- In harmonic charting; the Three Drives Pattern is a common sight. It is a close cousin of the familiar ABCD pattern for reasons that will become clear in a moment.

- In his best-selling book “Elliott Wave Principle,” Robert Prechter discussed this pattern.

- In this piece, I’ll teach you how to recognize it and explain the trading process. This essay will teach you everything you need to know about this design.

- Still, there’s more…

- I will also demonstrate how to do a backtest of the pattern to see whether or not it is something you should actively follow in your trade.

- Now we begin…

How to Identify the Three-Drive

- A reversal may happen if the price makes three consecutive new highs or new lows.

- If a lot of pressure has been building up, the change of direction can be a substantial movement. Of course, this doesn’t hold 100% of the time, but when it does work, this is the result.

- Do the relocations have specific time and distance parameters? Various literature has debated this; some say yes, and some say no. That’s why I’m going with the most straightforward answer, which is accepted by all Three Drives investors.

- How does it function?

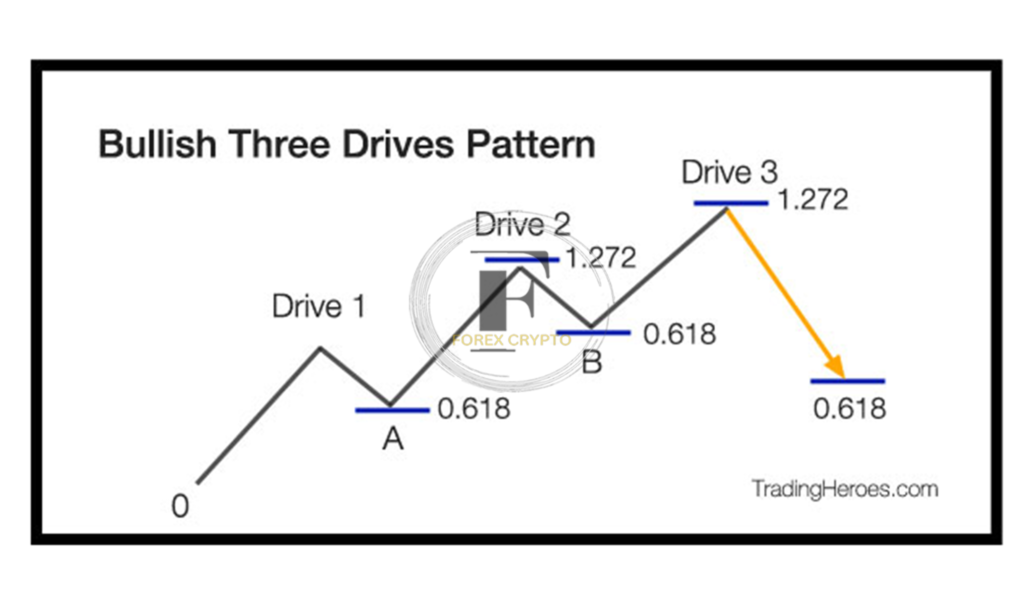

bullish three drives

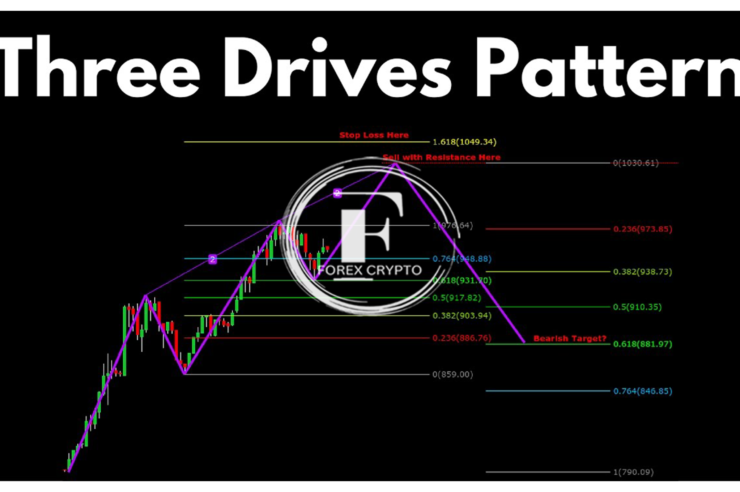

- There are three upward impulses or “pushes” in the bullish variation of this pattern. Each advance is followed by a retreat, denoted by the letters A and B. This pullback is a 0.618 Fibonacci retracement of the last advance.

- For the next leg of price action to qualify for the pattern, it must terminate close to the 1.272 Fibonacci extension. The ideal time to place a sell order is when the price is nearing the drive 3 points at the 1.272 extensions.

- Aim for the 0.618 retracements of the whole rise from zero to Drive Three’s summit.

- At least, that’s how it’s described in the books. So that’s why that’s the optimal spot to begin your exams.

- Here’s a real-world example to help illustrate the concept.

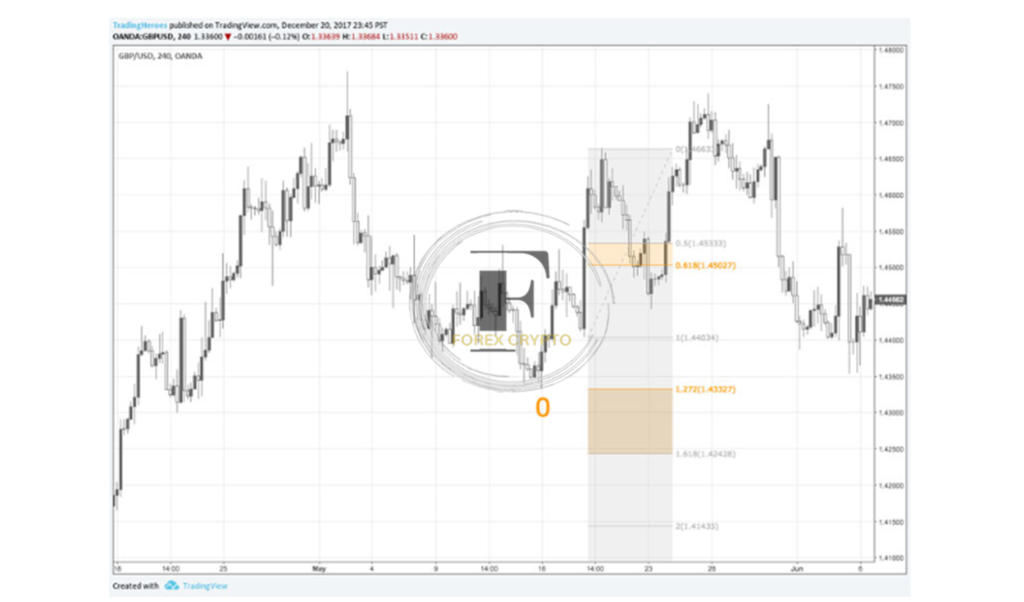

- This is the 4-hour chart for GBP/USD on TradingView and Oanda for May 16, 2016. This is for the benefit of individuals who want to follow along with the audio version while at home.

- I am marking zero on the graph, which yields the following representation:

The first retracement is nearly exactly at the 0.618 Fibonacci level.

Fibonacci analysis reveals that the retracement exceeded the 1.272 extensions of the initial decline. As a result, if you were to adhere strictly to the Three Drives Pattern, you would no longer consider this a good signal.

However, let’s keep going for the sake of argument.

In the same way, the 0.618 level was also overcome by the subsequent retracement.

The subsequent increase coincides with the 1.272 Fibonacci extension.

The 0.618 Fibonacci retracement of the whole move then becomes our profit goal. This target is easy to strike in this scenario.

This was not a textbook design, but it would have finally worked out. That brings up the question:

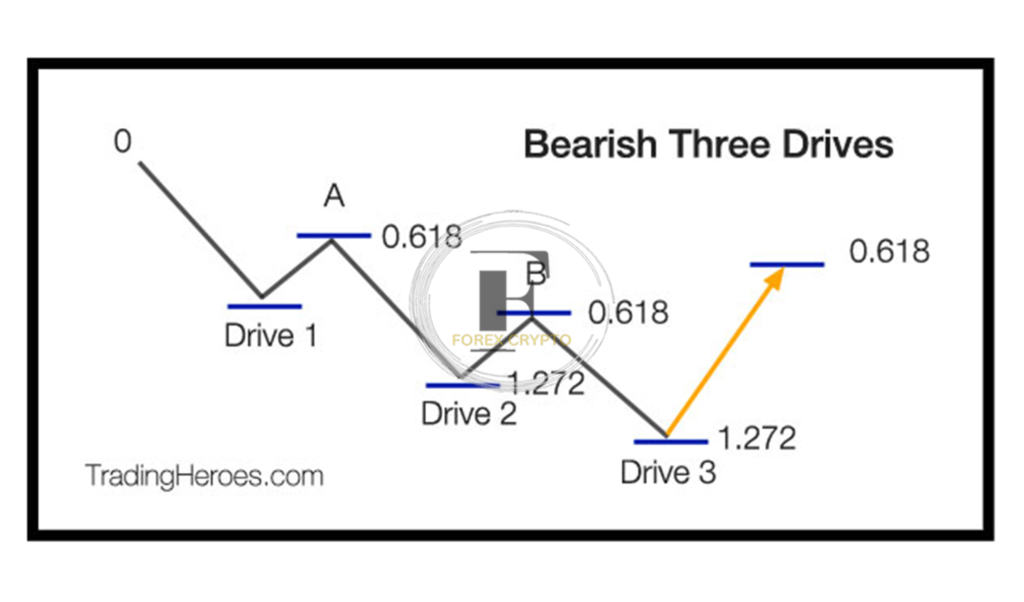

Bearish Three Drives

On the other hand, the bearish pattern is bullishly inverted.

How to Trade This Harmonic Forex Pattern

- Each trader will implement this pattern somewhat differently, as with every trading technique. However, the most widely disseminated strategy for trading this scenario is examined below.

- This is a solid foundation to work from if you want to undertake your own testing and optimization.

- You may enter a trade in one of three main ways:

- Place a stop loss order above the current price and a pending order at the previous 1.272 level.

- Hold out on entering a trade until the market prints a strong rejection bar, such as a pin bar or outside bar, and then place your stop loss order opposite the bar’s low or high.

- If the market declines below the 1.272 level, place a pending order with a stop loss above or below the prior swing high or low.

- Most publications recommend entering a trade at level 2 after waiting for the level to be rejected. So let’s adopt that strategy for the time being.

Potential Optimizations

Searching for divergence of any kind during testing may help you improve your entry. There are times when the Relative Strength Index is helpful.

It is clear from the example that drives 2 and 3 both produce more extraordinary highs on the chart, but that drive 3 produces a lower high on the relative strength index.

Another possible improvement is checking whether the top of drive 3 coincides with a previously significant support or resistance point. Indeed, a turning point coincides with a degree of resistance in the same scenario.

How to Backtest the Three Drives Pattern

Let’s get down to business, shall we?

After reading about it, most investors immediately put into practice what they’ve learned about a trading technique.

So, surprise, they end up broke and complaining that it doesn’t work. Between the time you learn a trading approach and the time you start trading real money, a lot may go wrong.

Here is a quick rundown:

- You misunderstood the guidelines.

- You are trading with too much of a margin of error and becoming nervous about every little price change.

- It turns out that the trading strategy could be more helpful and that nothing you read online is real.

- When you finally figure out how to trade it, remember the rules since you never bothered to write them down. You then decide you know more than anybody else and constantly alter those regulations.

- You have doubts, which cause you to pass up profitable transactions.

- The list goes on

- All people are susceptible to these kinds of errors. We, too, fall into that category. It would help if you didn’t put your hard-earned cash on the line to test your abilities.

- The first step is to document the system’s rules you want to verify.

- The backtesting plan worksheet is available for free download on this page.

- If you do this, you may be sure you will stay within your intended course of action.

- The next step is to do a backtest to ensure your system has a positive expectation. Then, start a Forex Tester to see how well your strategy works. If the strategy fails to perform well in historical trading simulations, it isn’t very likely to succeed in real-world trading.

- Backtesting is the first step towards taking your trading system live. Do not risk any real cash right now.

- Trading with real money should only be attempted if you have shown yourself competent on a demo account.

- Join the TraderEvo program to find out more about these and other processes.

Other Resources

Additional reading material about this chart pattern is provided below. In addition, observing how other traders approach a chart pattern might help you formulate a better action plan.

You do not have to follow them precisely, and you will likely discard many ideas. To contrast, all it takes is one brilliant idea to double your productivity overnight.

Charts tagged with the “Three Drives” category on Trading View, contributed by members of the TradingView community.

Videos relating to this chart pattern may be found in the following YouTube search results.

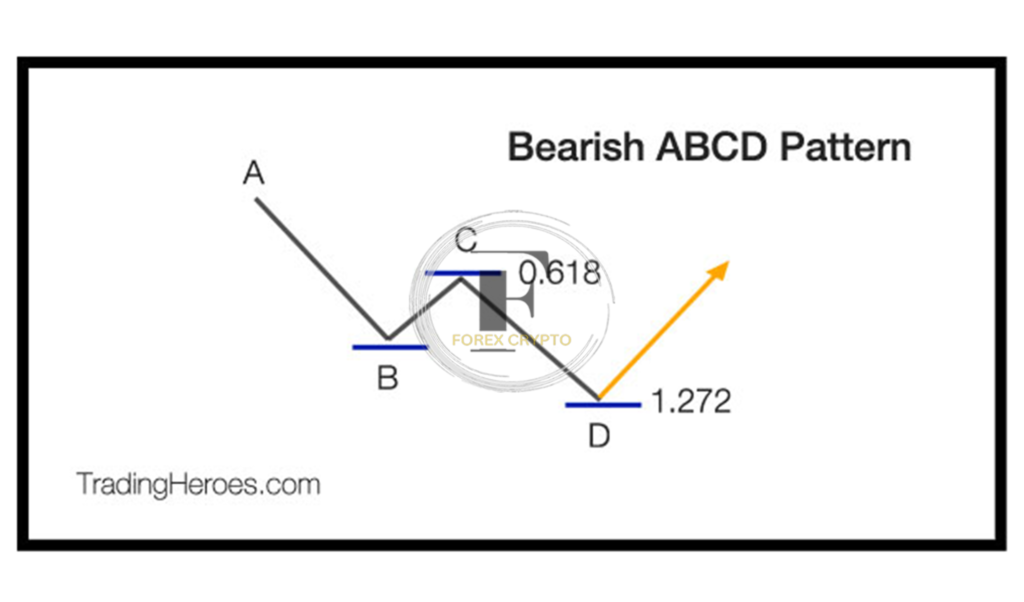

A Close Cousin: The ABCD Pattern

Many people will refer to the ABCD pattern while discussing the three drives. Therefore, we may also name this the “Two Drives” pattern.

There is a higher probability that the price would reverse after three movements than after two, so if I had to pick, I’d begin trying the Three Drives first. But, unfortunately, the distance Price must go just increases, making him increasingly “weary.”

Conclusion

Hence, you now know how to recognize the Three Drives technical chart pattern. However, keep in mind that when you see other traders using this pattern, it does not guarantee success.

It would help if you did your backtests to see whether the strategy suits your trading style.

Comments (No)