rises over the 20-day SMA, it signals an upward trend and a purchase opportunity. However, it suggests a downtrend and a sell signal to traders when it drops below the 20-day simple moving average.

MACD crossover

- This trading method is often regarded as one of the simplest and most accurate methods of determining when a price trend will change direction. The MACD indicator, “Moving Average Convergence Divergence,” determines and displays the relationship between two price moving averages (MA). One of them responds more rapidly to fluctuations in the market price than the other.

- The MACD line and the signal line are analyzed in the MACD crossover trading method. A new trend is indicated whenever the MACD line is crossed. A purchase signal is generated if the MACD line is above the signal line. If it drops below, though, that’s an indication to start selling.

- As you can see, these methods help determine whether a new trend is beginning and if a bullish or bearish stance is warranted.

Top tips for Forex swing trading

After familiarising yourself with the many swing trading tactics, the following advice is constructive.

Consider the long-term as well as the short-term patterns. Swing trading is neither a long-term nor a short-term approach to the markets. If you know where the trend is heading, you may avoid trading counter to it by timing your exit accordingly.

Keep in mind that exchanges are an option. A swap, or interest, is charged for holding a position overnight. It would help if you thought about swaps before you start swing trading so that the additional costs don’t catch you off guard.

Keep up with the latest headlines. The global political and economic climate, as well as business shifts, have a significant impact on stock and currency markets. As a result, you can better anticipate price swings and plan your next move if you have a firm grasp of the factors that affect the value of the assets you are trading.

You may want to use leverage. You can open more trades with little leverage than you could with only your initial investment. A positive outcome is guaranteed whenever one’s trading success rate increases.

Invest in a few different stocks. Since swing trading is more precarious than other forms of short-term investing, betting everything on a single stock might backfire. As much as feasible, spread your investment dollars around across many stocks.

How to swing trade stocks

- Now that you’re familiar with the best swing trading tactics, you may wonder what comes next.

- First, you’ll need a trading account to get started. Then, you may start a practice account to learn how to trade on swings without financial commitment.

- Learning about the present market is the next stage. Whether you combine this with technical analysis, you can determine if a trend reversal is imminent and better prepare for it.

- Once you have gathered sufficient data, selecting stocks to purchase is the next step. The danger of loss may be reduced by spreading your investment capital among many equities. Using a Stop Loss, you may reduce your exposure to loss by automatically closing your transactions whenever you reach your predetermined profit or loss threshold.

- Now that you’ve made your purchase decision, can you kick back and relax? Of course, not! The next and most crucial step is to keep track of where you now stand. You may have already done your homework, but you still need to watch the market to ensure the trend doesn’t reverse and cost you money. This also helps you choose when to cut your losses and lock in the most profit.

- You may exit your trades and collect your earnings from this swing trading session when you have achieved your desired outcomes.

Finding stocks to swing trade

It’s simple to say, “Buy the right stocks,” but more complicated to really figure out which businesses are most suited for swing trading. So here are some key factors to remember while browsing stock options.

Both volatility and liquidity are high. Swing traders, as we know, capitalize on market fluctuations and trend reversals. High-volatility equities are the most beneficial for traders because of their frequent price fluctuations.

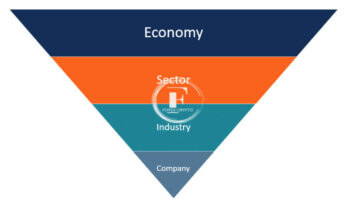

Bull or bear? You need to decide if you want to invest in the stock market during a bear or bull market before you buy any shares. Selecting a market may help you focus on the stocks most suited for your investment strategy, given the current market climate.

Formations on a graph. Technical analysis and pattern recognition scanners help predict which stocks will see price fluctuations. You may anticipate these movements and form a trading strategy based on the information provided by charts and technical analysis tools.

Performance. A large number of stocks may meet the requirements above, but it would only be possible to invest in some of them. Therefore, it is prudent to choose just the companies that have done well relative to others in their respective industries.

Summary

Our discussion today centered on the most common swing trading methods and how they might aid you, the trader, in making informed decisions. Swing trading might be a helpful strategy if you need more time to devote to the market continuously. Learn the ins and outs of technical analysis and pattern recognition scanners so you can identify the best stocks for swing trading and formulate a plan to profit from them.

Comments (No)