Forex trading is a decentralized market for trading currencies, where people buy and sell currencies based on their value against each other, It is a popular form of investment due to its high liquidity and potential for profit, However, the forex market is also influenced by various factors, including biases and predictions, which can greatly impact trades.

What is Forex Trading

Forex trading involves buying and selling currencies in order to profit from fluctuations in exchange rates, It is a global market that operates 24 hours a day, 5 days a week, with trillions of dollars exchanged daily, Forex traders can make money by predicting whether a currency will rise or fall in value relative to another currency.

How Forex Biases and Predictions Affect It

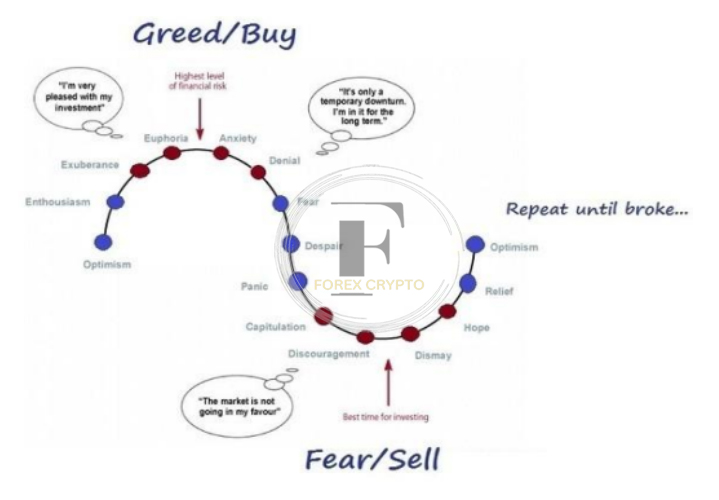

Forex biases refer to an individual’s tendency to make decisions based on their personal beliefs or experiences, which can affect their trading strategy, Predictions, on the other hand, involve forecasting future market movements based on previous trends and data, Both biases and predictions can impact forex trading by influencing the decisions of traders and creating market trends.

To be successful in forex trading, it is important to understand the various biases and predictions that can influence the market, Traders must remain objective and base their decisions on data and analysis rather than personal biases or emotions, By doing so, they can increase their chances of making profitable trades in the dynamic world of forex.

Overcoming Cognitive Biases in Forex Trading

Forex trading is a complex market, influenced by various biases and predictions, Biases, which are a trader’s personal beliefs and experiences, can affect their trading decisions, while predictions involve forecasting market movements based on data and trends, To succeed in forex trading, traders must objectively analyze data and avoid biases, By understanding biases and making rational decisions, traders can increase their chances of profitable trades.

Understanding Cognitive Biases in Forex Trading

Forex biases refer to a trader’s tendency to make decisions based on personal beliefs rather than data, Cognitive biases such as confirmation bias and anchoring bias can impact a trader’s strategy and lead to poor decision-making, Traders should be aware of these biases and avoid making decisions based on intuition alone.

Avoiding Biases and Making Rational Decisions

To avoid cognitive biases in forex trading, traders should analyze market data objectively and make rational decisions based on facts rather than emotions, By keeping an open mind and remaining flexible, traders can adapt to changing market trends and make informed decisions that lead to more profitable trades.

Technical Analysis and Predictive Indicators in Forex Trading

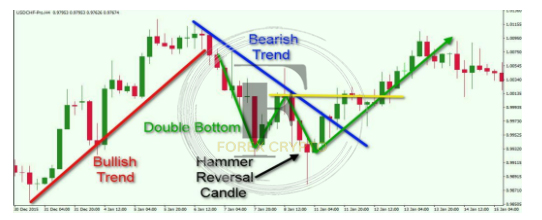

Technical Analysis’s Place in Forex Trading

Traders in the forex market use technical analysis to identify market trends and predict future price movements, Technical analysis involves studying charts and indicator patterns to understand past market behavior and make informed trading decisions.

Using Predictive Indicators to Gain an Edge

Predictive indicators such as moving averages and oscillators can give traders an edge in forex trading by providing insights into market trends and potential price movements, These indicators use complex mathematical calculations to identify trading opportunities and help traders make informed decisions based on data and analysis.

Fundamental Analysis and Predictive Factors in Forex Trading

The Importance of Fundamental Analysis in Forex Trading

Fundamental analysis is a crucial aspect of forex trading, It involves analyzing economic, social, and political events to determine the underlying factors that affect currency prices, By keeping a close eye on this data, traders can identify trends and anticipate shifts in the market.

Identifying Predictive Factors that Affect Forex Market

To gain an edge in forex trading, traders need to identify predictive factors that affect the market, These can include events such as elections, economic policy changes, and natural disasters, Using complex analysis and mathematical models, traders can determine how these variables will influence the market and make informed trading decisions based on the data.

Considerations When Making Forex Predictions

Identifying Trends and Patterns

Fundamental analysis is a vital tool used in forex trading, It involves studying data related to economic, social, and political events that impact currency prices, By analyzing this data, traders can identify trends and patterns that may indicate shifts in the market, This can help make informed decisions on when to buy or sell.

Assessing Risk and Reward

To gain an edge in forex trading, traders must assess the risk and reward of their investment, This involves identifying predictive factors that affect the market, using complex analysis and mathematical models to determine how these variables will influence the market, Analyzing information related to trends and patterns can also help evaluate potential risks and rewards of a trade.

The Role of Artificial Intelligence in Forex Trading

How Artificial Intelligence is Revolutionizing Forex Trading

Artificial intelligence (AI) has rapidly gained acceptance in forex trading as traders seek to leverage the power of machine learning to analyze vast amounts of data, By using AI algorithms to scour market data, traders can make more informed decisions on when to buy and sell, This technology has revolutionized forex trading, allowing traders to assess shifts in market trends and make data-driven predictions with greater accuracy.

AI Predictive Models and Their Efficacy

AI predictive models are increasingly being used in forex trading, with traders using these models to make predictions on currency pair prices, Thanks to machine learning technology, these predictive models can analyze vast amounts of data at high speeds, helping traders make more informed decisions, However, there is still room for improvement in these models, as data sets become larger and more complex, there is a need for constant innovation and updating of these models.

Common Forex Trading Predictions and Biases to Avoid

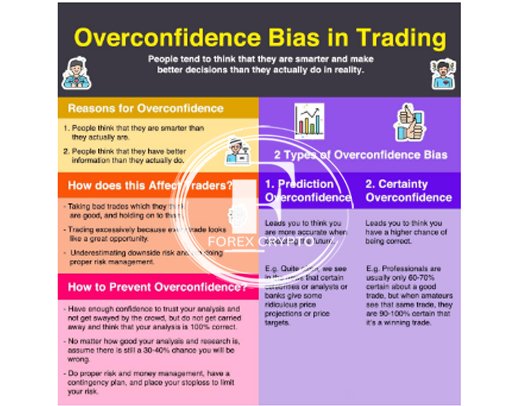

Overconfidence Bias

Traders should avoid overconfidence bias when making investment decisions, This bias occurs when traders overestimate their knowledge and expertise, leading them to make risky trades, To avoid this bias, traders should seek to diversify their investment portfolios and continuously learn about market trends.

Confirmation Bias

Traders may also fall victim to confirmation bias, where they seek out information that confirms their existing beliefs and ignore conflicting evidence, This can lead to a narrow-minded approach to trading that neglects important market signals, To mitigate this risk, traders should remain open minded and consider all available information before making trading decisions.

The Impact of News and Events on Forex Trading Predictions

Most Influential News in Forex Trading

News and events can significantly impact forex trading predictions, Some of the most influential news includes central bank announcements, non-farm payroll reports, and geopolitical events, Traders should stay up-to-date with these events and adjust their trading strategies to reflect the market changes.

News Trading Strategies to Gain Success

Incorporating news trading strategies can help traders benefit from market volatility, One such strategy is the ‘Straddle Strategy,’ where traders place both a buy and a sell order before a major news event, Another strategy is the ‘Breakout Strategy,’ where traders wait for a significant price movement after a news release before entering a trade, However, traders should always exercise caution and have proper risk management in place.

The Impact of News and Events on Forex Trading Predictions

Most Influential News in Forex Trading

News and events can have a significant impact on forex trading predictions, Some of the most influential news includes central bank announcements, non-farm payroll reports, and geopolitical events, Traders need to stay informed about these events and adjust their trading strategies accordingly.

News Trading Strategies to Gain Success

To benefit from market volatility, traders can use news trading strategies such as the ‘Straddle Strategy’ and ‘Breakout Strategy.’ However, traders must exercise caution and have proper risk management in place.

Recognizing and Overcoming Trading Biases

Traders can experience biases that can skew their trading decisions, Recognizing and overcoming these biases is essential for forex trading success.

Strategies for Making Forex Predictions

Traders can use various strategies such as technical analysis, fundamental analysis, and sentiment analysis for making forex predictions, Combining multiple analyses can provide a more accurate forex prediction.

Conclusion

In conclusion, staying informed about news and events that impact forex trading predictions and using appropriate trading strategies is crucial for success in the forex market, Recognizing and overcoming biases while making predictions through multiple analyses can provide a more accurate forex prediction.

Comments (No)