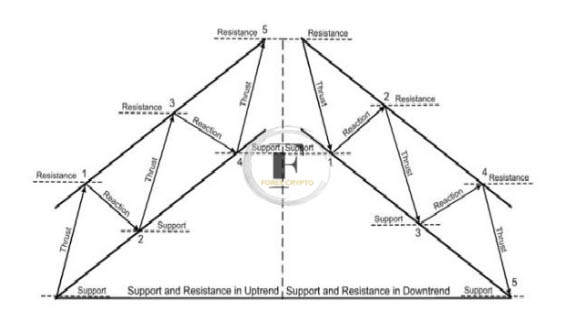

- The supply and demand meeting point is symbolized by the support and resistance levels used in technical analysis. In addition, support and resistance are fundamental to other facets of technical analysis, such as recognizing price trends.

- A support line is a price at which a stock (or currency pair) is likely to find buyers and where further price declines are unlikely. It represents the cost at which there is enough quantity to meet demand.

- Similarly, a resistance line is a price at which buyers and sellers meet, reducing the likelihood that a stock or currency pair will continue to increase. It represents the price at which supply is enough to halt the downward trend and flip it upward for a period.

Kinds of Trends

- In the foreign exchange market, trends indicate the typical pace of price change. Equity, currency, and commodities markets are not immune to trends. (minutes to multiyear). Recognizing and acting on a trend is a crucial skill for every trader. Traders must determine the direction in which the market or asset (stock, currency pair) moves before making trades.

- Currency exchange market trends may be broken down into the following categories:

- Inconstant Movements (range bound),

- Uptrend (higher lows)

- downtrend (lower highs).

- Tides of Stagnation

- A currency moving in a sideways trend is likely contained inside a narrow range between two levels of support and resistance. Without clear direction, the market consolidates for long periods inside this narrow range.

- Traders may tell whether the market is in a sideways trend by drawing horizontal lines between the highs and lows of the price, which act as resistance and support. But, unfortunately, traders can’t predict where the market is headed. Thus, prices are likely to move very slowly or not at all.

Uptrend

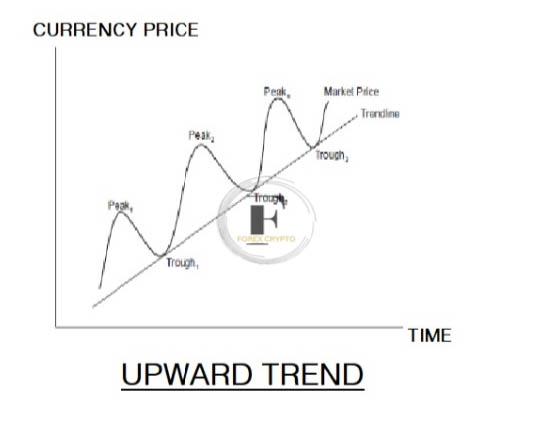

A bullish market is characterized by an upswing, which indicates that prices are trending higher. As a result, prices tend to rise and fall in choppy patterns that go against the prevalent trend.

Until there is a chart breakdown, an upward trend will continue. (going down below some major support areas). If the market is trending higher, we should be wary of establishing a short position (against the market’s general direction) on a modest pullback.

Below is another method for calculating an upward market or current pricing trend.

Currency pairs like the USD/INR follow more significant rising trends established by primary waves. In contrast, secondary waves operate as corrective phases of the primary waves by slightly correcting the currency value. (upward).

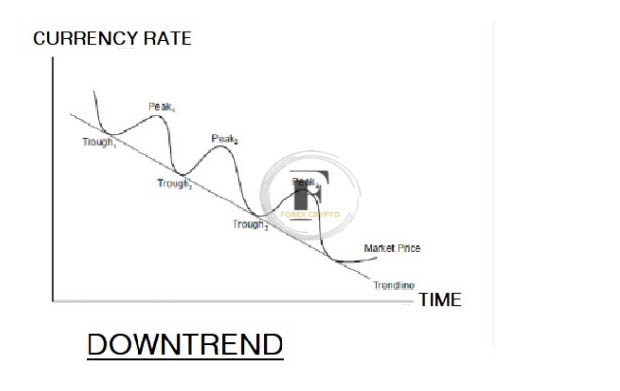

Downward Trend

- To summarize, a negative trend in the forex market looks like a decrease in the price of the USD/INR currency pair, with a brief period of stabilization marked by a bit of a price rise. (downward trend). A downward trend, in contrast to an upward trend, causes an adverse price change rate. A price chart shows a downtrend as a falling series of highs and lows.

- Because foreign exchange transactions usually take place in pairs, a decline in one currency’s value has less of an impact on the forex market than it would on other financial markets. If the USD/INR currency pair is in a downtrend, the falling USD price will eventually lead to an increasing INR price. This indicates that even when the economy is in a downturn, there is always some positive development.

This downward trend may also be interpreted as a primary (major trend) and secondary (small corrective) wave, as seen in the following graphic.

The primary downtrend wave in the preceding chart pushes the currency pair toward a more significant downward trend. In contrast, the up-trending secondary waves serve as corrective phases of the down-trending primary wave.

Percentage Retracement

- Retracements are secondary waves (brief reversals) in the direction of a currency that move opposite the initial wave. (major trend).

- It’s important to remember that the foreign currency market does not always move in a straight line, even in a strong-moving market. (uptrend or downtrend market). Therefore, in their pursuit of a price target, traders pay close attention to retracements of many percentage points.

- Using the “percent retracement” method, one may determine how much prices have fallen after a higher high (or higher low). This indicator quantifies price “retracement.”

- If a stock’s price goes from its yearly low of INR 50 to its current high of INR 100 and then falls back to its yearly average of INR 75, then the drop from INR 100 to INR 75 (25 INR) retraces 50% of the prior advance from INR 50 to INR 100 (100% upward travel).

Technical analysts strategically use percent retracement to predict when prices will turn and resume an upward trend. Whether the market is bullish or bearish, there is usually a retracement of 33–66% of the initial price movement. The bull market is likely over if the market reverses by more than 66%.

The Trendline

- Technical analysis is based on the idea that it is possible to predict future trends and, to a lesser degree, the length of such trends. (upward or downward). Higher highs (primary wave) and lower lows (correction wave) characterize a bull market, whereas lower downswings (primary wave) and higher corrective highs (secondary wave) characterize a bear market. (secondary wave).

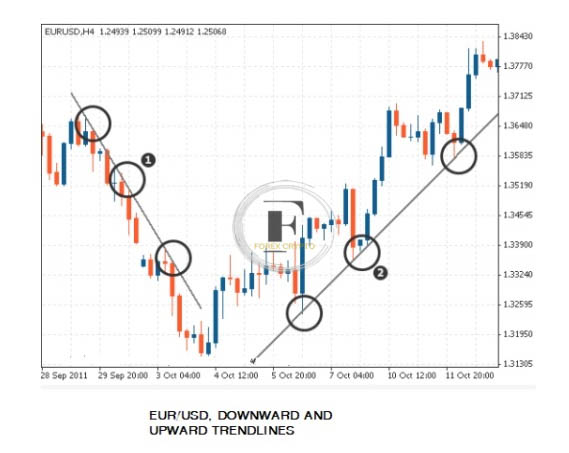

- Correctly drawing trendlines follows logically from pinpointing support and resistance levels, allowing traders to enter and exit positions at optimal times.

- A slant is made in the trendline, either above or below the price.

- You can see the negative and rising trends for the EUR/USD currency pair on the chart above. Plus, look at the following in the chart:

- Reversal pattern with three swing highs

- The uptrend has three swing lows.

- Thus, in a downtrend, the trendline is drawn above the price, and in an uptrend, the trendline is drawn below the price.

- It is the highest point during a downtrend and the lowest point during an upswing that will be used to draw the trend line.

- Three swing highs or lows are needed to construct a trend line in either direction with confidence. (uptrend or downtrend). The more often prices hit a trend line, the more traders consider it a potential support or resistance level.

Using trend lines to trade

- Most traders use two common approaches for trading using trend lines: market entry and exit at the trend line’s support and resistance levels.

- They are breaking the trend line to enter the market.

trend line as support or resistance

Since demand is represented by support and supply by resistance, price change is caused by a disparity between the two. When demand and supply are both unchanged, prices remain unchanged. However, when support and demand form below the current price of a security, the price stops dropping and begins to rise again. Similar to how an uptrend in security would halt if it reached a level of resistance or supply, the opposite is also true.

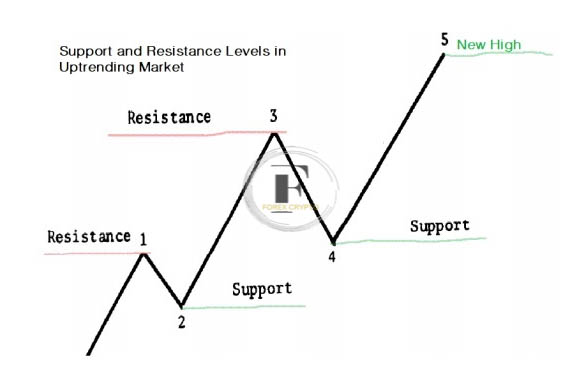

Therefore, each new resistance level (higher levels) will be established in an up-trending market. No resistance level can be determined if the market or security is unexplored. (can reach any new high).

Support and Resistance Levels in the Uptrend

Similarly, when a security (stock or currency pair) or market falls, it breaks below a series of supports. Finding precise support levels is impossible if the security/market is in a downtrend and falling below previous lows. (The only way is to go with retracement levels.)

Comments (No)