How to Trade During the London Session?

What may be found on this page?

- WHEN DOES THE LONDON FOREX MARKET BEGIN ITS DAY OPERATING HOURS?

- THE TOP 3 FACTORS TO UNDERSTAND ABOUT THE LONDON TRADES

- WHAT ARE THE BEST CURRENCY PAIRS TO TRANSACT DURING THE LONDON SESSION?

- WHAT TO DO WHILE TRADING BREAKOUTS DURING THE LONDON SESSION

- LONDON SESSION TRADING STRATEGIES AND TIPS

The London trading session is responsible for around 35 percent of the overall average turnover in the FX market, the highest amount among its competitors. The currency trading sessions in London and New York often overlap throughout the year.

The following are some key topics discussed in this article:

- When does the foreign exchange market in London start trading?

- Three of the most important things to know about the trading session in London

- Which currency combinations provide the most favorable trading opportunities?

- How to profit from breakouts during the trading day in London.

WHEN DOES THE LONDON FOREX MARKET BEGIN ITS DAY OPERATING HOURS?

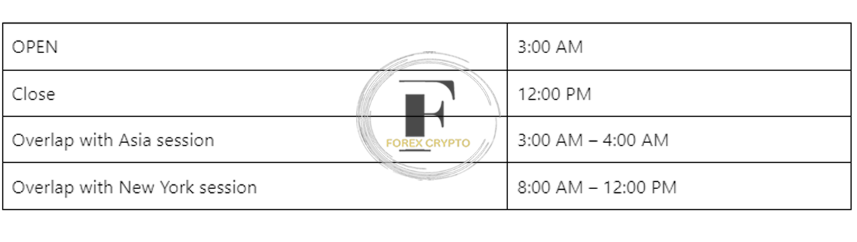

The hours of operation for the currency market in London are from three in the morning Eastern Time (ET) until noon ET. London’s foreign exchange market session has the highest volume of all the other forex market sessions.

The epoch of ET.

THE TOP 3 FACTORS TO UNDERSTAND ABOUT THE LONDON TRADES

- The London session is hectic and full of activity.

The sluggish market in Tokyo will lead into the London session. When prices begin to migrate from liquidity sources in the United Kingdom, traders may often expect to see rises in volatility during this period.

As prices begin coming in from London, the ‘average hourly move’ on many big currency pairs will typically climb. This is because the major currency pairings are where most trading occurs. The following report examines the EUR/USD exchange rate dependent on the time of day. Take note of how much more significant these shifts become, on average, when the Asian session concludes (the blue dot indicates that the Asian session closes at 3 AM ET):

During the European session, when volatility is often lower, support and resistance levels might be breached much more quickly than during the Asian session.

When speculating in the London Session, traders might attempt to leverage this volatility to their advantage by trading breakouts. Hence, these notions are essential to traders’ strategy when speculating in the London Session. When trading breakouts, investors seek dramatic price movements that have the potential to persist for a considerable amount of time.

- Keep an eye out for overlapping areas.

The ‘overlap’ refers to when the London and US sessions coincide (8 AM ET to noon ET). These are the two most essential market hubs in the globe. During these four hours, massive and rapid price movements may be noticed during the overlap because a significant amount of liquidity is being introduced to the market.

As can be seen in the figure to the right, the most volatile time of day is between 8:00 AM and 12:00 PM Eastern Time (ET). This is when the London forex session overlaps with the New York forex session. Traders may use a breakout trading technique to profit from the heightened volatility during the overlap. This approach can be used to trade the overlap.

- High liquidity

One of the most active and liquid trading sessions is held in London for the foreign exchange market. Because of the vast amount of buying and selling, big currency pairings can trade at very tight spreads. Day traders interested in targeting shorter swings may be interested in locating trends and breakouts to trade to lower the cost of the spreads they pay.

WHAT CURRENCY PAIRS ARE THE BEST TO TRADE DURING THE LONDON SESSION?

There is no such thing as the “best” currency pair to trade during the hours that the London forex market is open; nevertheless, there are currency pairings that will see a reduction in spread as a result of the high activity and provide traders with the opportunity to pay reduced spread charges.

These currencies include the most crucial currency pairings in the world, such as EUR/USD, USD/JPY, GBP/USD, and USD/CHF. During the London forex session, vast volumes of transactions about the main currency pairings are conducted.

Because of the inter-bank transactions between the United States and Europe/London, some currency pairings, such as the EUR/USD, USD/JPY, and GBP/USD, are more heavily impacted by the overlap than others. It would be best to keep an eye on these trading pairs since they will be swamped with liquidity and move more on average during the overlap. If your trading strategy is better suited for volatility, follow these trading pairs.

WHAT TO DO WHILE TRADING BREAKOUTS DURING THE LONDON SESSION

Trading breakouts during the London session utilizing a London breakout strategy is quite similar to trading breakouts during any other time of the day; the only difference is that traders should anticipate an assault of liquidity and volatility at the opening of the market when trading breakouts during the London session.

When traders are interested in trading breakouts, they often seek sturdy support or resistance to lay out their bets.

The following chart is an example of a rising wedge pattern, a trend line with a resistance level that is finally broken. This occurrence is referred to as a breakout.

The main advantage of using this configuration is improved risk management. Traders can maintain reasonably tight stops by positioning their stop-loss orders close to the trend line. Losses will be contained if the support/trend line is broken, and if the approach is successful, it can provide an excellent risk-to-reward ratio.

The rise in volatility during the London session, in conjunction with the increased liquidity during that session, made it far more probable that possible breakouts would occur.

LONDON SESSION TRADING STRATEGIES AND TIPS

When trading at the London Open, remember that volatility and liquidity will increase; as a result, you should trade with caution and use the proper amount of leverage. Download our Forex trading guide for beginners if you’re starting in the foreign exchange market so you can get a handle on the fundamentals.

Forex traders need to be aware of the differences between the London session, the New York session, and the Asian forex session. These differences are what set each session apart from the others.

Important notes:

- Higher levels of both liquidity and volatility characterize the London session.

- During the London session, breakouts may occur more often.

- Always keep an eye out for greater volatility and liquidity during the times when the London and New York trading sessions overlap.

The Triennial Report of the Bank of International Settlements (BIS) for the Year 2016*

Comments (No)