Stock trading is an exciting and lucrative activity that involves buying and selling shares of publicly traded companies, To be a successful trader, it is important to understand the basics of stock trading and find a trading style that fits your personality and goals.

What is stock trading?

Selling and buying shares of publicly listed firms to generate a profit is what is meant by the term “stock trading.” Traders can utilize various tactics and strategies to make educated judgments about which stocks to purchase or sell, These decisions are based on a variety of criteria, including the performance of the firm, trends in the industry, and the circumstances of the market, Stocks traded on stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq.

The importance of finding your trading style

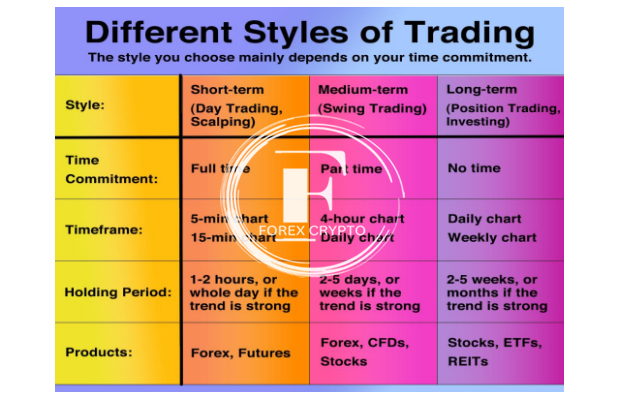

Finding a trading style that works for you is crucial for success in stock trading, Different styles include day trading, swing trading, and position trading, each with their own techniques and time frames, Day traders buy and sell stocks within the same day, while swing traders hold stocks for a few days to weeks, and position traders buy and hold stocks for months to years, It is important to find a trading style that suits your risk tolerance, time commitment, and financial goals.

Day Trading

Day Trading Overview

Day trading involves buying and selling stocks within the same trading day, typically making multiple trades each day, This trading style requires quick decision making, attention to market trends and news, and the ability to handle high levels of risk, Day trading can be highly profitable but also carries greater risks than other trading styles.

Strategies for Day Trading

There are various strategies for day trading, including scalping, momentum trading, and news trading, Scalping involves making small gains through frequent trades, while momentum trading focuses on riding the momentum of a stock’s price movement, News trading involves identifying stocks with upcoming news or earnings announcements and trading based on the expected impact, It is important to have a solid understanding of these strategies and to develop a trading plan before beginning day trading.

Swing Trading

Swing Trading Overview

Swing trading involves holding stocks for a short period of time, usually a few days to a few weeks, This trading style aims to capture price movements as they swing up or down, depending on market conditions, Swing traders use technical analysis tools and charts to identify these trends and make informed trading decisions.

Strategies for Swing Trading

There are various strategies for swing trading, including trend trading, breakouts, and countertrend trading, Trend trading involves following the direction of a stock’s trend, while breakout strategies focus on identifying stocks that are breaking out of support or resistance levels, Countertrend trading involves identifying stocks that may be overbought or oversold and trading against the trend, It is important to research and implement a trading plan that aligns with individual risk tolerance and investment goals.

Position Trading

Position Trading Overview

Position trading involves holding stocks for longer periods, usually weeks or months, This style of trading aims to capture larger price movements by following a stock’s trend over an extended period, Position traders use fundamental analysis to identify undervalued or overvalued stocks and make informed trading decisions based on long-term trends.

Strategies for Position Trading

Some strategies for position trading include value investing, growth investing, and dividend investing, Value investing entails identifying stocks that are undervalued by the market, while growth investing involves finding companies with high potential for growth, Dividend investing focuses on stocks with above-average dividend yields, It is important to have a well-defined investment strategy and to continually review and adjust positions as market conditions change.

Value Investing

Value Investing Overview

Value investing is a long-term investment strategy that involves identifying undervalued stocks in the market, Investors practicing this strategy must carefully analyze a company’s financial statements and look for stocks that have a low price-to-earnings ratio, low price-to-book ratio, or high dividend yield, The focus is on finding stocks that are currently trading for less than their intrinsic value.

Strategies for Value Investing

Value investing strategies may involve investing in individual stocks or funds that hold a portfolio of undervalued stocks, Some examples of value investing strategies include growth at a reasonable price (GARP), contrarian investing, and deep value investing, GARP investors look for companies with a reasonable price relative to earnings and earnings growth prospects, Contrarian investors invest in stocks that are currently out of favor with the market, Deep value investors focus on stocks that are trading for less than their intrinsic value due to temporary market dislocations.

Growth Investing

Growth Investing Overview

Growth investing is a strategy focused on finding companies with high potential for growth in earnings or revenue, Investors practicing this strategy typically prioritize stocks with high price-to-earnings ratios, strong growth prospects, and solid revenue streams, The focus is on finding companies with a bright future outlook, rather than undervalued stocks at present.

Strategies for Growth Investing

Growth investing strategies may involve investing in individual stocks or funds that hold a portfolio of growth stocks, Some examples of growth investing strategies include investing in disruptive technologies, investing in emerging markets, and investing in IPOs, Investors practicing growth investing typically prioritize companies that are poised for rapid growth and have a competitive edge in their respective markets.

Income Investing

Income Investing Overview

Income investing is a strategy focused on generating a steady stream of income from investments, Investors practicing this strategy priorities stocks with high dividend yields and consistent earnings growth, The focus is on generating regular income from investments rather than the potential growth in stock prices.

Strategies for Income Investing

Strategies for income investing may involve investing in individual stocks or funds that hold a portfolio of income-generating stocks, Some examples of income investing strategies include investing in real estate investment trusts (REITs), dividend-paying stocks, and fixed income securities like bonds, Investors practicing income investing prioritize investments that generate reliable, steady income.

Technical Analysis

Technical Analysis Overview

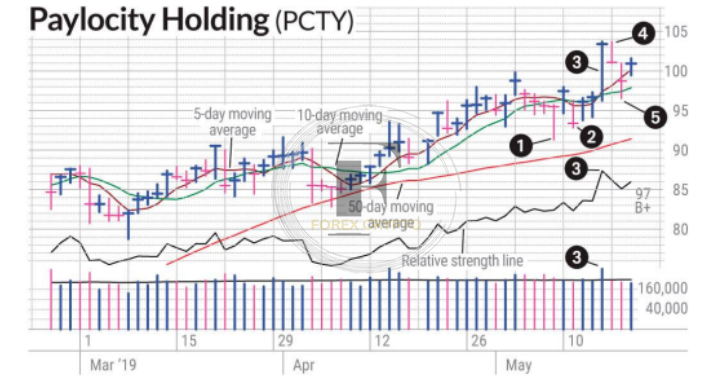

Technical analysis is a strategy used to analyze past market data and identify trends, patterns, and signals that inform investment decisions, This is done by analyzing charts, indicators, and trends to determine a stock’s future performance.

Strategies for Technical Analysis

There are several strategies for technical analysis, including trend analysis, chart patterns, and technical indicators, Trend analysis involves identifying the direction of a stock’s trend, while chart patterns involve identifying recurring patterns in stock charts, Technical indicators use mathematical calculations to identify buy and sell signals based on stock prices and volumes, Investors can use one or more of these strategies to inform their trades.

Fundamental Analysis

Fundamental Analysis Overview

Fundamental analysis is a strategy used to evaluate the intrinsic value of a stock by analyzing financial and economic data, This includes examining a company’s financial statements, earnings reports, and industry conditions to assess its future performance, The goal of fundamental analysis is to identify stocks that are undervalued or overvalued in the market.

Strategies for Fundamental Analysis

There are several strategies for fundamental analysis, including analyzing financial ratios, examining management effectiveness, and evaluating a company’s competitive advantage, Financial ratios compare a company’s financial metrics, such as earnings, revenue, and debt, to industry benchmarks, Evaluating management effectiveness involves analyzing how well a company’s executives utilize resources and make strategic decisions, Assessing a company’s competitive advantage involves analyzing how it differentiates itself from its competitors in the market, Investors can use one or more of these strategies to make informed investment decisions.

Fundamental Analysis

Fundamental Analysis Overview

This involves looking at a company’s financial statements, earnings reports, and the industry’s circumstances, The objective of fundamental analysis is to determine whether stocks in the market are undervalued or overpriced, Fundamental analysis is a method that examines the inherent value of a stock by analyzing financial and economic data.

Strategies for Fundamental Analysis

Strategies for fundamental analysis include analyzing financial ratios, management effectiveness, and a company’s competitive advantage, Financial ratios compare financial metrics to industry benchmarks, Management effectiveness assesses executives’ decision-making, while competitive advantage examines differentiation from competitors, Investors use these strategies to make informed decisions.

Conclusion

Choosing the right trading style for you

To choose a trading style, determine personal goals and preferences, Short-term traders aim for quick profits from fluctuations, while long-term investors focus on potential growth over time, Swing traders seek to capitalize on price movements over a few days, Scalp traders aim to make quick trades in seconds or minutes.

Tips and Tricks for successful stock trading

Successful stock traders stick to a well-defined strategy, keeping emotions in check, and diversifying portfolios, Regularly monitoring market trends, news, and dividends helps identify opportunities, Focus on high-quality stocks with growth potential, and don’t follow every trend, Patience and discipline can lead to profitable trading.