- Trade the News The stock markets are known for their long-term rising tendency. However, any investor’s resilience is tested during periodic downturns, like the fifty percent decrease in value seen by most major markets during the 2008–2009 global economic crisis.

- It doesn’t matter what happens around the globe; the most astute investors will always be able to profit. Incorporating news trading into your investment plan is essential. Day traders may make many news trades every session, whereas long-term investors may only do so periodically.

- Learning to trade the news is crucial for successful portfolio management and long-term results, regardless of your time horizon.

- INTERNATIONALLY RELEVANT CONCLUSIONS

- Market-moving news like earnings releases and economic updates tend to follow predictable patterns. So instead of making decisions on the fly, carefully plan your moves.

- Typically, the news is beneficial to specific asset classes and detrimental to others. Limiting your risk exposure reduces your overall portfolio volatility.

- Don’t give in to the pressure of the masses. Instead, keep your investing strategy the same if you’re happy with it.

Classifying News

The news may be broken down into two major groups:

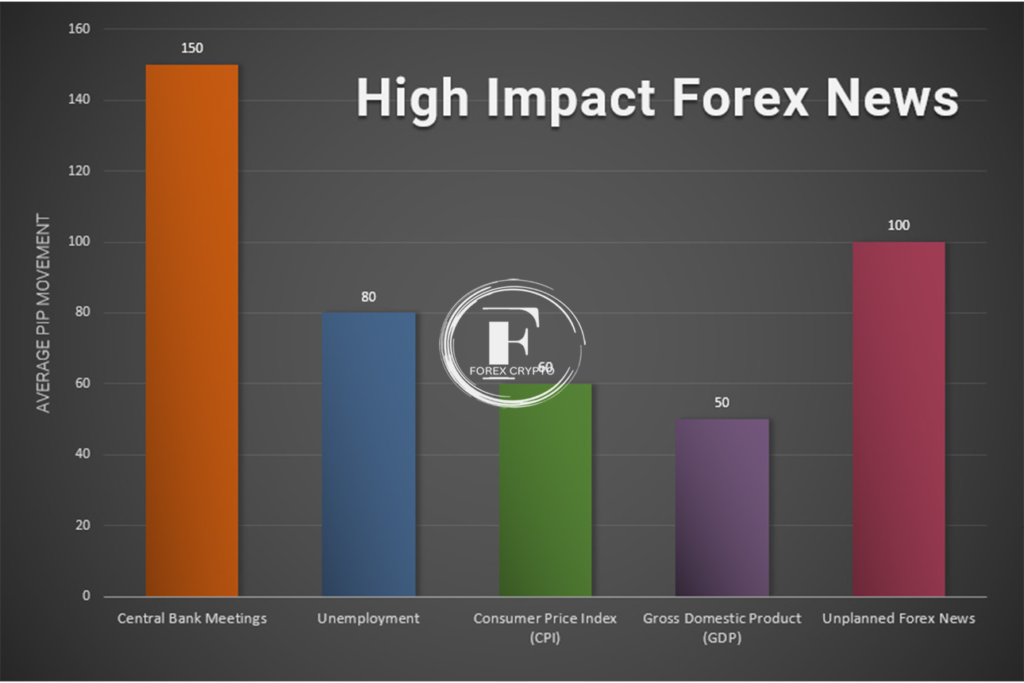

- Market-moving announcements like the Federal Reserve’s interest rate announcements, economic data releases, and company profits reports are all examples of periodic or recurring news.

- These events come out of nowhere, such as a terrorist attack, a sudden escalation in geopolitical tensions, or the potential financial default of a heavily indebted country. Generally speaking, negative news is more common than good when it comes as a surprise.

- Markets and industries might be impacted by news that isn’t always related to a single stock.

Trading the News

Following are some scenarios in which a trader may have reacted to recent news stories.

A Federal Reserve Announcement

- An interest rate announcement by the Federal Open Market Committee (FOMC) has always been one of the most market-moving events. Still, the statement made in the middle of March 2020 was unique for several reasons, not the least of which was that it was given on a Sunday.

- The Fed has reduced its key lending rate by one percentage point to mitigate the economic fallout from the crisis of 2020. It was the month’s second thinning. There were also intentions revealed to purchase $700 billion in government securities.

- The following day saw the most significant single-day point decrease in the Dow Jones Industrial Average since the collapse of 1987.

- Much money would have been put into Wall Street having a wonderful day, and those people would have lost. Instead, headlines focused on other topics, such as former President Trump’s prediction that the epidemic may run until August. (The reality was even worse.)

- But those who stuck it out for a few more weeks would have been well rewarded when the markets rose again.

- Immediately after the Fed’s announcement, a stock investor might have taken any of the following actions to protect against probable losses:

- To avoid leaving money on the table, we reduced our holdings in some of our most lucrative equities investments.

- Puts were bought on individual companies or an index such as the S&P 500 or the Nasdaq 100. In exchange for payment, the buyer of a put option is granted the right, but not the obligation, to sell the underlying stock at a specific future date and price. To profit from a decline in a security’s market price, an investor might sell at a higher contract price than the current market price.

- I bought several inverse exchange-traded funds (ETFs) to hedge my investment portfolio. These change direction inversely to the market or a subset of the market.

- While most investors would make these adjustments after the Fed pronouncement, a forward-thinking investor may put them in place in anticipation of the news. Of course, whether an investor chooses to react or anticipate a significant event or news relies on various variables, including the strength of their confidence about the market’s near-term path. Another consideration is the individual’s risk preference and trading style (passive vs. aggressive).

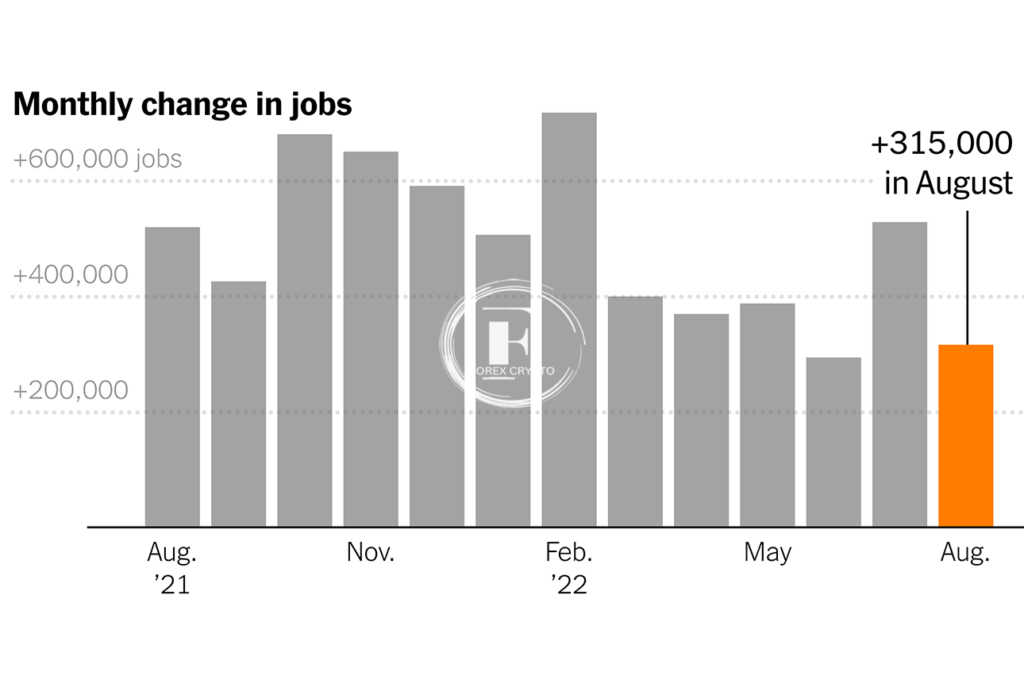

A Jobs Report

The U.S. employment report is a crucial economic indicator because of its far-reaching effects.

The confidence and spending of consumers, who make up 70% of the U.S. economy, are regularly monitored by traders and investors because of the significant impact that the employment level has on these factors.

Payroll statistics that fly beyond projections are considered a sign of strength, while those that fail forecasts are often seen as indicators of incipient economic deterioration.

The unemployment rate dropped to 6% in March 2021 after the government reported a gain of 916,000 nonfarm payroll jobs the previous month. It was predicted that just about 210,000 additional jobs would be produced. Most of these new positions, which bode well for the economy, were created in the tourist sector.

The Dow Jones Industrial Average ended the day up 171 points after a volatile session.

Investors often follow a script based on historical market movements when it comes to trading employment statistics.

The shortfall in predicted payroll means the Federal Reserve will be constrained to maintain historically low-interest rates for a lengthy period. This table allowed us to forecast the effect on several asset classes:

Asset/Instrument

Results Immediately

Equities

↑

Bonds

↑

monetary unit of the United States

↓

Volatility

↓

Gold

↔ (no apparent trend) (no clear trend)

Commodities

↔ (no apparent trend) (no clear trend)

Total payroll costs less than forecasted: Increases in bond yields and market interest rates may result if the Fed slows the rate at which it buys assets. That’s why it’s so probable that:

Asset/Instrument

Results Immediately

Equities

↓

Bonds

↓

United States Dollar

↑

Volatility

↑

Gold

↔ (no apparent trend) (no clear trend)

Commodities

↔ (no apparent trend) (no clear trend)

Traders might use these responses to the employment data to plan their moves before and after the news is released.

A Corporate Earnings Report

Before the release of quarterly results, investors in specific companies should have a trading plan ready to use.

The price of a company may rise or plummet within minutes of the release of either favorable or unfavorable financial results. For example, the stock price of the company you are shorting went up 40% after the bell because profits were significantly better than anticipated.

Earnings reports are not necessary to engage in trading. You can weather any quarterly storms in stock if you’re in it for the long haul and believe in its future. However, suppose you have a sizable long or short position in a company. In that case, you should consider the costs and benefits of maintaining that position through the earnings report and make any necessary adjustments immediately before the report is released. Consider the following while making your choice:

- The general bullishness or pessimism of the market right now;

- opinion of the stock industry among investors;

- The number of shares now sold short;

- goals for financial gain (whether unrealistically high or pleasantly modest);

- stock price estimates;

- how prices have behaved in the short- and long-term;

- The results and projections announced by rivals.

- Before an earnings release, an investor in a large-cap technology firm trading around multi-year highs can reduce the stock’s weight in the portfolio from 15% to 10%. This might be preferable to the potential for a dramatic drop in stock price after the announcement of profits if the company fails to live up to investors’ lofty expectations.

- An alternate strategy might be to purchase put options to protect against potential losses. A significant expense would be incurred to hedge the position, but the investor could keep the 15% allocation in place.

- When an investor does not have a stake in a company but (rightly or erroneously) has strong confidence about its future performance, it may make sense to trade an earnings report for that stock.

- Important reminders: don’t over-commit, and have a plan for limiting your losses if the deal doesn’t work out.

A Bolt from the Blue

- Of course, the worldwide nature of the crisis in 2020 caused stock markets throughout the globe to enter a bear market that would span from February 20th, 2020, to April 7th, 2020.

- Don’t stress if you can’t recall this. The stock markets started a sustained ascent to all-time highs when this happened. Following a brief dip of about two months, the bull market that had begun after the financial crisis of 2007–2008 picked back up again.

- This does not negate the significance of unfavorable information. However, it implies that a spontaneous decision to liquidate all possessions and head for the hills would not be the wisest course of action. The financial markets have shown to be rather sturdy throughout the years.

- Some investors may consider shifting their holdings from more risky equities toward safer ones as a hedge against global instability. Options trading and inverse exchange-traded funds are two other tools to protect yourself from the market’s decline.

- Even though you should reduce your stock exposure if it is too high, you should remember that market declines brought on by unanticipated geopolitical or macroeconomic events have historically proven to be the perfect long-term purchasing opportunities.

Tips for New News Traders

- Know when significant market events, such as FOMC statements, economic data releases, and earnings reports from major firms, will be made public. This information is easily accessible online. So get familiar with this schedule in advance.

- Establish a plan in advance: You should plan your trading strategy so that you are not making hasty judgments under pressure. For example, before the trading activity starts, you must know precisely when to enter and quit the market.

- Try not to respond emotionally: Invest sensibly, considering your risk tolerance and long-term goals. Doing so may require you to take a contrarian stance on specific issues, but successful long-term investors all agree that this is the way to purchase stocks.

- Control your degree of risk: Stay away from the urge to take a significant long or short position to make a quick buck. The question is, what if the transaction goes against you?

- Stand firm in your beliefs. Then, assuming you’ve done your due diligence, consider increasing your holdings in a company if its price falls below its true worth, or you may cash out of a hot stock to collect your winnings.

- Keep sight of the forest for the trees. The response to the news in the financial markets is sometimes predictable. For example, you could expect a stock price drop after the news of a dividend decrease. But, in other instances, investors welcome the news indicating that the firm is serious about expanding its operations.

- Be unmoved by the whims of the market. If you let yourself be persuaded too much by the market’s mood, you may be tempted to purchase high while enthusiasm is widespread and sell low when pessimism reigns. Think about the unfortunate investors who were scared out of their equities holdings around the lows in 2008 and lost a lot of money because they got out when the market was down. Instead, the S&P 500 index increased by an astounding 166% between March 2009 and October 2013.

- Master the art of “fading out” the media: It’s just as vital to “fade” (i.e., disregard) the news as it is to trade it. As a result, long-term investors may safely disregard short-term concerns.

The Bottom Line

Positioning your portfolio to take advantage of market movements and increase overall returns is only possible with news trading.

Comments (No)