What is forex?

To put it simply, one may engage in currency trading because of the existence of a worldwide financial market.

If you believe that one currency will be stronger in comparison to the other and your prediction turns out to be accurate, then you may be able to earn a profit.

Once upon a time, before the outbreak of a pandemic that affected the whole world, individuals were able to board aircraft and travel to other countries.

If you have ever gone to a different nation, you are probably familiar with the process of having to locate a currency exchange counter at the airport before being able to convert the money in your wallet into the local currency of the country you are visiting.

As you approach the counter, you see a screen showing various conversion rates for the various currencies.

The relative cost of purchasing one country’s currency with another country’s currency is referred to as an exchange rate.

You discover “Japanese yen” and exclaim, “Wow! One dollar is worth one hundred yen?! And I have 10 bucks! “I’m going to be wealthy!”

You might consider yourself to have taken part in the foreign exchange market when you do this.

You have successfully converted one currency into another.

Or, to speak in terms of foreign exchange trading, you have converted some of your dollars into yen because you are in Japan as an American tourist.

You discover the exchange rates have changed when you go to the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is pricey!). You stop by the booth before your flight back home to exchange the yen.

On the foreign currency market, your ability to profit from shifts in the exchange rates is what makes these movements possible.

What is forex?

The foreign exchange market, more often referred to as “forex” or “FX,” is the most important and extensive financial market in the whole globe.

The foreign exchange market (FX market) is a worldwide Cmarket where the currencies of the world are traded. Since exchange rates are variable on a second-by-second basis, the market is in a state of perpetual upheaval.

The “real economy,” which includes foreign commerce and tourism like the airport example from earlier, accounts for just a minuscule fraction of the total number of currency transactions.

Instead, the majority of currency transactions that take place in the global foreign exchange market are purchased (and sold) for speculative reasons. This is true for both buyers and sellers.

Currency traders, who are also known as currency speculators, are those who acquire currencies with the expectation of later being able to sell those currencies at a better price.

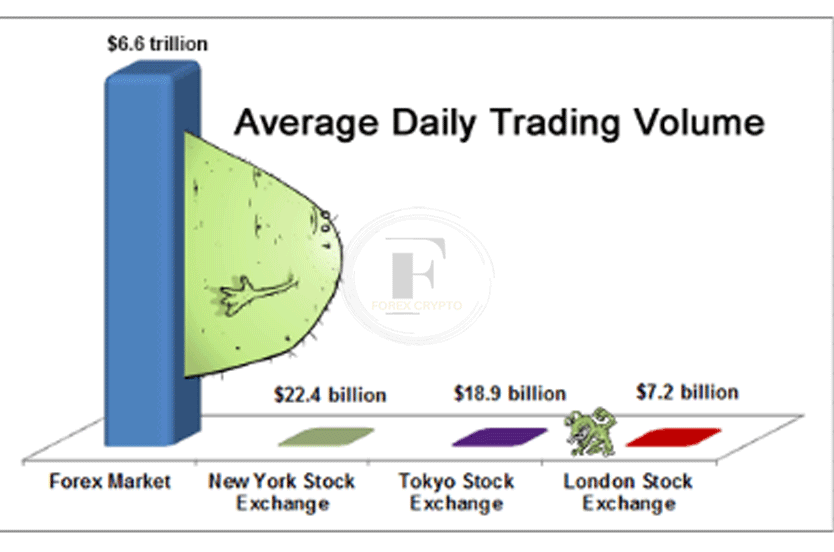

When compared to the “measly” $200 billion that is traded on the New York Stock Exchange (NYSE) each and every day, the foreign exchange market’s $6.6 TRILLION that is traded each and every day makes it seem to be an extremely enormous market.

That’s a “t” for trillion, by the way.

To help put everything into perspective, let’s take a minute to look at some creatures…

The New York Stock Exchange (NYSE), which is the biggest stock market in the world, conducts over $200 billion worth of trading every single day. This is what the New York Stock Exchange (NYSE) would look like if it were a monster…

Looks menacing. Looks like it works out. Some people may even find it sexually appealing.

You can’t go a day without hearing about the NYSE in the headlines… you may have heard about it on CNBC, Bloomberg, or the BBC; indeed, you may have even heard about it at your local gym. “The NYSE is higher today, etcetera, etcetera.”

Most of the time, when individuals refer to the “market,” they are referring to the stock market. The New York Stock Exchange is known for its booming volume as well as its penchant for making a great deal of racket.

On the other hand, if you were to compare it to the foreign exchange market, it would seem like this…

When compared to the foreign exchange market, the New York Stock Exchange (NYSE) seems so little. It doesn’t even have a shot of winning!

It causes one to ponder if the letter “S” in NYSE stands for “Stock” or “Scrawny.”

Even more insignificant is the Bitcoin market.

Take a look at this graph to get an idea of how much money is traded on the currency market, the New York Stock Exchange, the Tokyo Stock Exchange, and the London Stock Exchange on average each day:

The foreign exchange market is more than 200 times larger. It is a MONSTER!

But wait a minute, there’s a catch!

This enormous sum, $6.6 trillion, represents the whole of the global foreign exchange market; however, the “spot market,” which refers to the portion of the currency market that is important to the majority of forex traders, is far less, with a daily volume of just $2 trillion.

And then, if you simply want to count the daily trading volume from retail traders, which brings us to the next point, it is much lower.

The actual size of the retail FX market is extremely difficult to quantify, however, it is thought to be between three and five percent of total daily FX trading volumes, or between $200 to $300 billion (possibly less).

You can see that while the foreign exchange market is quite large, it is not quite as large as some people would have you think it is.

Don’t believe the hype that the foreign exchange industry is worth $6.6 trillion! The very large figure certainly seems impressive, but it may be giving the wrong impression. We don’t like to exaggerate. We simply keepin’ it genuine.

The market is big, and it seldom ever shuts, too! It is open pretty much always.

The currency market is open 24 hours a day, 5 days a week, with the exception of weekends. (What a group of sloths!)

Therefore, in contrast to the stock and bond markets, the foreign exchange market does NOT terminate trading at the conclusion of each trading day.

Instead, business activity simply relocates to other financial hubs located in other parts of the globe.

When the traders in Auckland/Wellington wake up, the day officially begins. The day then progresses to Sydney, Singapore, Hong Kong, Tokyo, Frankfurt, London, and eventually New York, before the trading day begins once again in New Zealand!

Comments (No)