What is the spread in trading?

In the context of investment and financial services, the word “spread” may refer to a variety of things, but most often it describes the difference between two prices, rates, or yields. One such instance is the bid-ask spread, which focuses on the price that traders are ready to pay when purchasing an asset, security, or commodity, as well as the price that the market is willing to accept when selling it. In bond markets, spread, however, has a somewhat different connotation, therefore it is essential to look at a few instances.

Types of spreads

In the following, we will take a look at some of the most frequent spreads that an investor could come across:

Bid-ask spread

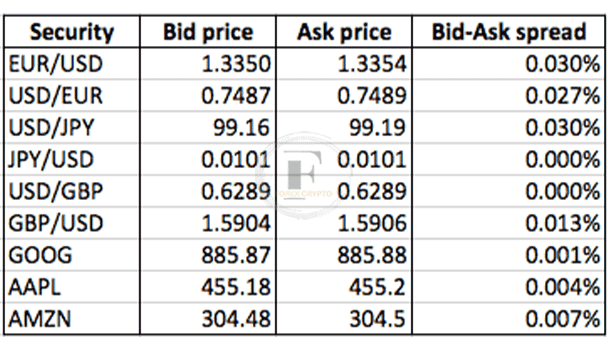

The difference in prices that a market maker quotes for the immediate sale (bid) and the immediate purchase (ask) of an asset is referred to as the bid-ask spread. This term is also known as the bid-offer spread or the buy-sell spread. It’s possible that the stocks, options, futures contracts, or currencies in issue are the assets in question. If the asking price for a stock is $15 and the bid price for the same stock is $13.50, then the bid-ask spread for that stock is $1.50. Another way to look at it is that the bid price is higher than the asking price. The amount of gap between the bid and the asking price of a security is another solid indicator of the liquidity of a market. For instance, with a bid-ask spread that is sometimes as low as 0.001%, the foreign exchange market is frequently regarded to be the most liquid in all of the world’s financial markets.

Yield spread

The yield spread, which is also known as the credit spread, is the term used to describe the difference in the rates of return that are offered by two distinct assets when they are compared in an order book or by a market maker. It is often used as a risk indicator for one investment product in comparison to another investment product. When discussing bonds, the term “yield spread” refers to the disparity in the yield that may be found between two distinct bonds or two distinct classes of bonds. The spread is an indicator for investors of the relative price or value of a bond, and they utilize it in that capacity. The yield spread is 2%, also known as 200 basis points when comparing two bonds, one of which yields 3% and the other of which yields 1%. This is important information for the investor to have since the bond or bond class with the higher yield is deemed to be riskier. The higher yield is compensation for the risk difference that exists between the two types of bonds.

Option-adjusted spread

A bond is said to have an option-adjusted spread (OAS) if it has embedded options or characteristics that provide the bond issuer or holder the ability to take a certain action at some point in the future. An OAS is comparable to a yield spread. The option-adjusted spread is the spread that is calculated after the option attached to the bond has been taken into account or removed.

The yield spread and a benchmark yield curve need to be combined together in order to provide a discount on the price of a security, which will allow it to be matched to the current price that is being offered on the market. This freshly recalculated price is referred to as the option-adjusted spread, and it is most often used with bonds, interest rate swaps, options, and mortgage-backed securities (MBSs). Therefore, the OAS of security is contingent on the assumptions that were made (for example, variable interest rates), and it can be interpreted as the security’s “expected outperformance” in comparison to the benchmarks, provided that the cash flows and the yield curve behave consistently with the valuation model.

Z-spread

In the same way that the OAS is used, the Z-spread, also known as the zero-volatility spread, is computed in order to determine the present or potential value of an asset. This is often used to give analysts a tool to analyze the price of a bond as it maps the difference between the current cash flow value and the yield curve for the U.S. Treasury spot rate. In other words, it maps the difference between the two.

Similar to the OAS, the Z-spread is a metric that may be used to provide investors with assistance when evaluating the yield of two distinct fixed-income products, each of which has embedded options. Embedded options are provisions that are built into some fixed-income securities. These provisions provide the investor or the issuer the ability to do certain actions, such as calling back the issuance. As an example, mortgage-backed securities often have embedded options owing to the prepayment risk that is linked with the mortgages that serve as the underlying asset.

Factors affecting spread

The variances in spreads are mostly the result of three different causes, which are as follows:

Liquidity

Similar to the example of the bid-ask spread, the liquidity of an asset is an essential component of the different spread models. When we talk about liquidity in this context, we are referring to the volume of shares that are exchanged on a daily basis. While certain assets are exchanged on a regular basis, others may only change hands a few times each day.

Volume

The bid-ask spreads of stocks and indexes that experience high trading volumes will be smaller than those of equities and indexes that experience low trading volumes. Illiquidity refers to the difficulty in converting an asset into cash and occurs when a stock has a low trading volume. This makes the asset difficult to sell. As a direct consequence of this, a broker will demand higher compensation in order to handle the transaction, which will account for the wider spread.

Volatility

When evaluating spreads, volatility is another crucial factor to take into account. For instance, the gap between the bid and the asking price is much greater during times of quick market increases or declines because market makers strive to capitalize on the chances that these occurrences present. In a similar vein, the bid-ask spread will be small when volatility will be low, uncertainty will be minimal, and risk will be at a minimum.

How to profit from the bid-ask spread

A market maker may profit from a bid-ask spread by simultaneously purchasing and selling an item. Market makers are able to generate arbitrage profits by repeatedly selling at the higher ask price and purchasing at the lower bid price. Even a minor spread may provide substantial returns if traded in big volumes throughout the day. As discussed earlier, assets that are in high demand have spreads that are narrower due to market maker competition.

Can the bid-ask spread be negative?

If markets are operating normally, the bid-ask spread cannot be negative since it would violate market equilibrium. The price difference between the highest amount a buyer is willing to pay for an asset and the lowest amount a seller is willing to sell it for is referred to as the asking price and the bid. The amount by which the asking price is higher than the bid is essentially the difference in price between those two amounts. Therefore, if one investor is prepared to sell a stock for $12 and another investor is willing to purchase the same for $10, then no deal will take place until someone crosses the spread. There will neither be a bid nor an ask until someone else joins the conversation.

Summary

Although the term “spread” may be defined in a variety of different ways in trading, it most often refers to the difference between two figures such as prices, rates, or yields. There are a number of distinct methods to describe “spread.” Spread is important to consider when dealing with many different types of assets, including stocks, options, futures, and currencies. However, when traders talk about “trading the spread,” they are often referring to the difference between the bid and the asking price. As was previously mentioned, the way that traders make a profit is by repeatedly selling assets at a higher ask price and buying at a lower bid price. Although it is optimal to have a wide bid-ask spread, trading with even a small spread can be profitable depending on the number of trades that are conducted.

Comments (No)