A standard harmonic structure seen on price charts is the ABCD, whose three distinct waves may be recognized. As part of their technical analysis, many traders in the financial markets look for this pattern in the hopes of profiting from price reversals.

However, traders must regularly practice and adequately comprehend this pattern’s conditions to reap its full benefits, as with any trading methods and formations. This article covered the ABCD pattern, its rules, and how to trade based on the ABCD pattern using real-world examples.

What is the ABCD pattern?

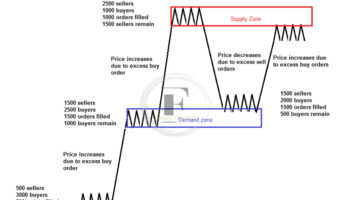

The ABCD pattern, often called AB=CD, is a harmonic structure consisting of three zigzag price swings in a row. Its configuration, like other harmonic patterns, relies on exact Fibonacci numbers, and any deviation from the essential ratios may render the whole arrangement incorrect.

Traders use the ABCD pattern to spot possible “reversal zones” where prices might reverse course. This cyclical pattern may be seen in bullish and bearish variations, effective in all markets and time scales.

The structure of the ABCD pattern dissected – Where can I get the instructions for this pattern?

The three legs of the ABCD pattern, together with the four major high and low points, give the structure the appearance of a lightning bolt. The exact details, or guidelines, for this design are as follows:

The first leg of the pattern, abbreviated “AB,” indicates that prices initially moved straight from point A to point B. The initial move of bearish ABCD sees the price increase from A to B, whereas the first move of bullish ABCD sees the price decrease from A to B.

The second swing in this pattern is the BC leg when the price moves back to point B and reverses direction. The retracement from point B to point C in a perfect ABCD formation should be between 61.8% and 78.6% of the AB line.

Leg CD: The CD leg is completed when the price continues to move in the same direction as the AB leg. The BC line is retraced by a Fibonacci ratio of 127.2% to 161.8% along the CD leg.

The pattern concludes at point D when buy and sell orders are placed against the CD trend.

AB and CD need to be longer than BC, and, more precisely, AB should be the same “length” and “duration” as a CD.

For the pattern to be considered bullish, point D must be below point B, while for the pattern to be considered bearish, point D must be above point B.

ABCD pattern trading

ABCD harmonic formation trading requires recognition of the pattern and subsequent drawing of the pattern on a price chart. Traders may now quickly construct the structure, i.e., three price swings, and see the accompanying Fibonacci ratios thanks to the ABCD indicator in many trading platforms. Point D is where orders should be placed to take advantage of the imminent price reversal once the pattern has been constructed with exact levels and all requirements have been met.

Bullish ABCD pattern Trading – Example

Once a downturn has run its course, the bullish ABCD pattern will form, signaling an upward price reversal. When prices drop from point A to B, the pattern formation starts. Finally, the pattern is finished with a retracement upward (the BC leg) and a subsequent decline to point D (below the B point level). “Buy” deals are often entered in the last D zone.

Trading an ABCD pattern in the positive direction is shown in the 1-hour chart of XAUUSD in the following example. We identified an ABCD pattern in a downward market and sketched the three price swings to verify that they followed the prescribed Fibonacci retracement levels.

The BC segment here represents a 61.4% retracement of the AB segment, while the CD segment represents a 127.9% retracement of the BC segment. If the setup is good, a “buy” trade entry may be made at point D, with a stop loss a few pips below the entry. The point C and A levels and the Fibonacci retracement levels may be used to establish take-profit targets.

Bearish ABCD pattern Trading– example

A negative trend reversal is imminent, as shown by the bearish ABCD pattern. From points A through B, prices rise, only to be retraced lower at point C, when the formation begins to take shape. At last, the price goes up from point C to point D, with D being more than B. There is a chance of a reversal at point D if the Fibonacci ratios in the setup are consistent with the pattern principles.

Below, we see an AB=CD pattern in the XAUUSD 30-minute chart, which might lead to a downward shift in price. Retracing AB by 61% yields the BC line, while retracing 127.9% yields the CD leg. For “sell” transactions, the entry point is at D, and the stop loss should be set a few pips above D. You can use the Fibonacci retracement tool to establish several take-profit goals at various percentages, or you can set TP1 at the point C level and TP2 at the point A level.

Is trading with the ABCD pattern right for you?

Despite ABCD pattern trading’s widespread praise for its high accuracy and substantial winning percentage, not all traders will feel comfortable adhering to its strict guidelines. However, if you put in the time to study and master this pattern, it may lead to some of the most lucrative long- and short-term reversal trading opportunities. The ABCD pattern may be used for any period, market, or price chart. If you want reliable and consistent returns when trading the ABCD pattern, it’s essential to practice sound risk management and stick to your trading plan.

Comments (No)