What may be found on this page?

- TALKING POINTS

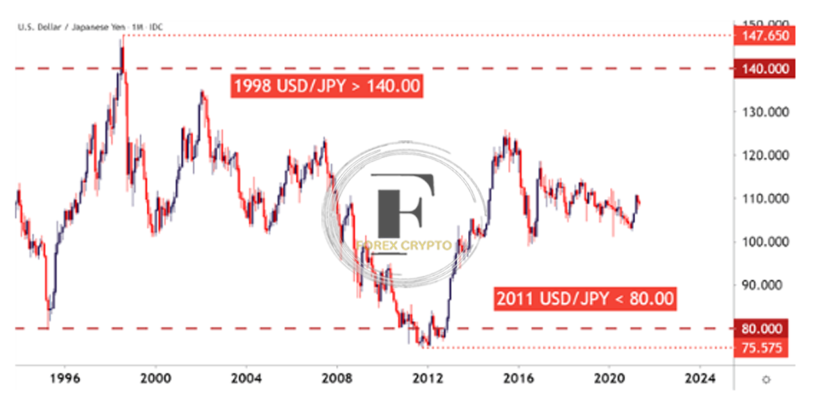

- MONTHLY CHART OF THE USD/JPY FOR 1977–2004

- THE ROLE OF THE JAPANESE YEN IN SETTING THE SCENE

- A HYPOTHETICAL EXAMPLE OF EXCHANGE RATES IN ACTION TAKEN FROM REAL-WORLD CIRCUMSTANCES

- THE EXCHANGE RATE FOR THE US DOLLAR TO THE JAPANESE YEN DROPPED BELOW 80 ONLY 13 YEARS LATER.

- THE RESPONSE

TALKING POINTS:

- Trade and Flows of Capital Make Up the Core of the Foreign Exchange Market.

- This article explains why changes in trade and capital movements, which are determined by currency spot prices, may significantly influence an economy and a business that operates inside that economy.

- In the next section, we will examine a hypothetical example utilizing accurate prices and genuine circumstances that have affected the economy of Japan.

It is customary to see changes in interest rates as the primary force behind the foreign exchange market, After all, an incentive may push capital flows into a particular currency if an investor can make interest payments daily just for being long or short in a pair of currencies, And suppose it’s a rising rate situation when an economy regularly raises interest rates to keep inflation in check, In that case, this may lead to a protracted trend in which market players bid that currency higher to capture that new, higher rate of return, This trend can last as long as the economy continually raises interest rates to keep inflation in check.

However, unlike stocks, currencies are not a separate asset class; instead, there are consequences associated with currency trading. Similarly, too much of a good thing may turn out to be a very terrible thing, as was seen by the country of Japan and how the so-called “Japanese Economic Miracle” of the post-World War II period in Japan turned into the “lost decades” for the Japanese economy.

A high Japanese yen, assisted by the Plaza Accord in 1985, brought about some significant economic loss as the economy was bogged by three decades of sluggish development and, in some instances, deflation. Although the Japanese economy enjoyed significant growth for 45 years, this economic erosion was brought about by a strong Japanese yen. In the next section, we will examine an example of how this might occur using a highly logical expenditure.

MONTHLY CHART OF THE USD/JPY FOR 1977–2004

James Stanley was the one who developed it.

THE ROLE OF THE JAPANESE YEN IN SETTING THE SCENE

To recount this narrative in its entirety, we need to first go through a little history lesson about the USD/JPY currency pair, and the core of this story can be traced back to the 1970s and the phenomenon of stagflation.

High interestIn the United States, to overcome stagflation, Paul Volcker had to increase interest rates to exceptionally high levels to stem the rapid inflation that was evident then. This was done to prevent stagflation from occurring. Because of the carry trade and the rate differential between the two pairs in the quotation, there was a considerable increase in demand for the US dollar due to these exceptionally high-interest rates.

The USD/JPY exchange rate increased by more than 56% from its low point in 1978 to its peak in 1982, After Volcker’s policies started to have an effect in the United States, the pair began to decline, nevertheless, from March 1984 until February 1985, bulls were in charge, which led to the USD/JPY pair reaching a high of 262.80 in 1985, And this was around the same time the Plaza Accord went into force, The Plaza Accord was an agreement amongst the G5 nations to manipulate exchange rates to cause the value of the US Dollar to decrease.

And at that point, the Yen’s strength started to emerge more noticeably.

In the following illustration, we will examine a hypothetical model that uses prices from 1998 through 2008, which is a period during which the USD/JPY exchange rate had a significant depreciation. The country of Japan has been dealing with this problem long before the year 1998.

A HYPOTHETICAL EXAMPLE OF EXCHANGE RATES IN ACTION TAKEN FROM REAL-WORLD CIRCUMSTANCES

Let’s assume a Japanese automaker came up with the concept for an automobile in 1998 and estimated that it would set them back around 2,800,000 ($20,000) to manufacture the vehicle. However, this would be fine since they planned to sell the vehicle for $30,000, which would enable them to make a respectable profit of $10,000 on each purchased vehicle.

In 1995, the conversion rate for USD to JPY was around 140.00, So, let’s take a look at the whole cost of buying and selling one of these automobiles, which is broken down below:

Remember that the price of one dollar in 1998 was around 140.00 yen, meaning the cost to manufacture the vehicle was 2,800,000? But that’s fine since they asked $30,000 for it, equivalent to 4,200,000. The automobile manufacturer could walk away with a healthy profit of 1,400,000, equivalent to $10,000.

Our automobile company would be content with a profit margin of fifty percent on each vehicle sold if things were to go on as they are now for the rest of time.

But things only remained in that state for a short time. Since 1998, a great deal of change has taken place throughout the planet.

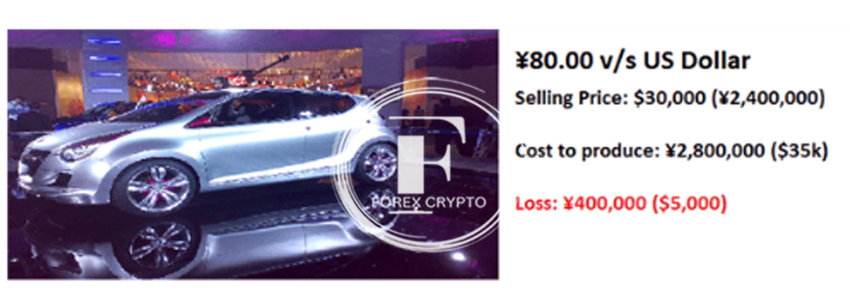

THE EXCHANGE RATE FOR THE US DOLLAR TO THE JAPANESE YEN DROPPED BELOW 80 ONLY 13 YEARS LATER.

James Stanley was the one who developed it.

Let’s look at how well our automobile firm would do in such an atmosphere.

Because the company pays employees in Japan and purchases items in Japan, the cost to construct the vehicle remains at 2,800,000 yen, Additionally, the company is paying excellent salaries to keep up with inflation, nonetheless, for our simplified scenario, we will assume that the labor cost remains the same, Therefore, the fluctuation in the exchange rate does not necessarily affect the organization’s overall cost structure.

However, it significantly affects the amount of money they make from sales. Recall that the asking price in the United States was thirty thousand dollars. However, they will only get a return of 2,400,000 ($30,000 multiplied by $80.00 equals 2,400,000).

They aren’t even making enough money to meet their expenses anymore! A profit margin of fifty percent has suddenly vanished into thin air, and the only reason for this is that the value has increased.

At this point, our automobile manufacturing is suffering a loss of 400,000 yen for every vehicle sold, In your opinion, for how much longer do you believe this will continue? If they are losing money rapidly, it is unlikely that many firms will be able to continue operating successfully.

So, what action will be taken by our automobile manufacturer? They will eventually answer, and their choices could be more desirable, They can increase prices in the US, but, as a result, they will sell fewer automobiles, Customers will observe that our Japanese auto manufacturer has increased the price more than German, American, or Chinese auto manufacturers, thus, this isn’t a choice that is widely accessible to choose from.

The majority of the time, their response will consist of reducing expenses, This entails terminating specific people’s employment or, at the absolute least, recruiting a smaller total workforce, They will start concentrating on the “efficiency” of the company, They will look for any opportunities to save money to ensure that they can, at the very least, meet their expenses.

Our automobile company has recently implemented several cost-cutting measures, each of which is likely to have a detrimental impact on the economy as a whole: Our auto manufacturer didn’t necessarily do anything wrong, but they were caught off guard by a much stronger currency, which led to fewer people being hired (leading to greater unemployment), more minor or non-existent rises in pay (leading to lower inflation), and a general feeling of worry about future economic certainty. This is especially concerning considering that our auto manufacturer didn’t do anything wrong.

This is precisely why Japan was locked in a recession that lasted for decades and had deflationary forces across its economy.

THE RESPONSE:

So, what kind of reaction does Japan have to this? They make efforts to devalue their currency because, if they are successful, they can make the reverse impact work to their advantage.

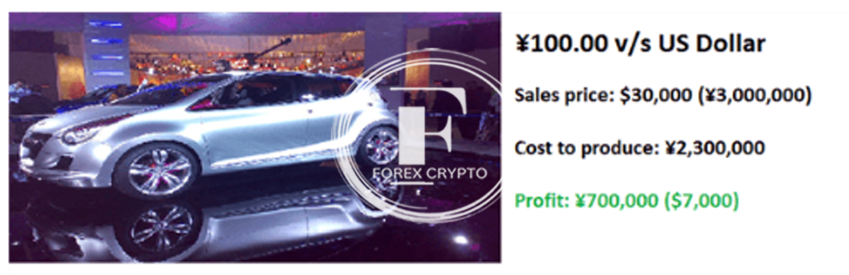

So, let’s assume our auto manufacturer has discovered a means to survive in this atmosphere of high yen prices, and they’ve managed to decrease expenses to 2,300,000 yen for each vehicle.

Because their profit potential is so low (only 100,000 yen per vehicle), there are better situations than this by any stretch of the imagination, However, they have figured out how to live.

However, when the Bank of Japan succeeds in depreciating the Yen, our automobile manufacturer will be in a position to gain a significant competitive advantage.

Let’s imagine the Bank of Japan does something similar to what it did at the end of 2012, and it reduces the value of the yen (which causes the USDJPY to rise higher) to 100.00.

However, despite the challenging economic climate, our auto manufacturer is still making the vehicle at the same price of 2,300,000 yen. However, given that USDJPY has reached the level of 100.00, they are now receiving 3,000,000 for each vehicle sold, which results in a profit of 700,000.

This has a significant impact since it allows the corporation to reinvest some of its profits in purchasing new equipment, The acquisition of this equipment will generate profits for Japanese manufacturers, who will then need to recruit more laborers to keep up with demand. Our automobile company may become more competitive with pricing given that they now have a profit margin with some cushion to decrease selling prices, and they can even attempt to outsell their German or American competitors by giving a lower price, This is because they now have a profit margin with a cushion to reduce selling prices.

Our auto manufacturer will eventually have to recruit more people, Since the demand for workers has grown (because equipment manufacturers and auto manufacturers are seeking to hire), salaries will have to go up to meet that need.

Even though the only thing that took place was a change in the exchange rate, this kicks off the synergistic influence of economic development inside an economy.

Reduced currencies may spur significant economic expansion for nations whose economies are heavily dependent on exports because of the positive impact reduced currency prices have on the competitiveness of their export markets.

Trade and capital movement are the two most important aspects of the foreign exchange market, and this is a factor that is frequently concealed in plain sight since a globalized economy has seen nations become so connected that it is impossible to conceive of one big economy sneezing without the other(s) contracting a cold.

Comments (No)