Bonds are debt securities that allow investors to lend money to corporations, municipalities, and governments in exchange for interest payments and the return of the principal investment upon maturity, Bond investing can provide a steady stream of income and a measure of stability to a portfolio.

What Are Bonds?

Bonds are fixed-income securities where an investor loans money to an entity for a predetermined period at a fixed or variable interest rate, This entity can be a corporation, a municipality, or a national government, Bonds are a form of debt financing as the issuer uses the money for funding projects or operations, The principal amount of the bond is returned to the investor upon maturity.

Types Of Bonds

There are various types of bonds, including corporate bonds, municipal bonds, Treasury bonds, and high-yield bonds, Corporate bonds are issued by corporations, while municipal bonds are issued by state and local governments, Treasury bonds are issued by national governments and are considered low-risk investments, High yield bonds offer a higher yield to investors but come with a higher level of risk.

Overview Of Bond Investments

Bonds are often seen as a less risky investment option compared to stocks, but they also typically offer lower returns, Bond investors usually receive regular interest payments over the lifetime of the bond, and the principal investment is returned upon maturity, The performance of bond investments is influenced by fluctuations in interest rates and credit risk, Overall, bond investments can provide a portfolio with a level of stability as well as a continuous supply of income.

Understanding Bond Investment

Advantages Of Bond Investments

Bond investments can provide regular and predictable income through interest payments, making them attractive to investors seeking a stable source of income, They also offer lower risk compared to stocks, making them a suitable option for investors who prioritize capital preservation over capital growth, Moreover, bonds provide diversification, reducing the overall risk of a portfolio by balancing out the riskier investments.

Disadvantages Of Bond Investments

Bonds have lower growth potential compared to stocks, which can limit the overall returns, They are also susceptible to inflation as the interest rate paid on the bond may not keep up with inflation, Additionally, bonds are sensitive to changes in interest rates, which could lead to fluctuations in their market value, Finally, bond investments may be subject to credit risk, which occurs when the entity that issues the bond defaults on its payments.

The Risks Involved In Bond Investments

Inflation Risk

Bonds are susceptible to inflation risk as the interest rate paid may not keep up with inflation, which can result in a decrease in the purchasing power of the investor’s returns.

Interest Rate Risk

Changes in interest rates can affect the market value of bonds, resulting in fluctuations in their prices, When interest rates rise, bond prices fall, and vice versa, which can impact the overall returns of the bond investment.

Credit Risk

Bond investments may be subject to credit risk if the entity issuing the bond fails to make its payments as scheduled or defaults, Credit risk can result in a total or partial loss of the invested capital, affecting the overall returns of the bond investment.

Different Types Of Bonds

Government Bonds

Government bonds are issued by national governments to finance their operations or fund public projects, These bonds are considered to be low-risk investments as they are backed by the government’s ability to levy taxes and print money if needed.

Corporate Bonds

Corporate bonds are issued by companies to raise capital to finance their operations or fund new projects, These bonds offer higher returns than government bonds but come with higher risks as the creditworthiness of the issuing company can affect the overall returns.

Municipal Bonds

Municipal bonds are issued by state or local governments to raise money to fund public projects such as schools, hospitals or highways, These bonds are typically exempt from federal income tax and can provide tax-free income to investors, However, they may also carry credit risk, depending on the issuing entity’s financial stability.

Factors To Consider When Evaluating Bond Investments

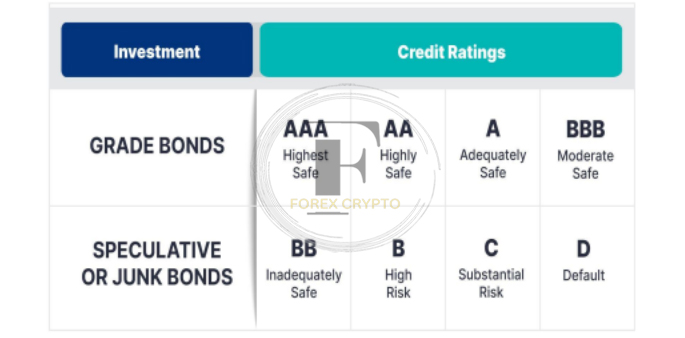

Credit Rating

When evaluating bond investments, credit rating is an important factor to consider as it speaks to the issuer’s financial stability, The higher the credit rating, the lower the risk of default and the lower the yield offered on the bond.

Yield

Yield is the return an investor will receive on their investment, Bonds with higher yields typically come with higher risks, so it’s essential to balance risk and reward when considering different bonds.

Duration

Duration refers to the amount of time until a bond matures, Long-term bonds may offer higher yields, but they also come with more significant interest rate risk, Short-term bonds have less interest rate risk, but may also offer lower yields, It’s important to consider investment goals and timelines when evaluating bond duration.

Historical Performance Of Bonds

Historical Trends In Bond Investments

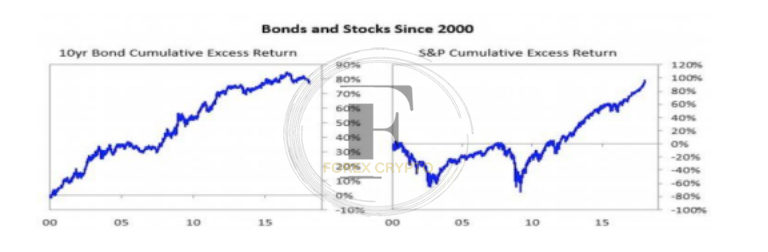

When looking at historical trends in bond investments, it’s important to recognize that bonds have traditionally been seen as a relatively safer investment compared to stocks, From the 1980s to the early 2000s, interest rates were generally declining, which led to rising bond prices and attractive returns for bond investors, However, in recent years, interest rates have been on the rise, which has caused bond prices to fall and resulted in lower returns.

Comparison With Other Investments

Compared to other investments, bonds generally offer less potential for growth but can provide steady income and a level of stability in a portfolio, Stocks, on the other hand, can offer greater potential for growth but come with higher risk and volatility, Real estate and commodities also have the potential for appreciation, but may come with higher costs and management requirements, It’s important to evaluate individual investment goals and risk tolerance when considering how to allocate funds across different assets.

Conclusion

Are Bonds A Good Investment?

Whether bonds are a good investment depends on individual investment goals and risk tolerance, Bonds provide stable returns and are often less risky than stocks, making them a desirable investment for risk-averse investors.

Final Thoughts On Bond Investments

Overall, bonds offer a level of portfolio diversification and income stability, However, it’s important to monitor interest rate changes and use them alongside other complimentary investments to achieve a well-diversified portfolio.